In the realm of finance, particularly when it comes to reporting and disclosure requirements for financial institutions, there are strict guidelines that must be adhered to. One such requirement is the completion and submission of the FS Form 5444, a document used by the Federal Reserve to collect data on institutions' lending activities. But who exactly can certify that these requirements have been met?

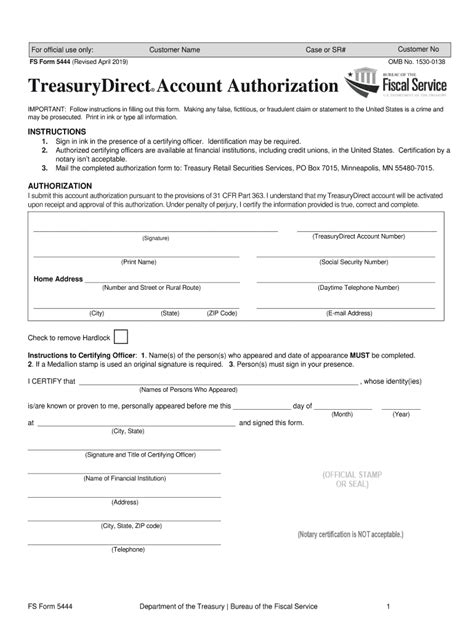

Understanding the FS Form 5444

The FS Form 5444 is a crucial document for financial institutions, as it provides the Federal Reserve with a comprehensive overview of their lending activities. This form requires institutions to report on various aspects of their lending, including loan volumes, interest rates, and credit characteristics. The data collected from this form is used to monitor and analyze trends in the financial industry, ultimately informing monetary policy decisions.

Who Can Certify FS Form 5444 Requirements?

Certification of the FS Form 5444 requirements typically falls under the purview of authorized personnel within a financial institution. These individuals must have the necessary expertise and knowledge to ensure that the information reported on the form is accurate and complete.

Some examples of individuals who may be authorized to certify FS Form 5444 requirements include:

- Chief Financial Officers (CFOs)

- Compliance Officers

- Risk Management Officers

- Financial Reporting Managers

- Auditors

These individuals must possess a deep understanding of the financial institution's lending activities, as well as the specific requirements outlined in the FS Form 5444 instructions. They must also be able to verify that the data reported on the form is accurate and compliant with relevant regulations.

Responsibilities of Authorized Personnel

Authorized personnel who certify FS Form 5444 requirements have several key responsibilities:

- Ensuring that all required data is reported accurately and completely

- Verifying that the institution's lending activities are compliant with relevant regulations

- Reviewing and validating the data reported on the form

- Identifying and addressing any errors or discrepancies

- Maintaining records of the certification process

By fulfilling these responsibilities, authorized personnel play a critical role in ensuring that financial institutions meet their reporting obligations and maintain the integrity of the financial system.

Consequences of Non-Compliance

Failure to comply with FS Form 5444 requirements can have serious consequences for financial institutions. These may include:

- Fines and penalties

- Enforcement actions

- Damage to reputation

- Loss of customer trust

It is therefore essential that financial institutions take the certification process seriously and ensure that authorized personnel have the necessary expertise and knowledge to certify FS Form 5444 requirements accurately.

Best Practices for Certification

To ensure that the certification process is carried out effectively, financial institutions should adopt the following best practices:

- Establish clear policies and procedures for certification

- Provide training and support for authorized personnel

- Regularly review and update certification procedures

- Maintain accurate and complete records of the certification process

- Encourage a culture of compliance and transparency

By following these best practices, financial institutions can ensure that their certification processes are robust and effective, reducing the risk of non-compliance and maintaining the integrity of the financial system.

Conclusion

In conclusion, the certification of FS Form 5444 requirements is a critical process that requires careful attention to detail and a deep understanding of the financial institution's lending activities. Authorized personnel play a vital role in ensuring that the data reported on the form is accurate and complete, and that the institution meets its reporting obligations. By adopting best practices and maintaining a culture of compliance, financial institutions can ensure that their certification processes are effective and reduce the risk of non-compliance.

We invite you to share your thoughts on the certification process for FS Form 5444 requirements. Have you encountered any challenges or successes in this area? What best practices do you recommend for ensuring compliance? Share your comments below!

What is the purpose of the FS Form 5444?

+The FS Form 5444 is used by the Federal Reserve to collect data on financial institutions' lending activities, which is used to monitor and analyze trends in the financial industry and inform monetary policy decisions.

Who can certify FS Form 5444 requirements?

+Authorized personnel within a financial institution, such as CFOs, Compliance Officers, Risk Management Officers, Financial Reporting Managers, and Auditors, can certify FS Form 5444 requirements.

What are the consequences of non-compliance with FS Form 5444 requirements?

+Non-compliance with FS Form 5444 requirements can result in fines and penalties, enforcement actions, damage to reputation, and loss of customer trust.