Termination of Decedent's Interest in Real Property, also known as the Affidavit of Termination of Decedent's Interest, is a crucial document used in the process of transferring real estate after the death of a property owner. This form is typically required in cases where the deceased individual held an interest in real property, and their heirs or beneficiaries need to formally terminate that interest to facilitate the transfer of ownership. In this article, we will delve into the specifics of filling out the Termination of Decedent's Interest form, highlighting six key steps to ensure accuracy and compliance with relevant laws.

Understanding the Purpose of the Termination of Decedent's Interest Form

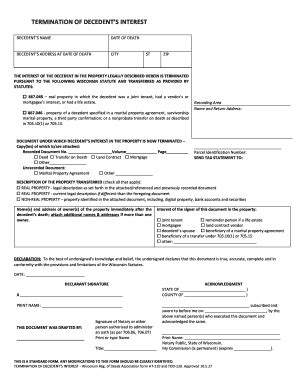

Before diving into the process of filling out the form, it's essential to understand its purpose. The Termination of Decedent's Interest form serves as a formal declaration that the deceased individual's interest in a particular property has ceased. This document is usually filed with the county recorder's office, where the property is located, and is a critical step in the probate process or in transferring ownership of the property.

Step 1: Gather Required Information and Documents

To accurately fill out the Termination of Decedent's Interest form, you will need to gather specific information and documents. These typically include:

- The deceased individual's full name and date of death

- A description of the property, including the address and assessor's parcel number

- The type of interest the deceased individual held in the property (e.g., sole owner, joint tenant, etc.)

- Information about the heirs or beneficiaries, including their names, addresses, and relationships to the deceased

- A copy of the death certificate

Key Documents to Reference

- The deed to the property

- The deceased individual's will or trust (if applicable)

- Any other relevant documents that establish the deceased individual's interest in the property

Step 2: Determine the Type of Property Interest

It is crucial to accurately determine the type of interest the deceased individual held in the property. This will affect how the form is filled out and what additional documentation may be required. The most common types of property interests include:

- Sole owner

- Joint tenant

- Community property

- Tenancy in common

Understanding the Implications of Each Type of Interest

- Sole owner: The deceased individual held the property in their name alone.

- Joint tenant: The deceased individual held the property with one or more co-owners, with rights of survivorship.

- Community property: The deceased individual held the property with their spouse, with equal ownership and rights.

- Tenancy in common: The deceased individual held the property with one or more co-owners, without rights of survivorship.

Step 3: Identify the Heirs or Beneficiaries

The next step is to identify the heirs or beneficiaries who will inherit the deceased individual's interest in the property. This information will be crucial in filling out the form and ensuring that the property is transferred correctly.

Key Information to Gather

- Names and addresses of the heirs or beneficiaries

- Relationships to the deceased individual (e.g., spouse, child, parent, etc.)

- Any relevant documentation, such as a will or trust, that establishes the heirs or beneficiaries

Step 4: Fill Out the Form Accurately and Completely

With all the necessary information and documents in hand, it's time to fill out the Termination of Decedent's Interest form. Be sure to follow these tips to ensure accuracy and completeness:

- Use the correct form for your state or county

- Fill out the form in its entirety, leaving no blank spaces

- Use black ink and print or type clearly

- Sign the form in front of a notary public (if required)

Common Mistakes to Avoid

- Incomplete or inaccurate information

- Failure to sign the form or have it notarized (if required)

- Using the wrong form or version

Step 5: Sign and Notarize the Form (If Required)

If the form requires a signature or notarization, be sure to follow the correct procedures. This may involve signing the form in front of a notary public or having the notary public acknowledge your signature.

Understanding the Importance of Notarization

- Notarization verifies the authenticity of the signature

- Notarization ensures that the form is executed voluntarily and without coercion

Step 6: File the Form with the County Recorder's Office

The final step is to file the completed and signed Termination of Decedent's Interest form with the county recorder's office. This will formally terminate the deceased individual's interest in the property and facilitate the transfer of ownership.

Key Information to Include with the Filing

- A copy of the death certificate

- A copy of the deed to the property

- Any other relevant documentation that establishes the deceased individual's interest in the property

By following these six steps, you can ensure that the Termination of Decedent's Interest form is filled out accurately and completely, facilitating a smooth transfer of ownership and avoiding any potential issues or delays.

What is the purpose of the Termination of Decedent's Interest form?

+The Termination of Decedent's Interest form serves as a formal declaration that the deceased individual's interest in a particular property has ceased.

What information is required to fill out the form?

+The form requires information about the deceased individual, the property, and the heirs or beneficiaries, including names, addresses, and relationships.

Do I need to notarize the form?

+Check with your state or county to determine if notarization is required. If so, be sure to follow the correct procedures.