As a veteran, you've served your country with honor and dedication. Now, it's time to prioritize your own well-being and financial security. One crucial aspect of this is understanding your life insurance options, particularly when it comes to VA Form 27-0820. This form is a crucial document that helps you apply for Veteran Life Insurance, but navigating its complexities can be daunting. In this article, we'll break down the ins and outs of VA Form 27-0820, guiding you through the process and ensuring you make the most of your benefits.

What is VA Form 27-0820?

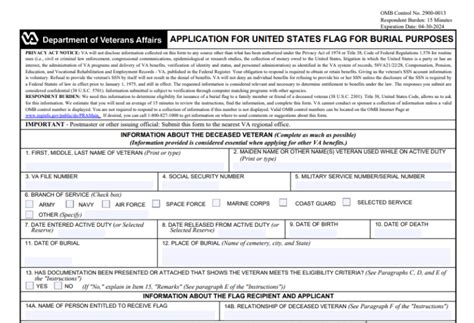

VA Form 27-0820, also known as the "Application for Veterans' Group Life Insurance," is a document used by eligible veterans to apply for life insurance coverage. This form is specifically designed for veterans who want to take advantage of the Veterans' Group Life Insurance (VGLI) program, which provides affordable life insurance coverage to eligible veterans.

Eligibility Requirements

To be eligible for VGLI, you must meet specific requirements:

- Be a veteran with a service-connected disability

- Have been discharged from the military under conditions other than dishonorable

- Be a member of the uniformed services who is within 1 year and 120 days of separation

- Be a veteran who has been awarded the Purple Heart

If you meet these requirements, you can apply for VGLI coverage using VA Form 27-0820.

Understanding the Application Process

The application process for VGLI involves several steps:

- Gather Required Documents: You'll need to provide proof of military service, such as your DD Form 214, and proof of identity.

- Complete VA Form 27-0820: Fill out the application form accurately and thoroughly, making sure to sign and date it.

- Submit the Application: Send the completed application to the Office of Servicemembers' Group Life Insurance (OSGLI) for processing.

Benefits of VGLI Coverage

VGLI coverage offers several benefits, including:

- Tax-Free Benefits: The death benefit paid to your beneficiary is tax-free.

- Portable Coverage: You can take your coverage with you, even if you change jobs or move.

- Guaranteed Insurability: You can increase your coverage amount every 5 years, up to the maximum allowed.

- Competitive Premium Rates: VGLI offers competitive premium rates, especially for younger veterans.

Common Mistakes to Avoid

When filling out VA Form 27-0820, it's essential to avoid common mistakes that can delay or even deny your application. These include:

- Inaccurate or Incomplete Information: Make sure to provide accurate and complete information, including your Social Security number and military service details.

- Failure to Sign and Date the Application: Don't forget to sign and date the application form.

- Not Submitting Required Documents: Ensure you submit all required documents, including proof of military service and identity.

Tips for Filing VA Form 27-0820

To ensure a smooth application process, follow these tips:

- Read the Instructions Carefully: Take the time to read the instructions and understand what's required.

- Gather All Required Documents: Make sure you have all the necessary documents before starting the application process.

- Seek Help if Needed: Don't hesitate to seek help if you're unsure about any part of the application process.

Conclusion: Taking Control of Your Financial Future

By understanding VA Form 27-0820 and the VGLI program, you're taking the first step towards securing your financial future. Don't let uncertainty hold you back – take control of your life insurance coverage and ensure your loved ones are protected.

We encourage you to share your experiences or ask questions about VA Form 27-0820 in the comments section below. Help us create a community of informed veterans who are taking charge of their financial well-being.

What is the deadline for submitting VA Form 27-0820?

+There is no specific deadline for submitting VA Form 27-0820, but it's recommended to apply within 1 year and 120 days of separation from the military.

Can I apply for VGLI coverage if I have a pre-existing medical condition?

+Yes, you can still apply for VGLI coverage, but you may be subject to a higher premium rate or a waiting period before your coverage takes effect.

How do I know if I'm eligible for VGLI coverage?

+You can check your eligibility by visiting the VA website or contacting the Office of Servicemembers' Group Life Insurance (OSGLI) directly.