Vermont residents who own and occupy their primary residence may be eligible for a homestead exemption, which can help reduce their property taxes. To claim this exemption, homeowners must file a Vermont Homestead Declaration Form HS-122 with their local town clerk's office. In this article, we will walk you through the 5 steps to file the Vermont Homestead Declaration Form HS-122 and provide you with the necessary information to complete the process successfully.

Understanding the Vermont Homestead Exemption

Before we dive into the steps to file the Vermont Homestead Declaration Form HS-122, let's take a brief look at what the homestead exemption is and how it works. The homestead exemption is a tax exemption available to Vermont residents who own and occupy their primary residence. The exemption reduces the taxable value of the property, resulting in lower property taxes.

Eligibility Requirements

To be eligible for the Vermont homestead exemption, you must meet the following requirements:

- You must own and occupy the property as your primary residence.

- You must be a Vermont resident.

- The property must be a single-family home, condominium, or cooperative.

Step 1: Gather Required Documents and Information

Before you start the filing process, make sure you have all the necessary documents and information. You will need:

- A copy of your property deed or title report.

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Your Vermont driver's license or state-issued ID card.

- The property's parcel ID number (available on your property tax bill or from your local town clerk's office).

Additional Information Required

You will also need to provide information about your property, including:

- The property's address and location.

- The type of property (single-family home, condominium, or cooperative).

- The date you occupied the property as your primary residence.

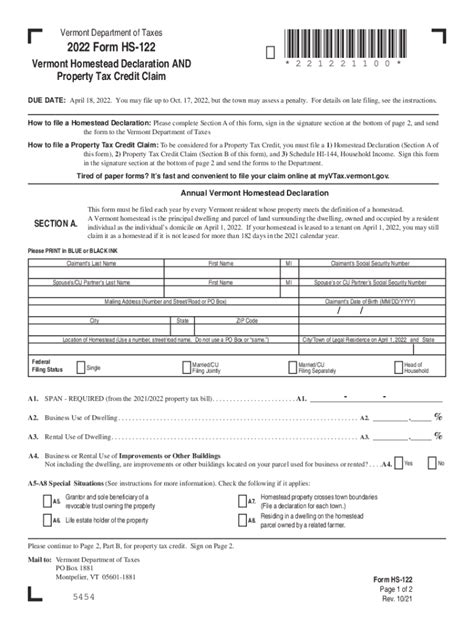

Step 2: Obtain the Vermont Homestead Declaration Form HS-122

You can obtain the Vermont Homestead Declaration Form HS-122 from your local town clerk's office or download it from the Vermont Department of Taxes website. Make sure to use the most up-to-date version of the form.

Form HS-122 Sections

The form is divided into several sections, including:

- Section 1: Property Information.

- Section 2: Owner Information.

- Section 3: Certification and Signature.

Step 3: Complete the Vermont Homestead Declaration Form HS-122

Carefully complete the form, making sure to provide accurate and complete information. You may want to use a black pen to fill out the form, as this will make it easier to read.

Section 1: Property Information

In this section, you will need to provide information about your property, including the parcel ID number, property address, and type of property.

Section 2: Owner Information

In this section, you will need to provide your name, Social Security number or ITIN, and Vermont driver's license or state-issued ID card number.

Section 3: Certification and Signature

In this section, you will need to certify that the information provided is accurate and complete. You will also need to sign and date the form.

Step 4: Submit the Completed Form to Your Local Town Clerk's Office

Once you have completed the form, submit it to your local town clerk's office. You can mail or hand-deliver the form. Make sure to keep a copy of the form for your records.

Deadline to File

The deadline to file the Vermont Homestead Declaration Form HS-122 is typically April 15th of each year. However, it's best to check with your local town clerk's office for specific deadlines and requirements.

Step 5: Verify Your Filing Status

After submitting the form, verify your filing status with your local town clerk's office. You can check the status online or by contacting the office directly.

Common Filing Issues

Some common filing issues include:

- Incomplete or inaccurate information.

- Missing signatures or certifications.

- Filing deadlines not met.

By following these 5 steps, you can successfully file the Vermont Homestead Declaration Form HS-122 and claim the homestead exemption on your primary residence. Remember to verify your filing status and address any issues promptly to ensure you receive the exemption.

We encourage you to share your experiences or ask questions about filing the Vermont Homestead Declaration Form HS-122 in the comments section below. Your feedback and insights can help others navigate the process more smoothly.

What is the deadline to file the Vermont Homestead Declaration Form HS-122?

+The deadline to file the Vermont Homestead Declaration Form HS-122 is typically April 15th of each year. However, it's best to check with your local town clerk's office for specific deadlines and requirements.

What documents do I need to provide when filing the Vermont Homestead Declaration Form HS-122?

+You will need to provide a copy of your property deed or title report, your Social Security number or Individual Taxpayer Identification Number (ITIN), and your Vermont driver's license or state-issued ID card.

How do I verify my filing status after submitting the Vermont Homestead Declaration Form HS-122?

+You can verify your filing status by contacting your local town clerk's office or checking online.