Tax season is upon us, and with it comes the daunting task of navigating the complex world of tax forms. Two forms that often cause confusion among tax filers are the 1040 and 8879. While both forms are used for tax-related purposes, they serve distinct functions and are used in different contexts. In this article, we will delve into the differences between the 1040 and 8879 forms, helping you understand which one you need and when.

The 1040 Form: A Brief Overview

The 1040 form is the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. It is used by individuals to report their income, claim deductions and credits, and calculate their tax liability. The 1040 form is typically filed annually by April 15th, and it is the most common tax form used by individuals.

The 8879 Form: An In-Depth Look

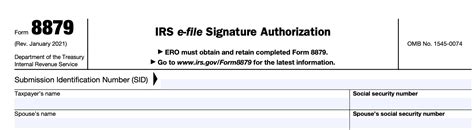

The 8879 form, also known as the IRS e-file Signature Authorization, is used to authorize the IRS to accept an electronic signature on a tax return. This form is typically used by tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), to sign and submit tax returns on behalf of their clients. The 8879 form is used in conjunction with the 1040 form and is required for all electronically filed tax returns.

Key Differences Between the 1040 and 8879 Forms

So, what are the main differences between the 1040 and 8879 forms? Here are the key distinctions:

- Purpose: The 1040 form is used to report personal income and calculate tax liability, while the 8879 form is used to authorize the IRS to accept an electronic signature on a tax return.

- Usage: The 1040 form is used by individuals to file their tax returns, while the 8879 form is typically used by tax professionals to sign and submit tax returns on behalf of their clients.

- Filing Requirements: The 1040 form is required for all individuals who earn income and must file a tax return, while the 8879 form is required for all electronically filed tax returns.

- Submission: The 1040 form is submitted directly to the IRS, while the 8879 form is submitted electronically through the IRS's e-file system.

Who Needs to Use the 8879 Form?

The 8879 form is required for all electronically filed tax returns. This means that if you are using a tax professional to prepare and submit your tax return, they will need to complete and sign the 8879 form on your behalf. Additionally, if you are using tax preparation software to e-file your return, you will need to sign and submit the 8879 form electronically.

Tips for Filing the 1040 and 8879 Forms

Here are some tips to keep in mind when filing the 1040 and 8879 forms:

- Make sure to complete all required fields: Both forms require accurate and complete information, so make sure to double-check your entries before submitting.

- Use the correct form: Ensure that you are using the correct form for your specific tax situation.

- Meet the filing deadline: The 1040 form must be filed by April 15th, while the 8879 form must be submitted electronically through the IRS's e-file system.

- Keep records: Keep a copy of both forms for your records, as you may need to refer to them in the future.

Common Mistakes to Avoid

When filing the 1040 and 8879 forms, there are several common mistakes to avoid:

- Inaccurate or incomplete information: Make sure to double-check your entries to avoid errors or omissions.

- Missing signatures: Ensure that all required signatures are obtained and submitted with the forms.

- Incorrect filing status: Verify that you are using the correct filing status on the 1040 form.

Conclusion:

In conclusion, the 1040 and 8879 forms are two distinct tax forms that serve different purposes. While the 1040 form is used to report personal income and calculate tax liability, the 8879 form is used to authorize the IRS to accept an electronic signature on a tax return. By understanding the differences between these forms and following the tips outlined in this article, you can ensure a smooth and accurate tax filing process.

What's Next?

We hope this article has helped you understand the differences between the 1040 and 8879 forms. If you have any questions or concerns, please don't hesitate to reach out. Stay tuned for more tax-related articles and tips to help you navigate the complex world of taxation.

FAQ Section

What is the purpose of the 1040 form?

+The 1040 form is used to report personal income and calculate tax liability.

Who needs to use the 8879 form?

+The 8879 form is required for all electronically filed tax returns.

What is the deadline for filing the 1040 form?

+The 1040 form must be filed by April 15th.