In the wake of natural disasters, the US government has implemented various measures to provide relief to affected individuals. One such measure is the Qualified 2018 Disaster Retirement Plan Distributions, which allows eligible individuals to access their retirement savings without incurring penalties. To claim this benefit, individuals must file Form 8915 with the Internal Revenue Service (IRS). In this article, we will delve into the details of Form 8915, its eligibility criteria, and the benefits it offers.

Understanding Form 8915

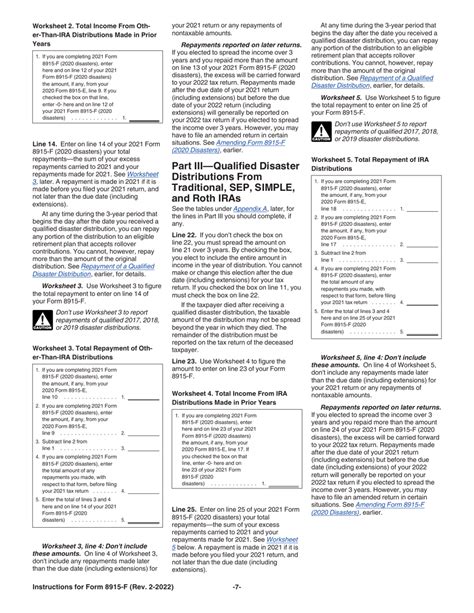

Form 8915 is used to report qualified disaster retirement plan distributions and repayments. The form is specifically designed for individuals who have received a qualified disaster distribution from a retirement plan, such as a 401(k) or an IRA. The distribution must have been made due to a qualified disaster, which includes hurricanes, wildfires, and other federally declared disasters that occurred in 2018.

Eligibility Criteria

To be eligible for a qualified disaster retirement plan distribution, individuals must meet certain criteria. These include:

- The individual must have received a qualified disaster distribution from a retirement plan.

- The distribution must have been made due to a qualified disaster that occurred in 2018.

- The individual must have been affected by the disaster, either by having a principal residence or a place of employment in the disaster area.

- The individual must have received the distribution within a specified timeframe, which is typically within 180 days of the disaster.

Benefits of Form 8915

Form 8915 offers several benefits to eligible individuals, including:

- Tax-free distributions: Qualified disaster retirement plan distributions are tax-free, which means that individuals do not have to pay income tax on the distribution.

- No penalty: Individuals who receive a qualified disaster distribution are not subject to the 10% penalty for early withdrawal from a retirement plan.

- Repayment flexibility: Individuals can repay the distribution to the retirement plan within a specified timeframe, which is typically within three years of the distribution.

How to File Form 8915

To file Form 8915, individuals must follow these steps:

- Gather required documents: Individuals must gather all required documents, including the retirement plan distribution statement and proof of eligibility.

- Complete Form 8915: Individuals must complete Form 8915, which includes reporting the qualified disaster retirement plan distribution and repayment information.

- Attach required documents: Individuals must attach all required documents to Form 8915.

- File Form 8915: Individuals must file Form 8915 with the IRS.

Repayment Options

Individuals who receive a qualified disaster retirement plan distribution have several repayment options, including:

- Repayment within three years: Individuals can repay the distribution to the retirement plan within three years of the distribution.

- Repayment in installments: Individuals can repay the distribution in installments over a period of time.

- No repayment: Individuals can choose not to repay the distribution, in which case it will be subject to income tax.

Consequences of Not Filing Form 8915

Failure to file Form 8915 can result in several consequences, including:

- Penalty and interest: Individuals who fail to file Form 8915 may be subject to penalty and interest on the distribution.

- Loss of tax benefits: Individuals who fail to file Form 8915 may lose the tax benefits associated with the qualified disaster retirement plan distribution.

Common Mistakes to Avoid

When filing Form 8915, individuals should avoid common mistakes, including:

- Incorrect filing status: Individuals should ensure that they file Form 8915 with the correct filing status.

- Incomplete information: Individuals should ensure that they provide complete and accurate information on Form 8915.

- Missed deadlines: Individuals should ensure that they file Form 8915 by the specified deadline.

Conclusion

Form 8915 is an important tax form that allows eligible individuals to access their retirement savings without incurring penalties. To claim this benefit, individuals must file Form 8915 with the IRS and meet certain eligibility criteria. By understanding the benefits and consequences of Form 8915, individuals can make informed decisions about their retirement savings.

Call to Action

If you have received a qualified disaster retirement plan distribution, it is essential that you file Form 8915 with the IRS. By doing so, you can avoid penalties and interest, and take advantage of the tax benefits associated with the distribution. Don't wait – file Form 8915 today and secure your retirement savings.

What is Form 8915?

+Form 8915 is a tax form used to report qualified disaster retirement plan distributions and repayments.

Who is eligible for a qualified disaster retirement plan distribution?

+Individuals who have received a qualified disaster distribution from a retirement plan and meet certain eligibility criteria are eligible for a qualified disaster retirement plan distribution.

What are the benefits of Form 8915?

+The benefits of Form 8915 include tax-free distributions, no penalty, and repayment flexibility.