Filling out a W-2 form can be a daunting task, especially for those who are new to the process. However, with the right guidance, it can be a breeze. In this article, we will walk you through the easy steps to complete a W-2 form fillable, making it easier for you to navigate the process.

What is a W-2 Form?

Before we dive into the steps, let's first understand what a W-2 form is. A W-2 form, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees and the Social Security Administration (SSA) at the end of each year. The form reports an employee's income, taxes withheld, and other relevant information.

Why is it Important to Complete a W-2 Form Accurately?

Completing a W-2 form accurately is crucial for both employees and employers. For employees, the form serves as proof of income and taxes paid, which is necessary for filing tax returns. For employers, accurate completion of the form helps ensure compliance with tax laws and regulations. Inaccurate or incomplete forms can lead to delays, penalties, and even audits.

Easy Steps to Complete a W-2 Form Fillable

Now that we understand the importance of completing a W-2 form accurately, let's move on to the easy steps to complete a W-2 form fillable.

Step 1: Gather Necessary Information

Before you start filling out the W-2 form, make sure you have all the necessary information. This includes:

- Employee's name, address, and Social Security number

- Employer's name, address, and Employer Identification Number (EIN)

- Employee's wages, tips, and other compensation

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

Step 2: Choose the Correct W-2 Form

There are several types of W-2 forms, including:

- W-2: Wage and Tax Statement

- W-2G: Certain Gambling Winnings

- W-2GU: Guam Wage and Tax Statement

- W-2VI: U.S. Virgin Islands Wage and Tax Statement

Choose the correct form based on your specific situation.

Step 3: Fill Out the Employer Information

Fill out the employer information section, including:

- Employer's name and address

- Employer's EIN

- Employer's state and local ID numbers (if applicable)

Step 4: Fill Out the Employee Information

Fill out the employee information section, including:

- Employee's name and address

- Employee's Social Security number

- Employee's wages, tips, and other compensation

Step 5: Report Taxes Withheld

Report the taxes withheld from the employee's wages, including:

- Federal income tax withheld

- Social Security tax withheld

- Medicare tax withheld

Step 6: Report Other Information

Report other information, including:

- Tips reported by the employee *Allocated tips

- Dependent care benefits

- Retirement plan contributions

Step 7: Sign and Date the Form

Sign and date the form, certifying that the information is accurate and complete.

Common Mistakes to Avoid When Completing a W-2 Form Fillable

When completing a W-2 form fillable, it's essential to avoid common mistakes that can lead to delays, penalties, and even audits. Here are some common mistakes to avoid:

- Inaccurate or incomplete employee information

- Inaccurate or incomplete employer information

- Failure to report taxes withheld

- Failure to report other information, such as tips and retirement plan contributions

Tips for Employers

As an employer, it's essential to ensure that you provide accurate and complete W-2 forms to your employees and the SSA. Here are some tips to help you avoid common mistakes:

- Use a W-2 form fillable template to ensure accuracy and completeness

- Double-check employee information and wages

- Verify taxes withheld and other information

- Provide W-2 forms to employees by January 31st of each year

Tips for Employees

As an employee, it's essential to review your W-2 form carefully to ensure that it's accurate and complete. Here are some tips to help you:

- Review your W-2 form carefully for errors or inaccuracies

- Verify your wages, taxes withheld, and other information

- Contact your employer if you notice any errors or inaccuracies

- Keep your W-2 form safe and secure, as it's an important document for tax purposes

Conclusion

Completing a W-2 form fillable can seem daunting, but with the right guidance, it can be a breeze. By following the easy steps outlined in this article, you can ensure that your W-2 form is accurate and complete. Remember to avoid common mistakes and take advantage of tips for employers and employees to make the process smoother.

What is the deadline for providing W-2 forms to employees?

+The deadline for providing W-2 forms to employees is January 31st of each year.

What is the penalty for failing to provide accurate W-2 forms?

+The penalty for failing to provide accurate W-2 forms can range from $30 to $100 per form, depending on the severity of the error.

Can I file an amended W-2 form if I notice an error?

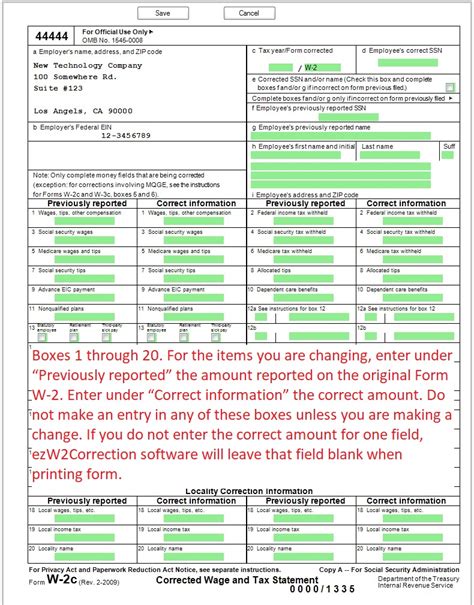

+Yes, you can file an amended W-2 form, known as a W-2C, if you notice an error. However, you must provide a corrected W-2 form to the employee and the SSA.