Direct deposit is a convenient and secure way to receive your paycheck, benefits, or other regular payments. It allows you to have your money deposited directly into your bank account, eliminating the need for paper checks and the risk of lost or stolen payments. In this article, we will discuss the Truliant Direct Deposit Form, its benefits, and how to fill it out easily.

What is Truliant Direct Deposit Form?

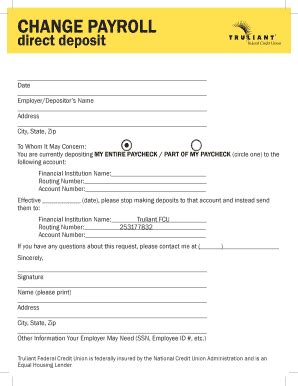

Truliant Direct Deposit Form is a document required by Truliant Federal Credit Union to set up direct deposit for its members. The form allows you to provide your bank account information and authorize Truliant to deposit your payments directly into your account.

Benefits of Using Truliant Direct Deposit Form

Using the Truliant Direct Deposit Form has several benefits, including:

- Convenience: Direct deposit allows you to receive your payments without having to visit a branch or wait for a check to clear.

- Security: Direct deposit reduces the risk of lost or stolen payments, as the funds are deposited directly into your account.

- Time-saving: Direct deposit saves you time and effort, as you don't have to deposit a check or wait for it to clear.

- Environmentally friendly: Direct deposit reduces paper waste and minimizes the carbon footprint associated with printing and mailing checks.

How to Fill Out Truliant Direct Deposit Form

Filling out the Truliant Direct Deposit Form is a straightforward process. Here's a step-by-step guide to help you fill out the form:

- Gather required information: Before filling out the form, make sure you have the following information:

- Your Truliant account number

- Your bank account number

- Your bank routing number

- Your employer's name and address (if applicable)

- Download the form: You can download the Truliant Direct Deposit Form from the Truliant website or obtain a copy from a Truliant branch.

- Fill out the form: Fill out the form with the required information, making sure to sign and date it.

- Attach required documents: Attach a voided check or a deposit slip to the form, if required.

- Submit the form: Submit the completed form to Truliant via mail, fax, or in-person at a Truliant branch.

Common Mistakes to Avoid When Filling Out Truliant Direct Deposit Form

When filling out the Truliant Direct Deposit Form, make sure to avoid the following common mistakes:

- Inaccurate account information: Double-check your account numbers and routing numbers to ensure accuracy.

- Missing signatures: Make sure to sign and date the form, as required.

- Incomplete forms: Ensure that you fill out all required fields and attach necessary documents.

Truliant Direct Deposit Form Requirements

To set up direct deposit with Truliant, you will need to meet the following requirements:

- Age: You must be at least 18 years old to set up direct deposit.

- Account: You must have an active Truliant account to set up direct deposit.

- Employer participation: Your employer must participate in the direct deposit program.

How to Check Truliant Direct Deposit Status

To check the status of your direct deposit, you can:

- Log in to online banking: Check your online banking account to see if your deposit has been processed.

- Contact Truliant customer service: Reach out to Truliant customer service to inquire about the status of your direct deposit.

Truliant Direct Deposit FAQs

Here are some frequently asked questions about Truliant Direct Deposit:

- Q: What is the Truliant Direct Deposit Form? A: The Truliant Direct Deposit Form is a document required to set up direct deposit with Truliant Federal Credit Union.

- Q: How do I fill out the Truliant Direct Deposit Form? A: Follow the step-by-step guide above to fill out the form.

- Q: What are the benefits of using Truliant Direct Deposit Form? A: The benefits include convenience, security, time-saving, and environmental friendliness.

What is the deadline to submit the Truliant Direct Deposit Form?

+The deadline to submit the Truliant Direct Deposit Form varies depending on the type of payment. Check with Truliant for specific deadlines.

Can I use the Truliant Direct Deposit Form for multiple accounts?

+No, you will need to fill out a separate form for each account.

How long does it take to process the Truliant Direct Deposit Form?

+The processing time varies depending on the type of payment. Check with Truliant for specific processing times.

We hope this article has provided you with a comprehensive guide to the Truliant Direct Deposit Form. If you have any further questions or concerns, please don't hesitate to reach out to us.