The Ultimate Medical Academy (UMA) 1098-T form is a crucial document for students who receive financial aid or scholarships to pursue higher education. As a student, it's essential to understand the significance of this form, how to read it, and what information it provides. In this article, we will delve into the details of the UMA 1098-T form, exploring its importance, components, and how to make the most of it.

What is the UMA 1098-T Form?

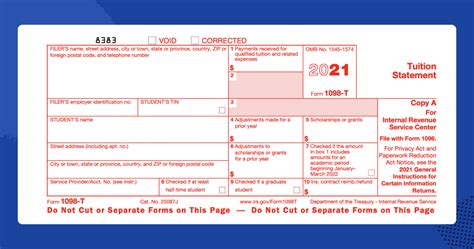

The 1098-T form is a tuition statement provided by eligible educational institutions, including the Ultimate Medical Academy, to students who have received financial aid or scholarships. The form reports the amount of qualified tuition and related expenses (QTRE) paid by the student during the calendar year. The Internal Revenue Service (IRS) requires educational institutions to provide this form to students by January 31st each year.

Why is the UMA 1098-T Form Important?

The 1098-T form is crucial for students who claim education credits or deductions on their tax returns. The form provides the necessary information for students to complete Form 8863, Education Credits, and claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). Additionally, the form helps students and their families to:

- Verify the amount of qualified tuition and related expenses paid

- Determine eligibility for education credits and deductions

- Claim education credits and deductions on tax returns

How to Read the UMA 1098-T Form

The 1098-T form is divided into several boxes, each containing specific information. Here's a breakdown of the key components:

- Box 1: Payments received for qualified tuition and related expenses

- Box 2: Amounts billed for qualified tuition and related expenses

- Box 3: Check if the educational institution changed its reporting method for the calendar year

- Box 4: Adjustments made to qualified tuition and related expenses for a prior year

- Box 5: Scholarships or grants received by the student

- Box 6: Adjustments to scholarships or grants for a prior year

- Box 7: Check if the amount in Box 2 includes amounts for an academic period beginning in the next calendar year

- Box 8: Check if the student is at least half-time enrolled

- Box 9: Check if the student is a graduate student

- Box 10: Total amount of tuition and fees

What to Do with the UMA 1098-T Form

Once you receive the 1098-T form, review it carefully to ensure accuracy. If you notice any errors, contact the Ultimate Medical Academy's Bursar's Office or Financial Aid Office to request corrections. If the form is accurate, you can use the information to:

- Complete Form 8863, Education Credits

- Claim education credits and deductions on your tax return

- Verify the amount of qualified tuition and related expenses paid

5 Ways to Understand the UMA 1098-T Form

To get the most out of the UMA 1098-T form, follow these five steps:

- Review the form carefully: Check for accuracy and ensure all information is correct.

- Understand the reporting method: Verify if the Ultimate Medical Academy has changed its reporting method for the calendar year.

- Calculate qualified tuition and related expenses: Use the information in Box 1 and Box 2 to calculate the total amount of qualified tuition and related expenses paid.

- Determine eligibility for education credits and deductions: Use the information on the form to determine if you're eligible for education credits and deductions.

- Claim education credits and deductions: Use the information on the form to complete Form 8863 and claim education credits and deductions on your tax return.

Conclusion

The Ultimate Medical Academy 1098-T form is a vital document for students who receive financial aid or scholarships. By understanding the components, importance, and how to read the form, students can make the most of the information provided. By following the five steps outlined above, students can ensure they're taking advantage of education credits and deductions available to them.

If you have any questions or concerns about the UMA 1098-T form, don't hesitate to reach out to the Ultimate Medical Academy's Financial Aid Office or Bursar's Office for assistance.

We'd love to hear from you! Share your thoughts and experiences with the UMA 1098-T form in the comments below.

What is the deadline for receiving the 1098-T form?

+The deadline for receiving the 1098-T form is January 31st each year.

What is the difference between the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC)?

+The American Opportunity Tax Credit (AOTC) is a credit of up to $2,500 for qualified education expenses, while the Lifetime Learning Credit (LLC) is a credit of up to $2,000 for qualified education expenses.

Can I claim education credits and deductions if I receive a scholarship or grant?

+Yes, you can claim education credits and deductions if you receive a scholarship or grant, but you must reduce the amount of qualified tuition and related expenses by the amount of the scholarship or grant.