As a taxpayer in Virginia, it's essential to understand the various tax forms and schedules that you need to complete and submit to the state government. One such form is the Form 760C, which is used to claim a credit for taxes paid to other states. In this article, we will break down the Form 760C in 5 essential points, helping you to understand its purpose, eligibility, and how to complete it.

What is Form 760C?

Form 760C is a tax credit form used by the Virginia Department of Taxation to allow taxpayers to claim a credit for taxes paid to other states. This form is used in conjunction with the Form 760, which is the individual income tax return form. The purpose of Form 760C is to provide relief to taxpayers who have paid taxes to multiple states, thereby reducing their tax liability in Virginia.

Who is Eligible to Claim the Credit?

To be eligible to claim the credit on Form 760C, you must meet certain conditions:

- You must have filed a tax return in Virginia (Form 760) and reported income from another state.

- You must have paid taxes to the other state on the same income that you reported on your Virginia tax return.

- The taxes paid to the other state must be an income tax, and not a tax on specific items such as sales or property taxes.

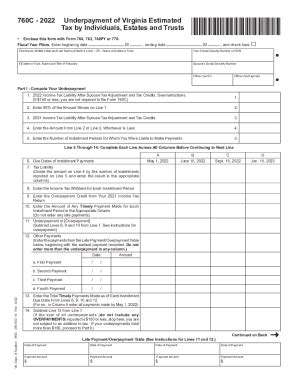

How to Complete Form 760C

To complete Form 760C, you will need to follow these steps:

- Determine the amount of taxes paid to the other state: You will need to obtain a copy of your tax return from the other state to determine the amount of taxes paid.

- Complete the credit calculation: You will need to calculate the credit amount using the instructions provided on Form 760C.

- Complete Form 760C: You will need to complete the form by providing the required information, including your name, social security number, and the amount of credit claimed.

What are the Benefits of Claiming the Credit?

Claiming the credit on Form 760C can provide several benefits, including:

- Reduced tax liability: By claiming the credit, you can reduce the amount of taxes you owe to Virginia.

- Increased refund: If you are due a refund, claiming the credit can increase the amount of your refund.

- Reduced double taxation: Claiming the credit can help to reduce double taxation, which occurs when you pay taxes on the same income in multiple states.

Common Mistakes to Avoid

When completing Form 760C, there are several common mistakes to avoid:

- Failing to provide required documentation: You must provide a copy of your tax return from the other state to support your credit claim.

- Miscalculating the credit amount: Make sure to follow the instructions provided on Form 760C to calculate the credit amount correctly.

- Failing to claim the credit: If you are eligible to claim the credit, make sure to complete Form 760C and submit it with your tax return.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind when completing Form 760C:

- Make sure to file Form 760C with your tax return (Form 760) to claim the credit.

- Keep a copy of your tax return from the other state, as you will need to provide this documentation to support your credit claim.

- If you have any questions or concerns, contact the Virginia Department of Taxation for assistance.

In conclusion, understanding Form 760C is essential for taxpayers in Virginia who have paid taxes to other states. By following the instructions provided in this article, you can ensure that you complete the form correctly and claim the credit you are eligible for.

We invite you to share your thoughts and experiences with Form 760C in the comments below. Have you ever claimed the credit on this form? Do you have any questions or concerns about the process? Let us know, and we'll do our best to help.

FAQ Section:

What is the purpose of Form 760C?

+Form 760C is used to claim a credit for taxes paid to other states.

Who is eligible to claim the credit on Form 760C?

+To be eligible, you must have filed a tax return in Virginia, reported income from another state, and paid taxes to that state.

How do I complete Form 760C?

+Complete the form by providing the required information, including your name, social security number, and the amount of credit claimed.