The world of finance can be complex and fascinating, with various regulations and filings that provide insight into the inner workings of publicly traded companies. One such filing is the Form 4, which is used to disclose insider trading activities. In this article, we will delve into the world of Tesla's Form 4 filings, exploring what they are, how they work, and what they can reveal about the company's inner dynamics.

Insider trading refers to the buying or selling of a company's securities by individuals with access to non-public information about the company. This can include executives, directors, and other employees who have a stake in the company's performance. The Securities and Exchange Commission (SEC) requires that these individuals disclose their transactions through the filing of a Form 4.

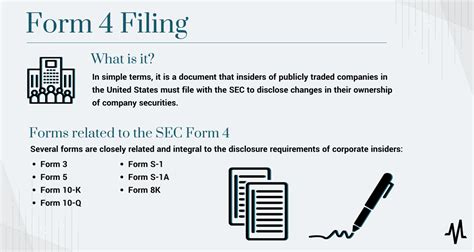

What is a Form 4 Filing?

A Form 4 is a document that insiders must file with the SEC to disclose their transactions involving the company's securities. The filing must be submitted within two business days of the transaction date and must include information about the transaction, such as:

- The type of security involved (e.g., stock, option, or warrant)

- The date of the transaction

- The number of securities involved

- The price per security

- The total value of the transaction

The purpose of the Form 4 is to provide transparency and accountability, allowing the public to monitor insider trading activities and make informed investment decisions.

How to Read a Form 4 Filing

Form 4 filings can be complex and difficult to understand, but they can provide valuable insights into a company's inner workings. Here are some key elements to look for when reading a Form 4 filing:

- Transaction Code: This code indicates the type of transaction that occurred. For example, "P" indicates a purchase, while "S" indicates a sale.

- Number of Securities: This field shows the number of securities involved in the transaction.

- Price per Security: This field shows the price per security at which the transaction occurred.

- Total Value: This field shows the total value of the transaction.

By analyzing these elements, you can gain a better understanding of the insider's transaction and its potential implications for the company.

Tesla's Form 4 Filings: What Do They Reveal?

Tesla's Form 4 filings can provide valuable insights into the company's inner dynamics and the confidence of its executives and directors in the company's performance. Here are some key takeaways from Tesla's recent Form 4 filings:

- Elon Musk's Transactions: As Tesla's CEO and largest shareholder, Elon Musk's transactions are closely watched by investors and analysts. Musk's Form 4 filings have shown that he has been actively buying and selling Tesla shares, with some transactions totaling millions of dollars.

- Executive Confidence: Tesla's executives and directors have shown confidence in the company's performance through their Form 4 filings. Many have purchased shares in recent years, indicating that they believe in the company's growth prospects.

- Option Exercises: Tesla's Form 4 filings have also shown that executives have exercised options to purchase shares, which can be a sign of confidence in the company's performance.

How to Access Tesla's Form 4 Filings

Tesla's Form 4 filings are publicly available through the SEC's website. Here's how to access them:

- SEC Website: Visit the SEC's website at .

- EDGAR Database: Search for Tesla's filings in the EDGAR database, which contains all of the company's publicly filed documents.

- Form 4 Filings: Filter the results to show only Form 4 filings, which will provide a list of all insider transactions.

By accessing Tesla's Form 4 filings, you can gain a better understanding of the company's inner dynamics and the confidence of its executives and directors in its performance.

Conclusion

Tesla's Form 4 filings provide valuable insights into the company's inner workings and the confidence of its executives and directors in its performance. By understanding how to read and analyze these filings, you can gain a better understanding of the company's growth prospects and make more informed investment decisions.

We encourage you to share your thoughts and opinions on Tesla's Form 4 filings in the comments section below. Do you think that insider trading activities can provide valuable insights into a company's performance? Share your insights and let's discuss!

What is a Form 4 filing?

+A Form 4 is a document that insiders must file with the SEC to disclose their transactions involving the company's securities.

How do I access Tesla's Form 4 filings?

+Tesla's Form 4 filings are publicly available through the SEC's website. You can search for the company's filings in the EDGAR database and filter the results to show only Form 4 filings.

What can Tesla's Form 4 filings reveal about the company?

+Tesla's Form 4 filings can provide valuable insights into the company's inner dynamics and the confidence of its executives and directors in its performance.