Correcting errors on a previously filed W-2 form is a common requirement for many employers. The W-2c form, also known as the Corrected Wage and Tax Statement, is used to rectify mistakes on a W-2 form that has already been submitted to the Social Security Administration (SSA) and provided to employees. Filling out a W-2c form correctly is crucial to avoid further errors, penalties, and delays in processing.

Employers may need to file a W-2c form for various reasons, such as incorrect employee information, wrong wage or tax amounts, or missed deadlines. The process of filling out a W-2c form can be complex, but with the right guidance, employers can ensure they complete it accurately. In this article, we will provide a step-by-step guide on how to fill out a W-2c form correctly, highlighting the essential sections and requirements.

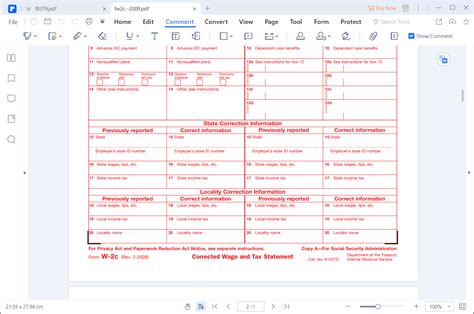

Understanding the W-2c Form

Before diving into the details of filling out a W-2c form, it's essential to understand the purpose and structure of the form. The W-2c form is divided into several sections, each requiring specific information. Employers must ensure they complete all necessary sections accurately to avoid rejection or delays.

Section 1: Employer Information

The first section of the W-2c form requires employers to provide their information, including their name, address, and Employer Identification Number (EIN). Employers must ensure they enter their EIN correctly, as it is used to identify their business.

- Employer's name and address

- Employer Identification Number (EIN)

5 Steps to Fill Out a W-2c Form Correctly

Now that we have covered the basics of the W-2c form, let's move on to the 5 steps to fill it out correctly.

Step 1: Identify the Error

Employers must first identify the error on the original W-2 form. This could be an incorrect employee name, wrong wage or tax amount, or missing information. Employers should carefully review the original W-2 form to determine the mistake.

Step 2: Gather Correct Information

Once the error has been identified, employers must gather the correct information to complete the W-2c form. This may involve reviewing payroll records, employee data, or other relevant documents.

Step 3: Complete the W-2c Form

Employers must complete the W-2c form accurately, using the correct information gathered in step 2. The form requires employers to provide the following information:

- Employee's name and Social Security number

- Employer's name and address

- Corrected wage and tax information

Step 4: Submit the W-2c Form

After completing the W-2c form, employers must submit it to the SSA and provide a copy to the affected employee. Employers can submit the form electronically or by mail, depending on their preference.

Step 5: Verify Receipt

Finally, employers should verify receipt of the W-2c form by the SSA and the affected employee. This ensures that the corrected information has been processed and is reflected in the employee's records.

Common Mistakes to Avoid

When filling out a W-2c form, employers must avoid common mistakes that can lead to rejection or delays. Some of the most common mistakes include:

- Incorrect employee information

- Wrong wage or tax amounts

- Missing or incomplete information

- Failure to submit the form timely

Best Practices for Filing W-2c Forms

To ensure accurate and timely filing of W-2c forms, employers should follow best practices, including:

- Reviewing payroll records regularly to catch errors early

- Using accurate and up-to-date employee information

- Submitting the W-2c form electronically to reduce processing time

- Verifying receipt of the W-2c form by the SSA and affected employee

Conclusion

Filling out a W-2c form correctly is crucial to avoid errors, penalties, and delays in processing. By following the 5 steps outlined in this article and avoiding common mistakes, employers can ensure they complete the form accurately and efficiently. Remember to review payroll records regularly, use accurate employee information, and submit the form timely to ensure compliance with SSA regulations.

We hope this article has provided valuable insights into filling out a W-2c form correctly. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may benefit from this information.

What is the purpose of the W-2c form?

+The W-2c form is used to correct errors on a previously filed W-2 form.

What information is required on the W-2c form?

+The W-2c form requires employers to provide corrected wage and tax information, as well as employee and employer identification numbers.

How do I submit the W-2c form?

+Employers can submit the W-2c form electronically or by mail to the Social Security Administration (SSA).