Filing for tax exemptions can be a daunting task, especially for individuals and organizations in the state of Wisconsin. The Wisconsin Department of Revenue offers a range of tax exemptions, but navigating the application process can be overwhelming. In this article, we will delve into the world of Wisconsin state tax exemptions, focusing on the Form 1NPR, and provide a comprehensive guide on how to file for tax exemption with ease.

What is Form 1NPR?

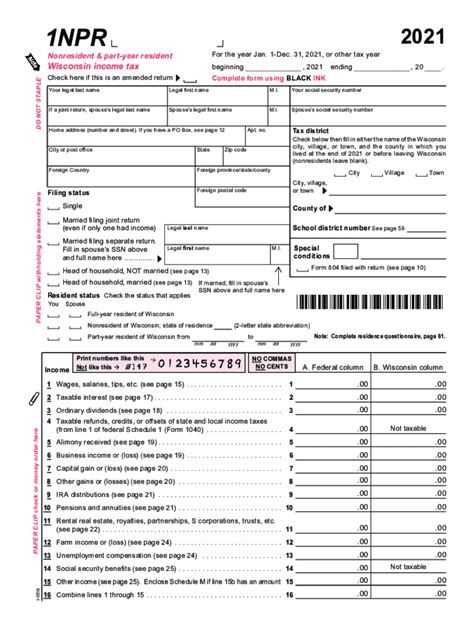

Form 1NPR is a tax exemption application form used by the Wisconsin Department of Revenue to determine eligibility for state tax exemptions. The form is designed for non-profit organizations, such as charities, educational institutions, and healthcare organizations, to apply for exemption from state income tax.

Who is Eligible for Tax Exemption in Wisconsin?

To be eligible for tax exemption in Wisconsin, an organization must meet specific criteria. These criteria include:

- Being a non-profit organization, such as a 501(c)(3) or 501(c)(4) organization

- Having a mission or purpose that aligns with the state's tax exemption policies

- Meeting the state's requirements for financial reporting and transparency

- Not engaging in activities that are deemed commercial or for-profit

How to File Form 1NPR

Filing Form 1NPR requires careful attention to detail and a thorough understanding of the application process. Here are the steps to follow:

- Gather Required Documents: Before starting the application process, gather all required documents, including:

- Articles of Incorporation

- Bylaws

- Financial statements (balance sheet and income statement)

- Tax returns (Form 1120 or Form 990)

- Complete Form 1NPR: Fill out Form 1NPR, which can be downloaded from the Wisconsin Department of Revenue website or obtained by contacting the department directly. Make sure to answer all questions accurately and provide all required documentation.

- Submit the Application: Submit the completed Form 1NPR and supporting documentation to the Wisconsin Department of Revenue. The department will review the application and determine eligibility for tax exemption.

Tips for Filing Form 1NPR

To ensure a smooth application process, follow these tips:

- Read the Instructions Carefully: Before starting the application, read the instructions carefully to ensure you understand the requirements.

- Provide Complete and Accurate Information: Make sure to provide complete and accurate information to avoid delays or rejection of the application.

- Submit Supporting Documentation: Submit all required supporting documentation to avoid delays or rejection of the application.

- Follow Up: Follow up with the Wisconsin Department of Revenue to ensure the application is being processed and to address any questions or concerns.

Benefits of Tax Exemption in Wisconsin

Tax exemption in Wisconsin offers several benefits, including:

- Reduced Tax Liability: Tax exemption can significantly reduce an organization's tax liability, allowing for more resources to be allocated to its mission and purpose.

- Increased Funding: Tax exemption can also increase funding for organizations, as donors may be more likely to contribute to tax-exempt organizations.

- Improved Credibility: Tax exemption can also improve an organization's credibility and reputation, as it demonstrates compliance with state and federal regulations.

Common Mistakes to Avoid

When filing Form 1NPR, it's essential to avoid common mistakes that can delay or reject the application. These mistakes include:

- Inaccurate or Incomplete Information: Providing inaccurate or incomplete information can delay or reject the application.

- Failure to Submit Supporting Documentation: Failing to submit required supporting documentation can delay or reject the application.

- Not Following Instructions: Not following the instructions carefully can delay or reject the application.

Conclusion

Filing for tax exemption in Wisconsin using Form 1NPR requires careful attention to detail and a thorough understanding of the application process. By following the steps outlined in this article and avoiding common mistakes, organizations can ensure a smooth application process and take advantage of the benefits of tax exemption in Wisconsin.

What is the purpose of Form 1NPR?

+Form 1NPR is a tax exemption application form used by the Wisconsin Department of Revenue to determine eligibility for state tax exemptions.

Who is eligible for tax exemption in Wisconsin?

+To be eligible for tax exemption in Wisconsin, an organization must meet specific criteria, including being a non-profit organization, having a mission or purpose that aligns with the state's tax exemption policies, meeting the state's requirements for financial reporting and transparency, and not engaging in activities that are deemed commercial or for-profit.

What are the benefits of tax exemption in Wisconsin?

+Tax exemption in Wisconsin offers several benefits, including reduced tax liability, increased funding, and improved credibility.