Filling out forms can be a daunting task, especially when it comes to complex documents like the Usm 285 form. This form is a crucial part of the customs process, and accuracy is key to avoid delays or penalties. In this article, we will guide you through the process of filling out the Usm 285 form correctly, highlighting the essential steps and providing valuable tips to ensure you get it right.

Understanding the Usm 285 Form

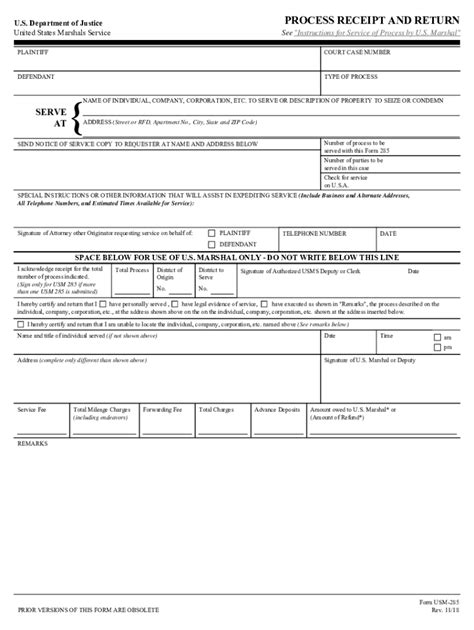

The Usm 285 form, also known as the "Continued Dumping and Subsidy Offset Act of 2000" form, is used to distribute offset funds to affected domestic producers. The form is administered by the U.S. Customs and Border Protection (CBP) and is an essential part of the customs process. The form requires detailed information about the imported goods, including the Harmonized System (HS) codes, country of origin, and value of the goods.

Step 1: Gather Required Information

Before filling out the Usm 285 form, it's essential to gather all the required information. This includes:

- HS codes for the imported goods

- Country of origin for the goods

- Value of the goods

- Date of importation

- Entry number

Having this information readily available will make the process of filling out the form much easier.

Step 2: Determine the Correct HS Codes

The HS codes are a critical part of the Usm 285 form. The codes are used to identify the type of goods being imported and are essential for determining the correct duty rates. It's essential to ensure that the HS codes are accurate, as incorrect codes can lead to delays or penalties.

Step 3: Fill Out the Form Accurately

Once you have gathered all the required information, it's time to fill out the Usm 285 form. Here are some tips to ensure you fill out the form accurately:

- Use a black pen or pencil to fill out the form

- Print clearly and legibly

- Use the correct date format (mm/dd/yyyy)

- Ensure all fields are completed, including the HS codes, country of origin, and value of the goods

Step 4: Review and Verify the Information

Before submitting the Usm 285 form, it's essential to review and verify the information. This includes:

- Checking the HS codes for accuracy

- Verifying the country of origin and value of the goods

- Ensuring all fields are completed correctly

Step 5: Submit the Form

Once you have reviewed and verified the information, it's time to submit the Usm 285 form. The form can be submitted electronically or by mail, depending on the CBP's requirements.

Benefits of Filling Out the Usm 285 Form Correctly

Filling out the Usm 285 form correctly has several benefits, including:

- Avoiding delays or penalties

- Ensuring accurate duty rates

- Simplifying the customs process

- Reducing the risk of errors or discrepancies

Common Mistakes to Avoid

When filling out the Usm 285 form, there are several common mistakes to avoid, including:

- Inaccurate HS codes

- Incorrect country of origin or value of the goods

- Missing or incomplete fields

- Incorrect date format

Conclusion

Filling out the Usm 285 form correctly is crucial for ensuring a smooth customs process. By following the steps outlined in this article and avoiding common mistakes, you can ensure that your form is accurate and complete. Remember to review and verify the information carefully before submitting the form, and don't hesitate to seek help if you need it.

Take Action

If you're responsible for filling out the Usm 285 form, take action today to ensure you're doing it correctly. Review the form and the information required, and seek help if you need it. Don't risk delays or penalties by filling out the form incorrectly.

FAQ Section

What is the Usm 285 form used for?

+The Usm 285 form is used to distribute offset funds to affected domestic producers.

What information is required on the Usm 285 form?

+The form requires detailed information about the imported goods, including the HS codes, country of origin, and value of the goods.

How do I submit the Usm 285 form?

+The form can be submitted electronically or by mail, depending on the CBP's requirements.