Understanding the intricacies of the VA amendatory clause form can be a daunting task, especially for those who are new to the world of real estate and veteran benefits. However, grasping the concept of this form is crucial for individuals who are looking to buy, sell, or refinance a home using their VA loan benefits. In this article, we will delve into the world of VA amendatory clause forms and provide you with 5 ways to understand this complex topic.

What is a VA Amendatory Clause Form?

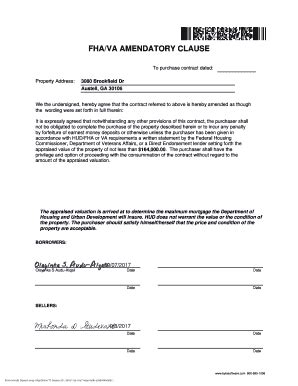

A VA amendatory clause form is a document that is used to amend or modify the terms of a VA loan. This form is typically used when there are changes to the original loan agreement, such as a change in the interest rate, loan amount, or repayment terms. The VA amendatory clause form is an essential document that ensures that all parties involved in the loan are aware of the changes and agree to them.

Why is a VA Amendatory Clause Form Important?

A VA amendatory clause form is important because it provides a clear and concise record of the changes made to the original loan agreement. This form helps to prevent misunderstandings and disputes between the lender, borrower, and the Department of Veterans Affairs (VA). By using a VA amendatory clause form, all parties can ensure that the changes to the loan are accurate and in compliance with VA regulations.

5 Ways to Understand VA Amendatory Clause Forms

1. Know the Purpose of the Form

The primary purpose of a VA amendatory clause form is to modify the terms of a VA loan. This form is used to make changes to the original loan agreement, such as changing the interest rate, loan amount, or repayment terms. Understanding the purpose of the form is crucial in ensuring that it is used correctly and that all parties are aware of the changes.

2. Understand the Types of Changes That Can Be Made

There are several types of changes that can be made to a VA loan using an amendatory clause form. These changes include:

- Changes to the interest rate

- Changes to the loan amount

- Changes to the repayment terms

- Changes to the loan term

- Changes to the type of loan (e.g., from a fixed-rate loan to an adjustable-rate loan)

Understanding the types of changes that can be made to a VA loan is essential in determining whether an amendatory clause form is necessary.

3. Know Who is Involved in the Process

The VA amendatory clause form involves several parties, including:

- The borrower (the veteran who is using their VA loan benefits)

- The lender (the financial institution that is providing the loan)

- The Department of Veterans Affairs (VA)

Understanding who is involved in the process is crucial in ensuring that all parties are aware of the changes and agree to them.

4. Understand the Requirements for Completing the Form

To complete a VA amendatory clause form, certain requirements must be met. These requirements include:

- The form must be completed in its entirety

- The form must be signed by all parties involved

- The form must be dated

- The form must include a clear description of the changes being made

Understanding the requirements for completing the form is essential in ensuring that it is done correctly and that all parties are aware of the changes.

5. Seek Professional Help if Necessary

If you are unsure about how to complete a VA amendatory clause form or if you have questions about the process, it is essential to seek professional help. A qualified real estate agent or loan officer can provide guidance and ensure that the form is completed correctly.

Benefits of Using a VA Amendatory Clause Form

Using a VA amendatory clause form provides several benefits, including:

- Clarity and transparency: The form provides a clear and concise record of the changes made to the original loan agreement.

- Compliance with VA regulations: The form ensures that all parties are aware of the changes and agree to them, which helps to prevent misunderstandings and disputes.

- Protection for the borrower: The form provides protection for the borrower by ensuring that they are aware of the changes and agree to them.

Common Mistakes to Avoid

When using a VA amendatory clause form, there are several common mistakes to avoid, including:

- Failing to complete the form in its entirety

- Failing to obtain signatures from all parties involved

- Failing to date the form

- Failing to include a clear description of the changes being made

Avoiding these common mistakes is essential in ensuring that the form is completed correctly and that all parties are aware of the changes.

Conclusion: Take Control of Your VA Loan

Understanding the VA amendatory clause form is essential for individuals who are looking to buy, sell, or refinance a home using their VA loan benefits. By knowing the purpose of the form, understanding the types of changes that can be made, and seeking professional help if necessary, you can take control of your VA loan and ensure that you are getting the best possible deal.

We encourage you to comment below with any questions or concerns you may have about VA amendatory clause forms. Share this article with others who may be interested in learning more about this topic.

What is a VA amendatory clause form used for?

+A VA amendatory clause form is used to amend or modify the terms of a VA loan.

Who is involved in the process of completing a VA amendatory clause form?

+The borrower, lender, and Department of Veterans Affairs (VA) are all involved in the process of completing a VA amendatory clause form.

What are the benefits of using a VA amendatory clause form?

+Using a VA amendatory clause form provides clarity and transparency, ensures compliance with VA regulations, and provides protection for the borrower.