As a real estate investor or developer, you're likely familiar with the importance of depreciation in reducing your taxable income. One key form used by the IRS to calculate depreciation is Form 8582, also known as the "Passive Activity Loss Limitations" form. However, navigating this form can be complex, and it's essential to understand the rules and regulations surrounding it. In this article, we'll delve into five crucial things to know about Form 8582.

What is Form 8582, and Who Needs to File It?

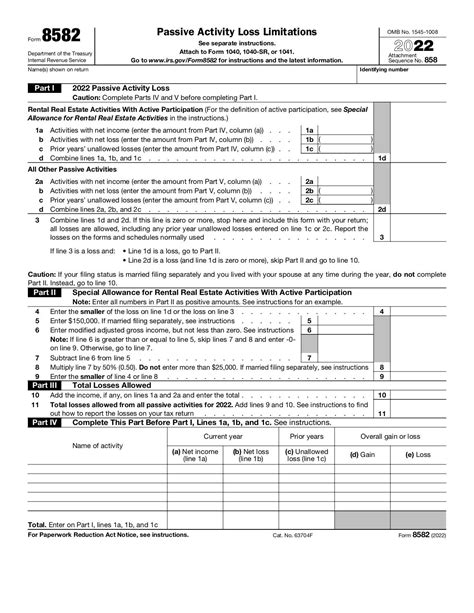

Form 8582 is used to report passive activity losses, including depreciation, from rental real estate, partnerships, S corporations, and other businesses. You'll need to file this form if you have a passive activity loss, which is a loss from a business or investment in which you don't actively participate. This includes rental real estate, partnerships, and S corporations.

You'll need to file Form 8582 if you have:

- A passive activity loss from rental real estate, such as rental income and expenses

- A passive activity loss from a partnership or S corporation

- A self-employment tax liability from a partnership or S corporation

Passive Activity Loss Limitations

One of the primary purposes of Form 8582 is to calculate the passive activity loss limitations. Passive activity losses can only be deducted against passive activity income. If you have a net passive activity loss, you can only deduct up to $25,000 of that loss against ordinary income, such as wages and interest income. This is known as the "passive activity loss limitation."

The passive activity loss limitation is $25,000, or $12,500 if you're married filing separately. However, this limitation is phased out if your modified adjusted gross income (MAGI) exceeds certain thresholds. For 2022, the phase-out begins at $100,000 and is completely phased out at $150,000.

Calculating the Passive Activity Loss Limitation

To calculate the passive activity loss limitation, you'll need to complete Part 1 of Form 8582. You'll need to report your passive activity income and losses from all sources, including rental real estate, partnerships, and S corporations.

Here's a step-by-step guide to calculating the passive activity loss limitation:

- Report your passive activity income from all sources

- Report your passive activity losses from all sources

- Calculate your net passive activity loss

- Calculate the passive activity loss limitation using the phase-out thresholds

Rental Real Estate Activities

Rental real estate activities are considered passive activities, unless you meet certain requirements. If you're a real estate professional, you may be able to deduct losses from rental real estate activities against ordinary income.

To qualify as a real estate professional, you must meet one of the following tests:

- You must spend at least 750 hours per year in real estate activities

- You must spend more than 50% of your working hours in real estate activities

If you meet one of these tests, you can deduct losses from rental real estate activities against ordinary income, without being subject to the passive activity loss limitation.

Rental Real Estate Income and Losses

To report rental real estate income and losses on Form 8582, you'll need to complete Part 2 of the form. You'll need to report:

- Rental income

- Rental expenses, including depreciation and interest

- Net rental income or loss

Here's an example of how to report rental real estate income and losses on Form 8582:

- Rental income: $100,000

- Rental expenses: $80,000

- Net rental income: $20,000

Partnerships and S Corporations

If you have a partnership or S corporation interest, you'll need to report your share of income and losses on Form 8582. You'll receive a Schedule K-1 from the partnership or S corporation, which will show your share of income and losses.

To report partnership and S corporation income and losses on Form 8582, you'll need to complete Part 3 of the form. You'll need to report:

- Your share of partnership or S corporation income

- Your share of partnership or S corporation losses

- Your net share of partnership or S corporation income or loss

Here's an example of how to report partnership income and losses on Form 8582:

- Partnership income: $50,000

- Partnership losses: $30,000

- Net partnership loss: $20,000

Common Errors to Avoid

When completing Form 8582, there are several common errors to avoid. Here are a few:

- Failing to report all passive activity income and losses

- Miscalculating the passive activity loss limitation

- Failing to complete all required parts of the form

- Not signing and dating the form

To avoid these errors, make sure to carefully review the instructions for Form 8582 and seek professional help if you're unsure.

Conclusion

Form 8582 is a complex form that requires careful attention to detail. By understanding the rules and regulations surrounding passive activity losses and the passive activity loss limitation, you can ensure you're taking advantage of the deductions you're eligible for.

Remember to carefully review the instructions for Form 8582 and seek professional help if you're unsure. With the right guidance, you can navigate the complexities of Form 8582 and minimize your tax liability.

We encourage you to share your thoughts and questions about Form 8582 in the comments below. Have you had experience with Form 8582? Share your story with us!

What is the purpose of Form 8582?

+Form 8582 is used to report passive activity losses, including depreciation, from rental real estate, partnerships, S corporations, and other businesses.

Who needs to file Form 8582?

+You'll need to file Form 8582 if you have a passive activity loss, which is a loss from a business or investment in which you don't actively participate.

What is the passive activity loss limitation?

+The passive activity loss limitation is $25,000, or $12,500 if you're married filing separately. However, this limitation is phased out if your modified adjusted gross income (MAGI) exceeds certain thresholds.