The MCS-90 form is a crucial document in the trucking industry, serving as a guaranty of insurance coverage for motor carriers operating in the United States. Despite its importance, many people are unsure about what the MCS-90 form entails, its purpose, and how it affects their business. In this article, we will delve into the world of MCS-90, exploring five key things you need to know about this vital document.

What is the MCS-90 Form?

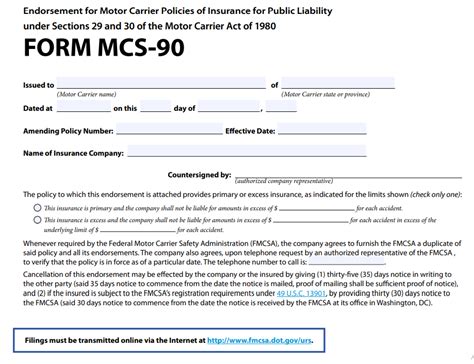

The MCS-90 form, also known as the Endorsement for Motor Carrier Policies of Insurance for Public Liability, is a federal filing requirement for motor carriers operating in the United States. This document serves as proof of insurance coverage for bodily injury or property damage resulting from the operation of a commercial motor vehicle. The MCS-90 form is typically filed with the Federal Motor Carrier Safety Administration (FMCSA) and is a mandatory requirement for motor carriers with a Gross Vehicle Weight Rating (GVWR) of 10,001 pounds or more.

Purpose of the MCS-90 Form

The primary purpose of the MCS-90 form is to provide financial assurance to the public in the event of an accident involving a commercial motor vehicle. By filing the MCS-90 form, motor carriers demonstrate their ability to cover damages resulting from their operations, thereby protecting the public from potential harm.

5 Key Things to Know About the MCS-90 Form

Now that we have covered the basics of the MCS-90 form, let's dive deeper into five key things you need to know about this crucial document.

1. Coverage Requirements

The MCS-90 form requires motor carriers to maintain a minimum level of public liability insurance coverage, which varies depending on the type of cargo being transported and the GVWR of the vehicle. For example, motor carriers transporting hazardous materials may be required to carry higher levels of coverage than those transporting non-hazardous materials.

2. Filing Requirements

Motor carriers are required to file the MCS-90 form with the FMCSA, which can be done electronically or by mail. The form must be filed within a specific timeframe, typically within 30 days of obtaining insurance coverage or making changes to existing coverage.

3. Consequences of Non-Compliance

Failure to file the MCS-90 form or maintain adequate insurance coverage can result in severe consequences, including fines, penalties, and even the revocation of operating authority. Motor carriers found non-compliant may also face increased insurance premiums and difficulty obtaining coverage in the future.

4. Relationship Between MCS-90 and Other Forms

The MCS-90 form is often filed in conjunction with other forms, such as the MCS-150 (Motor Carrier Identification Report) and the BOC-3 (Designation of Process Agent). Motor carriers must ensure that all required forms are filed accurately and on time to avoid any compliance issues.

5. Tips for Managing MCS-90 Compliance

To ensure compliance with MCS-90 regulations, motor carriers should:

- Verify insurance coverage and policy details before filing the MCS-90 form

- Use the FMCSA's online filing system to streamline the process

- Maintain accurate records and documentation

- Consult with an insurance expert or attorney to ensure compliance with all regulations

In conclusion, the MCS-90 form is a critical document that plays a vital role in ensuring public safety and protecting motor carriers from potential financial losses. By understanding the key aspects of the MCS-90 form, motor carriers can navigate the complex world of compliance and maintain a strong reputation in the industry.

Final Thoughts

The MCS-90 form may seem like a daunting task, but with the right knowledge and resources, motor carriers can ensure compliance and avoid any potential consequences. We encourage you to share your thoughts and experiences with the MCS-90 form in the comments below. Don't forget to share this article with your colleagues and peers to help spread awareness about the importance of MCS-90 compliance.

What is the purpose of the MCS-90 form?

+The primary purpose of the MCS-90 form is to provide financial assurance to the public in the event of an accident involving a commercial motor vehicle.

Who is required to file the MCS-90 form?

+Motor carriers with a Gross Vehicle Weight Rating (GVWR) of 10,001 pounds or more are required to file the MCS-90 form.

What are the consequences of non-compliance with MCS-90 regulations?

+Failure to file the MCS-90 form or maintain adequate insurance coverage can result in severe consequences, including fines, penalties, and even the revocation of operating authority.