As a seller of real estate in Virginia, it's essential to understand the tax implications of your sale. One crucial aspect is the withholding tax, which can be a significant portion of the sale proceeds. In this article, we'll delve into the world of Virginia Form 763S, exploring what it is, who needs to file it, and how to navigate the process.

What is Virginia Form 763S?

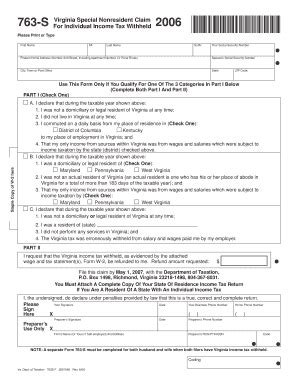

Virginia Form 763S is a tax form used to report the sale of real estate in the state of Virginia. It's specifically designed for sellers who are not exempt from withholding tax. The form requires sellers to provide information about the sale, including the sale price, buyer's information, and the amount of withholding tax due.

Who Needs to File Virginia Form 763S?

Not all sellers are required to file Virginia Form 763S. However, if you're a seller of real estate in Virginia, you'll likely need to file this form unless you're exempt. Exemptions include:

- Sales of principal residences (primary homes)

- Sales of property valued at $100,000 or less

- Sales of property that are exempt from taxation under Virginia law

If you're unsure about your exemption status, consult with a tax professional or the Virginia Department of Taxation.

How to File Virginia Form 763S

Filing Virginia Form 763S involves several steps:

- Obtain the form: You can download Virginia Form 763S from the Virginia Department of Taxation website or obtain a copy from a local tax office.

- Gather required information: You'll need to provide the following information:

- Sale price of the property

- Buyer's name, address, and taxpayer identification number (TIN)

- Seller's name, address, and TIN

- Property location and description

- Complete the form: Fill out the form accurately and completely. Make sure to sign and date the form.

- Submit the form: File the form with the Virginia Department of Taxation, either electronically or by mail. You'll also need to provide a copy to the buyer.

Withholding Tax Rates

The withholding tax rate in Virginia is 2.25% of the sale price. However, if the seller is a non-resident, the withholding tax rate increases to 2.75%. The withholding tax is due at the time of sale and must be paid to the Virginia Department of Taxation.

Penalties for Non-Compliance

Failure to file Virginia Form 763S or pay the withholding tax can result in penalties and interest. The Virginia Department of Taxation may impose penalties of up to 30% of the unpaid tax, plus interest and fees.

Benefits of Filing Virginia Form 763S

Filing Virginia Form 763S ensures compliance with Virginia tax laws and avoids potential penalties. Additionally, filing the form provides a record of the sale and withholding tax paid, which can be useful for future tax purposes.

Common Mistakes to Avoid

When filing Virginia Form 763S, common mistakes to avoid include:

- Failing to provide accurate and complete information

- Not signing and dating the form

- Not submitting the form to the Virginia Department of Taxation

- Not providing a copy to the buyer

Conclusion

Filing Virginia Form 763S is a critical step in the real estate sale process. By understanding the requirements and process, sellers can avoid penalties and ensure compliance with Virginia tax laws. If you're unsure about any aspect of the process, consult with a tax professional or the Virginia Department of Taxation.

Take Action

If you're a seller of real estate in Virginia, take the following steps:

- Review the Virginia Department of Taxation website for the latest information on Virginia Form 763S

- Consult with a tax professional to ensure compliance with Virginia tax laws

- File Virginia Form 763S accurately and on time to avoid penalties

By following these steps, you can ensure a smooth and compliant real estate sale process.

Frequently Asked Questions

What is the withholding tax rate in Virginia?

+The withholding tax rate in Virginia is 2.25% of the sale price. However, if the seller is a non-resident, the withholding tax rate increases to 2.75%.

Who is exempt from filing Virginia Form 763S?

+Exemptions include sales of principal residences (primary homes), sales of property valued at $100,000 or less, and sales of property that are exempt from taxation under Virginia law.

What are the penalties for non-compliance?

+Failure to file Virginia Form 763S or pay the withholding tax can result in penalties and interest. The Virginia Department of Taxation may impose penalties of up to 30% of the unpaid tax, plus interest and fees.