Filling out tax forms can be a daunting task, especially when it comes to specific state forms like the Utah TC-40. The Utah TC-40 is a vital form for Utah residents and businesses, as it is used to report and pay state income taxes. In this article, we will guide you through the process of filling out the Utah TC-40 form correctly, highlighting five essential steps to ensure accuracy and compliance.

Understanding the Utah TC-40 Form

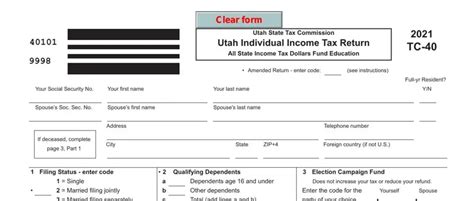

Before diving into the steps, it's crucial to understand what the Utah TC-40 form is and what it's used for. The TC-40 is a tax return form issued by the Utah State Tax Commission, which is responsible for collecting state income taxes. The form is used to report an individual's or business's income, deductions, and credits, and to calculate the amount of taxes owed or refunded.

Step 1: Gather Required Documents and Information

To fill out the Utah TC-40 form correctly, you'll need to gather the required documents and information. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Utah state tax ID number (if applicable)

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance or contract work

- Your federal income tax return (Form 1040)

- Any other relevant tax documents, such as receipts for charitable donations or medical expenses

Tips for Gathering Documents

- Make sure to keep all your tax documents organized and easily accessible.

- Double-check that all your W-2 and 1099 forms are accurate and complete.

- If you're unsure about what documents you need, consult with a tax professional or contact the Utah State Tax Commission.

Step 2: Determine Your Filing Status

Your filing status is essential in determining your tax obligations and potential refund. The Utah TC-40 form allows for the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Understanding Filing Status

- Your filing status may affect your tax rates and deductions.

- If you're unsure about your filing status, consult with a tax professional or refer to the Utah State Tax Commission's guidelines.

Step 3: Report Your Income

Reporting your income accurately is critical when filling out the Utah TC-40 form. You'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Self-employment income

- Other income (such as alimony or unemployment benefits)

Tips for Reporting Income

- Make sure to report all your income, even if it's not listed on your W-2 or 1099 forms.

- If you're self-employed, you'll need to complete Schedule C (Form 1040) and attach it to your Utah TC-40 form.

Step 4: Claim Deductions and Credits

Deductions and credits can significantly reduce your tax liability. The Utah TC-40 form allows for various deductions and credits, including:

- Standard deduction

- Itemized deductions (such as mortgage interest, charitable donations, and medical expenses)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Understanding Deductions and Credits

- Make sure to claim all eligible deductions and credits.

- If you're unsure about what deductions and credits you qualify for, consult with a tax professional or refer to the Utah State Tax Commission's guidelines.

Step 5: Review and Submit Your Return

Once you've completed the Utah TC-40 form, review it carefully to ensure accuracy and completeness. You can submit your return:

- Electronically through the Utah State Tax Commission's website

- By mail to the address listed on the form

- In person at a Utah State Tax Commission office

Tips for Submitting Your Return

- Make sure to sign and date your return.

- If you're submitting electronically, ensure you receive a confirmation number.

- If you're submitting by mail, make sure to keep a copy of your return and supporting documents.

By following these five steps, you'll be able to fill out the Utah TC-40 form correctly and accurately. Remember to take your time, and don't hesitate to seek help if you're unsure about any part of the process.

What is the deadline for filing the Utah TC-40 form?

+The deadline for filing the Utah TC-40 form is typically April 15th of each year, unless you file for an extension.

Can I e-file my Utah TC-40 form?

+Yes, you can e-file your Utah TC-40 form through the Utah State Tax Commission's website.

What happens if I don't file my Utah TC-40 form on time?

+If you don't file your Utah TC-40 form on time, you may be subject to penalties and interest on any unpaid taxes.

We hope this article has provided you with valuable insights and guidance on filling out the Utah TC-40 form correctly. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the Utah State Tax Commission.