As a taxpayer in Vermont, it's essential to understand the various forms and requirements that come with filing your taxes. One such form is the VT Form IN-111, which is a crucial document for residents and non-residents alike. In this comprehensive guide, we'll delve into the world of VT Form IN-111, exploring its purpose, benefits, and step-by-step instructions for completion.

What is VT Form IN-111?

VT Form IN-111 is the Vermont Income Tax Return form, used by residents and non-residents to report their income earned within the state. This form is a critical component of the tax filing process, as it allows taxpayers to calculate their tax liability, claim deductions and credits, and report any tax owed or refunds due.

Who Needs to File VT Form IN-111?

Not everyone is required to file VT Form IN-111. However, the following individuals and entities must submit this form:

- Vermont residents with a federal adjusted gross income (AGI) exceeding $10,000 (single filers) or $20,000 (joint filers)

- Non-residents with Vermont-sourced income exceeding $10,000

- Estates and trusts with Vermont-sourced income

- Businesses with Vermont-sourced income

Benefits of Filing VT Form IN-111

Filing VT Form IN-111 offers several benefits, including:

- Compliance with Vermont tax laws and regulations

- Accurate calculation of tax liability and potential refunds

- Opportunity to claim deductions and credits, such as the Vermont Earned Income Tax Credit (EITC)

- Ability to report tax withheld from wages, pensions, and other sources

Step-by-Step Instructions for Completing VT Form IN-111

Completing VT Form IN-111 requires attention to detail and accurate reporting of income, deductions, and credits. Here's a step-by-step guide to help you navigate the process:

- Gather necessary documents, including:

- Federal tax return (Form 1040)

- W-2 forms from employers

- 1099 forms for self-employment income, interest, and dividends

- Proof of Vermont residency (driver's license, utility bills, etc.)

- Determine your filing status:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

- Report your income:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Other income (rental income, alimony, etc.)

- Claim deductions and credits:

- Standard deduction or itemized deductions

- Vermont EITC

- Child and dependent care credit

- Education credits

- Other credits (e.g., homebuyer credit)

- Calculate your tax liability:

- Apply the Vermont income tax rates to your taxable income

- Subtract any tax withheld from wages, pensions, and other sources

- Report any tax owed or refunds due:

- If you owe tax, submit payment with your return

- If you're due a refund, choose from direct deposit, paper check, or applying the refund to next year's tax liability

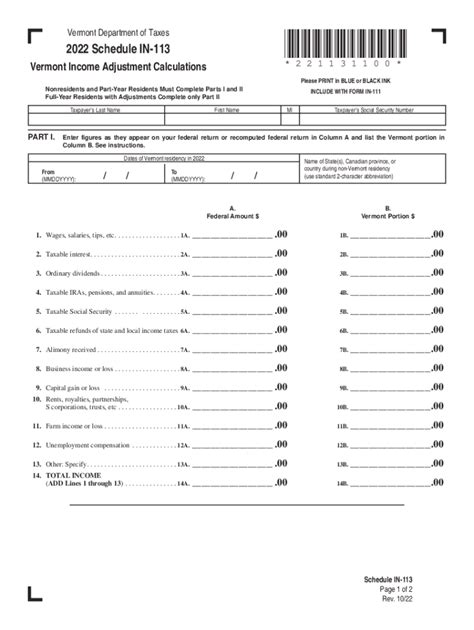

VT Form IN-111 Schedules and Attachments

Several schedules and attachments may be required with your VT Form IN-111, including:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividend Income

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

- Schedule E: Supplemental Income and Loss

- Form VT-1120: Vermont Corporate Income Tax Return (for businesses)

Common Errors to Avoid When Filing VT Form IN-111

When completing VT Form IN-111, be sure to avoid the following common errors:

- Incorrect or incomplete information

- Failure to report all income

- Incorrect calculation of tax liability

- Failure to claim eligible deductions and credits

- Late filing or payment

VT Form IN-111 Due Date and Payment Options

The due date for VT Form IN-111 is April 15th for individual filers. Businesses must file by March 15th. Payment options include:

- Check or money order

- Electronic Fund Transfer (EFT)

- Credit card

- Debit card

Conclusion

Filing VT Form IN-111 is a critical step in reporting your income and complying with Vermont tax laws. By following this comprehensive guide, you'll be well on your way to accurately completing your Vermont income tax return. Remember to gather all necessary documents, report your income, claim deductions and credits, and calculate your tax liability. Don't hesitate to seek professional help if you're unsure about any aspect of the process.

We invite you to share your experiences or ask questions about VT Form IN-111 in the comments section below. Additionally, if you found this guide helpful, please consider sharing it with others who may benefit from this information.

FAQ Section:

What is the due date for VT Form IN-111?

+The due date for VT Form IN-111 is April 15th for individual filers. Businesses must file by March 15th.

What is the Vermont Earned Income Tax Credit (EITC)?

+The Vermont EITC is a refundable credit for low-to-moderate-income working individuals and families. It is designed to provide financial assistance to those who need it most.

Can I file VT Form IN-111 electronically?

+Yes, you can file VT Form IN-111 electronically through the Vermont Department of Taxes' website. This option is available for both individual and business filers.