As an independent contractor or seller on TCGplayer, managing your taxes is crucial to avoid any penalties or fines. One of the essential tax forms you need to submit is the W-9 form, which provides your taxpayer identification number and certification to TCGplayer. In this article, we will explore three ways to file your TCGplayer W-9 tax form, ensuring you comply with the tax requirements and avoid any issues.

Why is the W-9 form important for TCGplayer sellers?

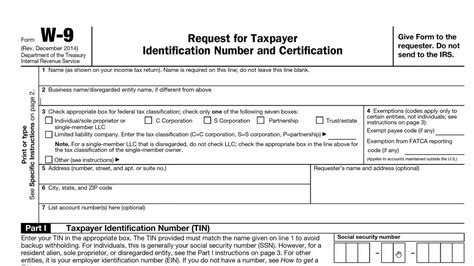

The W-9 form is a critical document that provides TCGplayer with your taxpayer identification number, name, and address. This information is used to prepare your annual 1099-K form, which reports your payment card and third-party network transactions. By submitting the W-9 form, you certify that the information provided is accurate and that you are not subject to backup withholding.

Method 1: Filing W-9 Form through TCGplayer's Website

TCGplayer provides an easy way to file your W-9 form through their website. To do this:

- Log in to your TCGplayer account.

- Click on the "Account" dropdown menu and select "Tax Information."

- Click on the "W-9 Form" link and follow the prompts to fill out the form.

- Enter your taxpayer identification number, name, and address.

- Review and certify the information provided.

- Submit the form.

Once you've submitted the W-9 form, TCGplayer will review and process it. You can also print a copy of the completed form for your records.

Method 2: Filing W-9 Form through the IRS Website

You can also file your W-9 form through the IRS website. To do this:

- Visit the IRS website at .

- Click on the "Forms and Publications" link.

- Search for Form W-9 and select the current year's form.

- Download and print the form.

- Fill out the form with your taxpayer identification number, name, and address.

- Sign and date the form.

- Fax or mail the completed form to TCGplayer's tax department.

Make sure to keep a copy of the completed form for your records.

Method 3: Filing W-9 Form through a Tax Professional

If you're not comfortable filing your W-9 form yourself, you can consult a tax professional. They can guide you through the process and ensure that your form is accurate and complete. To find a tax professional:

- Search online for tax professionals in your area.

- Check with local accounting firms or tax preparation services.

- Ask friends or family members for recommendations.

- Schedule a consultation with the tax professional.

- Provide them with the necessary information to complete your W-9 form.

- Review and sign the completed form.

A tax professional can also help you with other tax-related issues, such as filing your annual tax return or resolving any tax discrepancies.

Common mistakes to avoid when filing your W-9 form

When filing your W-9 form, make sure to avoid the following common mistakes:

- Inaccurate or incomplete information: Double-check your taxpayer identification number, name, and address to ensure they are accurate and complete.

- Unsigned or undated form: Make sure to sign and date the form before submitting it.

- Using an outdated form: Always use the current year's form to ensure you're providing the correct information.

By avoiding these common mistakes, you can ensure that your W-9 form is processed correctly and avoid any delays or penalties.

What to do if you need to update your W-9 form

If you need to update your W-9 form, you can follow the same steps as filing a new form. Make sure to notify TCGplayer of any changes to your taxpayer identification number, name, or address. You can also update your information through TCGplayer's website or by contacting their tax department.

Conclusion

Filing your TCGplayer W-9 tax form is a crucial step in managing your taxes as an independent contractor or seller. By following the three methods outlined in this article, you can ensure that your form is accurate and complete. Remember to avoid common mistakes and update your information if necessary. If you have any questions or concerns, don't hesitate to reach out to TCGplayer's tax department or consult a tax professional.

Take Action!

- Log in to your TCGplayer account and file your W-9 form today.

- Consult a tax professional if you need help with filing your W-9 form.

- Share this article with fellow TCGplayer sellers to ensure they're aware of the importance of filing their W-9 form.

FAQ Section

What is the deadline for filing my W-9 form?

+There is no specific deadline for filing your W-9 form. However, it's recommended to file it as soon as possible to avoid any delays or penalties.

Can I file my W-9 form electronically?

+Yes, you can file your W-9 form electronically through TCGplayer's website or by using tax preparation software.

What happens if I don't file my W-9 form?

+If you don't file your W-9 form, you may be subject to backup withholding, which can result in a delay or reduction in your payments.