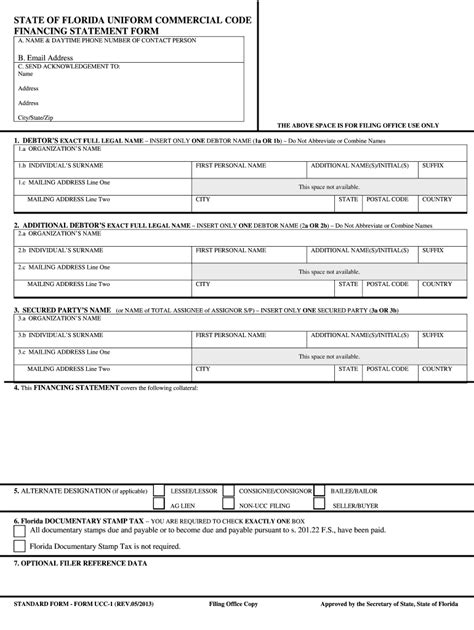

The Uniform Commercial Code (UCC) is a set of laws that govern commercial transactions in the United States. In Florida, the UCC is used to regulate and facilitate business transactions, including the creation and enforcement of security interests in personal property. If you have received a Florida UCC statement request, it is essential to understand the reasons behind it and the implications it may have on your business or personal transactions.

Here are five reasons you may have received a Florida UCC statement request:

1. A Lender or Creditor is Verifying Your Collateral

When a lender or creditor provides financing to a business or individual, they often require collateral to secure the loan. The UCC statement request is used to verify the collateral and ensure that it is properly described and identified. This is typically done to perfect the security interest, which gives the lender priority over other creditors in the event of default.

What You Need to Do

If you have received a UCC statement request due to a loan or credit agreement, you should review the document carefully to ensure that the collateral is accurately described and identified. You should also verify that the lender or creditor has a valid security interest in the collateral.

2. A Business is Updating Its UCC Records

Businesses are required to file UCC statements with the state to perfect their security interests in personal property. If a business has updated its UCC records, it may send a UCC statement request to ensure that the changes are accurately reflected.

What You Need to Do

If you have received a UCC statement request due to a business updating its UCC records, you should review the document to ensure that the changes are accurate. You should also verify that the business has properly identified and described the collateral.

3. A Lender or Creditor is Preparing to Foreclose

If a borrower defaults on a loan, the lender or creditor may send a UCC statement request as part of the foreclosure process. This is typically done to verify the collateral and ensure that it is properly identified and described.

What You Need to Do

If you have received a UCC statement request due to a potential foreclosure, you should take immediate action to address the issue. You should review the document carefully and verify that the collateral is accurately described and identified. You should also seek the advice of an attorney to understand your rights and options.

4. A Business is Merging or Being Acquired

When a business is merging or being acquired, the parties involved may send a UCC statement request to verify the collateral and ensure that it is properly identified and described.

What You Need to Do

If you have received a UCC statement request due to a merger or acquisition, you should review the document carefully to ensure that the collateral is accurately described and identified. You should also verify that the parties involved have properly identified and described the collateral.

5. A Lender or Creditor is Conducting a UCC Search

A UCC search is a process used to identify any existing security interests in personal property. If a lender or creditor is conducting a UCC search, they may send a UCC statement request to verify the results.

What You Need to Do

If you have received a UCC statement request due to a UCC search, you should review the document carefully to ensure that the results are accurate. You should also verify that the lender or creditor has properly identified and described the collateral.

In conclusion, receiving a Florida UCC statement request can be a complex and confusing experience. However, by understanding the reasons behind it and the implications it may have on your business or personal transactions, you can take the necessary steps to address the issue.

Final Thoughts:

- Always review the UCC statement request carefully to ensure that the collateral is accurately described and identified.

- Verify that the lender or creditor has a valid security interest in the collateral.

- Seek the advice of an attorney if you are unsure about the implications of the UCC statement request.

What is a UCC statement request?

+A UCC statement request is a document used to verify the collateral and ensure that it is properly identified and described.

Why did I receive a UCC statement request?

+You may have received a UCC statement request due to a loan or credit agreement, a business updating its UCC records, a potential foreclosure, a merger or acquisition, or a UCC search.

What should I do if I receive a UCC statement request?

+Review the document carefully to ensure that the collateral is accurately described and identified. Verify that the lender or creditor has a valid security interest in the collateral. Seek the advice of an attorney if you are unsure about the implications of the UCC statement request.