As the tax landscape continues to evolve, it's essential to stay informed about the various tax forms and regulations that impact your financial situation. One such form is the Additional Medicare Tax Form 8959, which was introduced as part of the Affordable Care Act (ACA) in 2013. In this article, we'll delve into the details of Form 8959, its purpose, and how it affects your tax obligations.

Understanding the Additional Medicare Tax

The Additional Medicare Tax is a surtax imposed on high-income individuals to fund the Medicare program. This tax is levied on the wages, compensation, and self-employment income of individuals who exceed certain threshold amounts. The tax rate is 0.9%, which is in addition to the existing Medicare tax rate of 1.45% for employees and 2.9% for self-employed individuals.

Who is Subject to the Additional Medicare Tax?

The Additional Medicare Tax applies to individuals with income above the following threshold amounts:

- $250,000 for married couples filing jointly

- $125,000 for married couples filing separately

- $200,000 for single filers

- $200,000 for heads of household

These threshold amounts are not adjusted for inflation, which means that more individuals may be subject to the tax over time due to inflation.

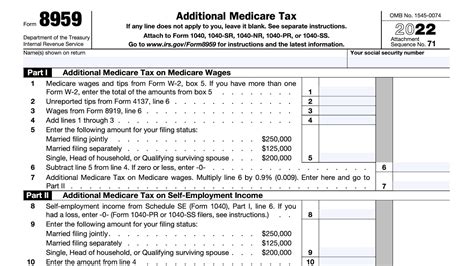

Filing Form 8959

Form 8959 is used to report and calculate the Additional Medicare Tax. The form is typically filed annually with the individual's tax return (Form 1040). Employers are also required to withhold the Additional Medicare Tax from employees' wages when the employee's income exceeds the threshold amounts.

The form consists of three parts:

- Part I: Reporting of Additional Medicare Tax

- Part II: Calculation of Additional Medicare Tax

- Part III: Additional Medicare Tax on Wages and Self-Employment Income

How to Complete Form 8959

To complete Form 8959, you'll need to gather the following information:

- Your total wages, compensation, and self-employment income

- Your Medicare tax withheld from wages and self-employment income

- Your threshold amount based on your filing status

You'll then use this information to calculate your Additional Medicare Tax liability. If you're subject to the tax, you'll report the amount on Line 62 of your Form 1040.

Consequences of Not Filing Form 8959

Failure to file Form 8959 or underreporting the Additional Medicare Tax can result in penalties and interest. The IRS may impose a penalty of up to 20% of the unpaid tax, plus interest on the unpaid amount.

Avoiding Penalties

To avoid penalties, it's essential to ensure you're accurately reporting your Additional Medicare Tax liability. If you're unsure about your obligations or need help completing Form 8959, consider consulting a tax professional or using tax preparation software.

Exemptions and Special Rules

Certain individuals may be exempt from the Additional Medicare Tax or subject to special rules. For example:

- Non-resident aliens are exempt from the tax

- Certain types of income, such as tax-exempt bonds, are not subject to the tax

- Self-employed individuals may be able to deduct half of their Additional Medicare Tax as a business expense

It's essential to review the IRS instructions for Form 8959 to determine if you're eligible for any exemptions or special rules.

Conclusion: Understanding Your Obligations

The Additional Medicare Tax Form 8959 is an essential part of the tax filing process for high-income individuals. By understanding your obligations and accurately reporting your Additional Medicare Tax liability, you can avoid penalties and ensure compliance with the IRS. Remember to review the IRS instructions and consult a tax professional if you're unsure about your obligations.

Who is subject to the Additional Medicare Tax?

+The Additional Medicare Tax applies to individuals with income above $250,000 for married couples filing jointly, $125,000 for married couples filing separately, and $200,000 for single filers and heads of household.

What is the purpose of Form 8959?

+Form 8959 is used to report and calculate the Additional Medicare Tax. The form is typically filed annually with the individual's tax return (Form 1040).

What are the consequences of not filing Form 8959?

+Failure to file Form 8959 or underreporting the Additional Medicare Tax can result in penalties and interest. The IRS may impose a penalty of up to 20% of the unpaid tax, plus interest on the unpaid amount.