Direct deposit has become a staple in modern banking, allowing individuals to receive their paychecks, tax refunds, and government benefits directly into their bank accounts. Varo, a digital banking platform, offers a convenient and user-friendly direct deposit feature that enables users to set up and manage their direct deposits with ease. In this article, we will delve into the Varo direct deposit form, its setup process, and the benefits it offers.

Varo is a mobile banking app that provides a range of financial services, including direct deposit, bill pay, and ATM access. With Varo, users can set up direct deposit to receive their paychecks, tax refunds, and government benefits directly into their Varo account. The process is simple, secure, and convenient, allowing users to access their funds quickly and easily.

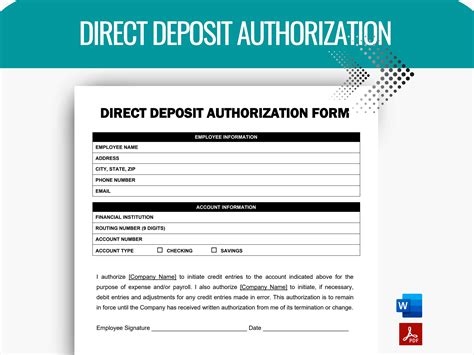

Setting Up Varo Direct Deposit Form

To set up Varo direct deposit, users need to follow a few simple steps:

- Log in to your Varo account: Open the Varo mobile app and log in to your account using your username and password.

- Navigate to the direct deposit section: Tap on the "Move Money" tab and select "Direct Deposit" from the menu.

- Enter your employer's information: Enter your employer's name, address, and phone number to set up the direct deposit.

- Provide your account information: Enter your Varo account number and routing number to complete the setup process.

- Submit the direct deposit form: Review the information and submit the direct deposit form to complete the setup process.

What You Need to Know About Varo Direct Deposit Form

Before setting up Varo direct deposit, users should be aware of the following:

- Routing number: The Varo routing number is 124303201. This number is required to set up direct deposit.

- Account number: Users need to provide their Varo account number to complete the setup process.

- Employer's information: Users need to provide their employer's name, address, and phone number to set up the direct deposit.

Benefits of Varo Direct Deposit

Varo direct deposit offers several benefits, including:

- Convenience: Direct deposit allows users to receive their paychecks, tax refunds, and government benefits directly into their Varo account, eliminating the need to visit a bank branch or ATM.

- Speed: Direct deposit is faster than traditional deposit methods, allowing users to access their funds quickly and easily.

- Security: Direct deposit is a secure way to receive funds, reducing the risk of lost or stolen checks.

- Flexibility: Varo direct deposit allows users to set up recurring deposits, making it easy to manage their finances.

Additional Benefits of Varo Direct Deposit

In addition to the benefits mentioned above, Varo direct deposit also offers:

- Early access to direct deposit funds: Varo offers early access to direct deposit funds, allowing users to access their funds up to two days earlier than traditional deposit methods.

- Real-time notifications: Varo provides real-time notifications when direct deposit funds are deposited into the user's account.

- Mobile banking: Varo's mobile banking app allows users to manage their direct deposit and access their account information on the go.

Varo Direct Deposit Limits and Requirements

Varo direct deposit has certain limits and requirements, including:

- Deposit limits: Varo has a deposit limit of $10,000 per day for direct deposit.

- Account requirements: Users need to have a Varo account to set up direct deposit.

- Employer requirements: Employers need to participate in the direct deposit program to offer this service to their employees.

Varo Direct Deposit Requirements for Employers

Employers need to meet certain requirements to offer Varo direct deposit to their employees, including:

- Participation in the direct deposit program: Employers need to participate in the direct deposit program to offer this service to their employees.

- Compliance with direct deposit regulations: Employers need to comply with direct deposit regulations, including the Electronic Fund Transfer Act (EFTA).

Varo Direct Deposit Form FAQ

Here are some frequently asked questions about Varo direct deposit:

- What is the Varo routing number?: The Varo routing number is 124303201.

- How do I set up Varo direct deposit?: To set up Varo direct deposit, log in to your Varo account, navigate to the direct deposit section, enter your employer's information, provide your account information, and submit the direct deposit form.

- What are the benefits of Varo direct deposit?: Varo direct deposit offers several benefits, including convenience, speed, security, and flexibility.

Additional Varo Direct Deposit FAQs

Here are some additional FAQs about Varo direct deposit:

- What is the deposit limit for Varo direct deposit?: The deposit limit for Varo direct deposit is $10,000 per day.

- What are the requirements for Varo direct deposit?: Users need to have a Varo account and meet certain requirements to set up direct deposit.

- How do I access my direct deposit funds?: Users can access their direct deposit funds through the Varo mobile banking app or by visiting a Varo ATM.

What is the Varo routing number?

+The Varo routing number is 124303201.

How do I set up Varo direct deposit?

+To set up Varo direct deposit, log in to your Varo account, navigate to the direct deposit section, enter your employer's information, provide your account information, and submit the direct deposit form.

What are the benefits of Varo direct deposit?

+Varo direct deposit offers several benefits, including convenience, speed, security, and flexibility.

In conclusion, Varo direct deposit is a convenient and user-friendly feature that allows users to receive their paychecks, tax refunds, and government benefits directly into their Varo account. By following the setup process and meeting the requirements, users can enjoy the benefits of Varo direct deposit, including early access to direct deposit funds, real-time notifications, and mobile banking.