As a resident of Connecticut, receiving your W-2 form at the beginning of each year can be a crucial step in filing your taxes. The W-2 form, also known as the Wage and Tax Statement, provides essential information about your income and taxes withheld from your employer. Understanding the contents of your W-2 form is vital to ensure accurate tax filing and avoid any potential issues with the IRS.

In Connecticut, the W-2 form is typically issued by your employer by January 31st of each year, and it reports your income and taxes withheld for the previous tax year. The form is divided into several sections, each containing specific information that you'll need to complete your tax return. Let's break down the different parts of the W-2 form and what you can expect to find on it.

What's Included on Your W-2 Form?

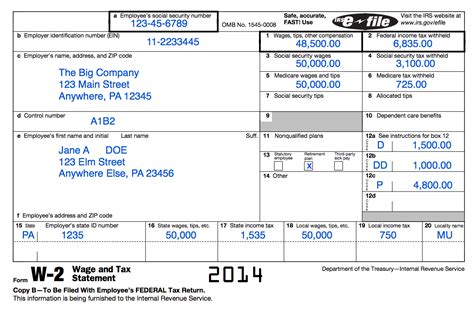

Your W-2 form will typically include the following information:

- Your name and address: This section will display your name and address as it appears on your employer's records.

- Your employer's name and address: This section will display your employer's name and address, as well as their Employer Identification Number (EIN).

- Your Social Security number: This section will display your Social Security number, which is used to identify you for tax purposes.

- Wages, tips, and other compensation: This section will report your total wages, tips, and other compensation earned during the tax year.

- Federal income tax withheld: This section will report the amount of federal income tax withheld from your wages.

- Social Security tax withheld: This section will report the amount of Social Security tax withheld from your wages.

- Medicare tax withheld: This section will report the amount of Medicare tax withheld from your wages.

Box 1: Wages, Tips, and Other Compensation

Box 1 of your W-2 form will report your total wages, tips, and other compensation earned during the tax year. This amount will include:

- Your regular wages

- Tips and gratuities

- Bonuses and commissions

- Other forms of compensation, such as severance pay or prizes

Keep in mind that this amount may not reflect your take-home pay, as it doesn't account for deductions or other withholdings.

How to Use Your W-2 Form for Tax Filing

When filing your taxes, you'll need to report the information from your W-2 form on your tax return. Here's how to use the information from your W-2 form:

- Report your income: Use the amount in Box 1 of your W-2 form to report your income on your tax return.

- Claim your withholding: Use the amounts in Boxes 2, 4, and 6 of your W-2 form to claim your federal, Social Security, and Medicare tax withholding on your tax return.

- Complete your tax return: Use the information from your W-2 form to complete the rest of your tax return, including reporting any deductions or credits you're eligible for.

Common Issues with W-2 Forms in Connecticut

While W-2 forms are typically accurate, there are some common issues that can arise. Here are a few things to watch out for:

- Incorrect information: If you notice any errors on your W-2 form, such as an incorrect name or address, contact your employer immediately to have it corrected.

- Missing information: If you don't receive your W-2 form by January 31st, contact your employer to request a replacement.

- Delayed filing: If you're unable to file your taxes on time due to an issue with your W-2 form, you may be eligible for an automatic six-month extension.

What to Do If You Have Questions About Your W-2 Form

If you have questions about your W-2 form or need help understanding the information it contains, there are several resources available to you:

- Contact your employer: Reach out to your employer's HR or payroll department for assistance with questions about your W-2 form.

- IRS resources: Visit the IRS website or contact the IRS directly for guidance on how to use your W-2 form for tax filing.

- Tax professional: Consider consulting a tax professional for personalized advice on how to use your W-2 form and complete your tax return.

Conclusion and Next Steps

Understanding your W-2 form is a crucial step in filing your taxes accurately and avoiding any potential issues with the IRS. By knowing what to expect on your W-2 form and how to use the information it contains, you can ensure a smooth tax filing process. If you have questions or concerns about your W-2 form, don't hesitate to reach out to your employer or a tax professional for assistance.

We hope this article has been informative and helpful in understanding your W-2 form in Connecticut. If you have any further questions or topics you'd like us to cover, please don't hesitate to ask in the comments below.

What is a W-2 form?

+A W-2 form, also known as the Wage and Tax Statement, is a document that reports your income and taxes withheld from your employer.

When will I receive my W-2 form?

+Your W-2 form will typically be issued by your employer by January 31st of each year.

What if I don't receive my W-2 form?

+If you don't receive your W-2 form by January 31st, contact your employer to request a replacement.