Retirement planning is a critical aspect of securing a comfortable financial future. For many individuals, qualified retirement plans, such as 401(k) or 403(b) plans, play a significant role in this process. However, when it comes to withdrawals or distributions from these plans, the tax implications can be complex. This is where Form 8915-F comes into play.

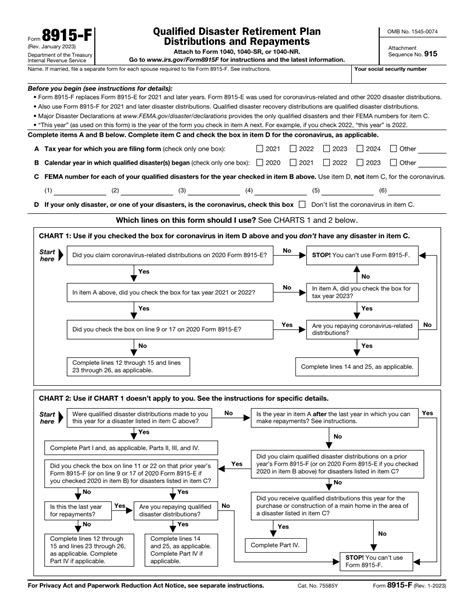

The IRS requires individuals who receive distributions from qualified retirement plans to report these transactions on their tax returns. Turbotax Form 8915-F, also known as the Qualified Retirement Plan Distributions, is specifically designed to help taxpayers accurately report and calculate the tax implications of these distributions. In this article, we will delve into the world of qualified retirement plan distributions, explore the importance of Form 8915-F, and provide guidance on how to navigate this process.

Understanding Qualified Retirement Plan Distributions

Qualified retirement plans are employer-sponsored plans that provide tax benefits to both employers and employees. These plans allow employees to contribute a portion of their salary to a retirement account on a pre-tax basis, reducing their taxable income. The funds in these accounts grow tax-deferred, meaning that taxes are not paid until the funds are withdrawn.

There are several types of qualified retirement plans, including:

- 401(k) plans

- 403(b) plans

- Thrift Savings Plans

- Profit-sharing plans

- Defined benefit plans

Types of Distributions

Distributions from qualified retirement plans can occur for various reasons, including:

- Separation from service (e.g., retirement or termination)

- Disability

- Death

- Financial hardship

- Loan repayment

These distributions can be either taxable or tax-free, depending on the type of plan and the reason for the distribution.

The Importance of Form 8915-F

Form 8915-F is a crucial document for individuals who receive distributions from qualified retirement plans. This form helps taxpayers calculate the taxable amount of the distribution and determine any potential penalties or taxes owed.

The form requires taxpayers to provide information about the distribution, including:

- The type of plan

- The reason for the distribution

- The amount of the distribution

- The taxable amount of the distribution

How to Complete Form 8915-F

To complete Form 8915-F, taxpayers will need to follow these steps:

- Gather required documents, including the distribution statement from the plan administrator

- Determine the type of plan and the reason for the distribution

- Calculate the taxable amount of the distribution using the instructions provided on the form

- Complete the form and attach it to the tax return (Form 1040)

Tax Implications of Qualified Retirement Plan Distributions

The tax implications of qualified retirement plan distributions can be significant. Generally, distributions from these plans are taxable as ordinary income. However, there are some exceptions and special rules that may apply.

For example:

- Distributions made before age 59 1/2 may be subject to a 10% penalty

- Distributions made after age 59 1/2 may be subject to income tax

- Distributions made to a beneficiary after the account owner's death may be subject to income tax

Penalties and Taxes Owed

Taxpayers who receive distributions from qualified retirement plans may be subject to penalties and taxes owed. The most common penalties include:

- The 10% penalty for premature distributions (before age 59 1/2)

- The 50% penalty for excess contributions

- The 6% penalty for excess accumulations

In addition to penalties, taxpayers may also owe income tax on the distribution.

Practical Examples and Statistical Data

To illustrate the importance of Form 8915-F, let's consider a few examples:

- John, a 55-year-old employee, receives a distribution of $100,000 from his 401(k) plan due to separation from service. He uses Form 8915-F to calculate the taxable amount of the distribution and determines that he owes $20,000 in income tax and a $10,000 penalty for premature distribution.

- Sarah, a 65-year-old retiree, receives a distribution of $50,000 from her 403(b) plan. She uses Form 8915-F to calculate the taxable amount of the distribution and determines that she owes $10,000 in income tax.

According to the IRS, in 2020, there were over 12 million distributions from qualified retirement plans, totaling over $400 billion.

Conclusion: Navigating the Complex World of Qualified Retirement Plan Distributions

Navigating the complex world of qualified retirement plan distributions can be challenging. However, with the help of Form 8915-F, taxpayers can accurately report and calculate the tax implications of these distributions. By understanding the types of distributions, the importance of Form 8915-F, and the tax implications, taxpayers can make informed decisions about their retirement planning and minimize potential penalties and taxes owed.

We hope this article has provided valuable insights into the world of qualified retirement plan distributions. If you have any questions or comments, please feel free to share them below.

What is Form 8915-F?

+Form 8915-F is a tax form used to report qualified retirement plan distributions.

What types of distributions are reported on Form 8915-F?

+Distributions from qualified retirement plans, including 401(k), 403(b), and other plans, are reported on Form 8915-F.

What are the tax implications of qualified retirement plan distributions?

+Distributions from qualified retirement plans are generally taxable as ordinary income, and may be subject to penalties and taxes owed.