As a Daily Fantasy Sports (DFS) enthusiast, you're likely familiar with DraftKings, one of the most popular platforms in the industry. While winning contests and building your bankroll is exciting, it's essential to understand the tax implications of your DFS activities. In this article, we'll delve into the world of DraftKings tax forms, exploring what you need to know to ensure you're in compliance with the IRS.

The IRS requires DraftKings to report winnings exceeding $600 in a calendar year. If you've reached this threshold, you can expect to receive a tax form from DraftKings. But what does this form mean, and how do you report your winnings on your tax return?

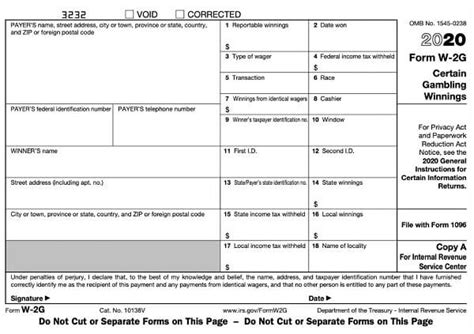

Understanding the 1099-MISC Form

The 1099-MISC form is used to report miscellaneous income, including prizes and awards. DraftKings will issue a 1099-MISC form to players who have won $600 or more in a calendar year. The form will show the total amount of winnings, which may include cash prizes, free entries, and other types of awards.

It's essential to note that the $600 threshold applies to the total amount of winnings, not individual contest prizes. For example, if you won $500 in one contest and $200 in another, you would not receive a 1099-MISC form. However, if you won $500 in one contest and $150 in another, and also received a $100 free entry, your total winnings would exceed $600, and you would receive a 1099-MISC form.

Reporting Winnings on Your Tax Return

When you receive a 1099-MISC form from DraftKings, you'll need to report your winnings on your tax return. The IRS considers DFS winnings to be taxable income, and you'll need to report it on your Form 1040.

To report your winnings, you'll need to complete the following steps:

- Enter the total amount of winnings shown on the 1099-MISC form on Line 21 of your Form 1040.

- If you have any expenses related to your DFS activities, such as entry fees or travel expenses, you may be able to deduct them on Schedule C (Form 1040).

- If you have a net loss from your DFS activities, you may be able to deduct it on Schedule C (Form 1040).

Important Deadlines and Dates

Here are some important deadlines and dates to keep in mind:

- January 31st: DraftKings will issue 1099-MISC forms to players who have won $600 or more in the previous calendar year.

- February 1st: Players can access their 1099-MISC forms in their DraftKings account.

- April 15th: Tax returns are due for the previous tax year.

Frequently Asked Questions

Here are some frequently asked questions about DraftKings tax forms:

- Q: Do I need to report my DFS winnings if I didn't receive a 1099-MISC form? A: Yes, you're still required to report your winnings on your tax return, even if you didn't receive a 1099-MISC form.

- Q: Can I deduct my DFS losses on my tax return? A: Yes, you may be able to deduct your DFS losses on Schedule C (Form 1040), but only if you have a net loss from your DFS activities.

- Q: Do I need to pay taxes on my DFS winnings if I'm not a U.S. citizen? A: Yes, the IRS requires all players, regardless of citizenship, to report their DFS winnings on their tax return.

What is the deadline for reporting DFS winnings on my tax return?

+The deadline for reporting DFS winnings on your tax return is April 15th of each year.

Can I deduct my DFS entry fees on my tax return?

+Yes, you may be able to deduct your DFS entry fees on Schedule C (Form 1040), but only if you have a net loss from your DFS activities.

Do I need to report my DFS winnings if I'm not a U.S. citizen?

+Yes, the IRS requires all players, regardless of citizenship, to report their DFS winnings on their tax return.

Stay informed, stay compliant, and keep on playing! Share your thoughts on DraftKings tax forms in the comments below, and don't forget to share this article with your fellow DFS enthusiasts.