As a veteran, navigating the complexities of tax season can be a daunting task. With numerous forms and regulations to keep track of, it's easy to feel overwhelmed. One crucial form that veterans should be familiar with is the VA Form 760ES, Estimated Income Tax for Veterans. In this article, we will delve into the world of VA Form 760ES, exploring its purpose, benefits, and requirements.

What is VA Form 760ES?

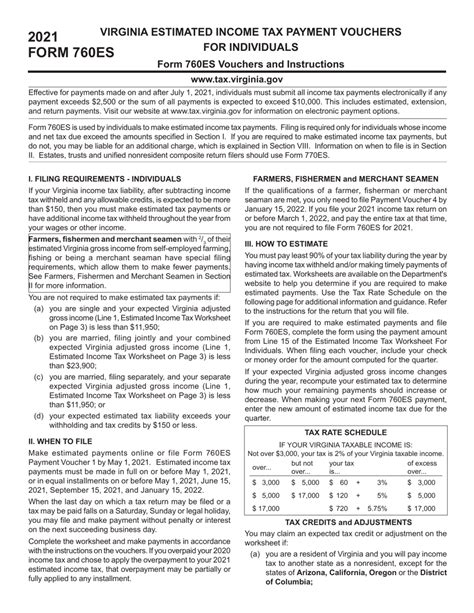

VA Form 760ES is an estimated income tax form specifically designed for veterans who receive tax-exempt income from the U.S. Department of Veterans Affairs (VA). This form is used to report and pay estimated taxes on a quarterly basis, ensuring that veterans stay compliant with the Internal Revenue Service (IRS) regulations.

Why is VA Form 760ES important?

Failing to file VA Form 760ES can result in penalties and interest on unpaid taxes. By filing this form, veterans can avoid these consequences and ensure they are meeting their tax obligations. Additionally, this form helps veterans to:

- Report tax-exempt income from the VA

- Pay estimated taxes on a quarterly basis

- Avoid penalties and interest on unpaid taxes

- Stay compliant with IRS regulations

Who needs to file VA Form 760ES?

Veterans who receive tax-exempt income from the VA are required to file VA Form 760ES. This includes:

- Veterans receiving VA disability compensation

- Veterans receiving VA pension benefits

- Veterans receiving VA education benefits

- Veterans receiving VA vocational rehabilitation benefits

How to file VA Form 760ES

Filing VA Form 760ES is a relatively straightforward process. Here are the steps to follow:

- Obtain the form: Download VA Form 760ES from the VA website or obtain a copy from your local VA office.

- Gather required information: Collect your tax-exempt income information from the VA, including your disability compensation, pension benefits, education benefits, and vocational rehabilitation benefits.

- Complete the form: Fill out the form with your required information, including your name, address, and Social Security number.

- Calculate your estimated tax: Calculate your estimated tax liability using the form's instructions.

- Make a payment: Make a payment for the estimated tax liability using the form's instructions.

- File the form: File the completed form with the IRS by the quarterly deadline.

Quarterly deadlines for VA Form 760ES

The quarterly deadlines for VA Form 760ES are:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Benefits of filing VA Form 760ES

Filing VA Form 760ES offers several benefits to veterans, including:

- Avoiding penalties and interest on unpaid taxes

- Ensuring compliance with IRS regulations

- Reducing the risk of an audit

- Receiving a refund if overpaid

Common mistakes to avoid

When filing VA Form 760ES, avoid the following common mistakes:

- Failing to report all tax-exempt income

- Underestimating tax liability

- Missing quarterly deadlines

- Failing to keep accurate records

Conclusion

VA Form 760ES is a crucial form for veterans to understand and file accurately. By following the steps outlined in this article, veterans can ensure they are meeting their tax obligations and avoiding penalties and interest on unpaid taxes. Remember to file VA Form 760ES by the quarterly deadlines and keep accurate records to avoid common mistakes.

What is the purpose of VA Form 760ES?

+VA Form 760ES is an estimated income tax form specifically designed for veterans who receive tax-exempt income from the U.S. Department of Veterans Affairs (VA).

Who needs to file VA Form 760ES?

+Veterans who receive tax-exempt income from the VA are required to file VA Form 760ES, including those receiving disability compensation, pension benefits, education benefits, and vocational rehabilitation benefits.

What are the quarterly deadlines for VA Form 760ES?

+The quarterly deadlines for VA Form 760ES are April 15th for the first quarter, June 15th for the second quarter, September 15th for the third quarter, and January 15th of the following year for the fourth quarter.