As the tax season approaches, you might receive a crucial document in the mail - the W-2 form. This seemingly straightforward document is more than just a piece of paper; it holds valuable information that can help you navigate the tax filing process and even make informed financial decisions. In this article, we'll delve into the world of W-2 forms and explore five essential things it tells you.

Understanding the W-2 Form

Before we dive into the nitty-gritty details, let's take a step back and understand what the W-2 form is. The W-2 form, also known as the Wage and Tax Statement, is an annual tax document that employers must provide to their employees and the Social Security Administration (SSA) by January 31st of each year. The form outlines the employee's income, taxes withheld, and other relevant details.

What's Included in a W-2 Form?

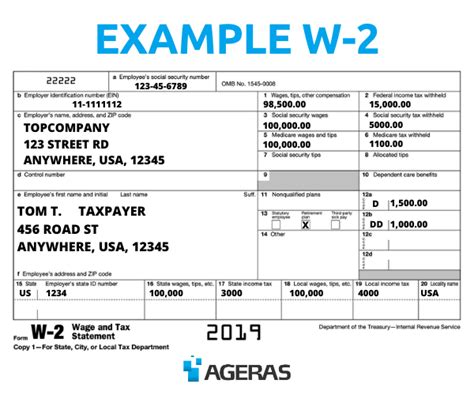

A standard W-2 form typically includes the following information:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Employee's gross income and taxable income

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

- State and local taxes withheld (if applicable)

5 Things W-2 Form Tells You

Now that we've covered the basics, let's explore five essential things your W-2 form tells you:

1. Your Income and Tax Withholding

The W-2 form provides a comprehensive breakdown of your income and taxes withheld. Box 1 shows your gross income, while Box 2 displays the federal income tax withheld. You'll also find the Social Security tax withheld in Box 4 and the Medicare tax withheld in Box 6. This information is crucial for tax filing purposes.

2. Your Social Security Benefits

The W-2 form also includes information about your Social Security benefits. Box 3 shows your Social Security wages, which is the amount of income subject to Social Security tax. Box 4 displays the Social Security tax withheld, which is typically 6.2% of your Social Security wages. This information is essential for understanding your Social Security benefits and potential retirement income.

3. Your Medicare Benefits

In addition to Social Security, the W-2 form also provides information about your Medicare benefits. Box 5 shows your Medicare wages, which is the amount of income subject to Medicare tax. Box 6 displays the Medicare tax withheld, which is typically 1.45% of your Medicare wages. This information is crucial for understanding your Medicare benefits and potential healthcare costs in retirement.

4. Your State and Local Taxes

If you live in a state or locality with income taxes, your W-2 form will also include information about your state and local taxes. Box 15 shows your state and local wages, while Box 16 displays the state and local income tax withheld. This information is essential for understanding your state and local tax obligations.

5. Your Retirement Plan Contributions

Finally, the W-2 form may also include information about your retirement plan contributions. Box 12 shows your retirement plan contributions, which can include 401(k), 403(b), or other qualified retirement plan contributions. This information is crucial for understanding your retirement savings and potential tax benefits.

What to Do with Your W-2 Form

Now that you've received your W-2 form, what should you do with it? Here are a few steps to follow:

- Review your W-2 form carefully to ensure accuracy and completeness.

- Use the information on your W-2 form to file your tax return (Form 1040).

- Keep a copy of your W-2 form with your tax records for future reference.

- If you have any questions or concerns about your W-2 form, contact your employer or a tax professional for assistance.

Conclusion

The W-2 form may seem like a straightforward document, but it holds a wealth of information that can help you navigate the tax filing process and make informed financial decisions. By understanding the five things your W-2 form tells you, you'll be better equipped to manage your taxes, retirement savings, and overall financial well-being. Remember to review your W-2 form carefully, use the information to file your tax return, and keep a copy for future reference.

We encourage you to share your thoughts and experiences with W-2 forms in the comments below. How do you use the information on your W-2 form to manage your finances? Do you have any questions or concerns about W-2 forms? Let's start a conversation!

What is a W-2 form?

+A W-2 form is an annual tax document that employers must provide to their employees and the Social Security Administration (SSA) by January 31st of each year. The form outlines the employee's income, taxes withheld, and other relevant details.

What information is included on a W-2 form?

+A standard W-2 form typically includes the employee's name, address, and Social Security number, employer's name, address, and Employer Identification Number (EIN), employee's gross income and taxable income, federal income tax withheld, Social Security tax withheld, Medicare tax withheld, and state and local taxes withheld (if applicable).

What should I do with my W-2 form?

+Review your W-2 form carefully to ensure accuracy and completeness, use the information on your W-2 form to file your tax return (Form 1040), keep a copy of your W-2 form with your tax records for future reference, and contact your employer or a tax professional if you have any questions or concerns.