As a taxpayer, it's essential to understand the various tax forms and their purposes to ensure compliance with the IRS regulations and to take advantage of the available tax benefits. Among the numerous tax forms, Forms 8814 and 4972 are crucial for taxpayers who receive certain types of income or benefits. In this article, we'll delve into the details of these forms, their purposes, and how to fill them out accurately.

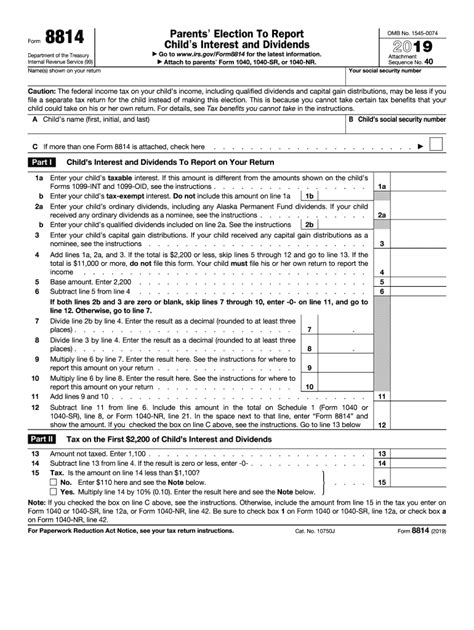

Understanding Form 8814: Parents' Election to Report Child's Interest and Dividends

Form 8814 is used by parents to report their child's interest and dividend income on their tax return. This form allows parents to elect to include their child's income on their tax return, rather than filing a separate tax return for the child. By doing so, parents can avoid the complexity of filing a separate tax return for their child and potentially reduce their tax liability.

The primary purpose of Form 8814 is to report the child's income from:

- Interest income, such as interest from savings accounts, bonds, or certificates of deposit

- Dividend income from stocks or mutual funds

To qualify for this election, the child must meet specific requirements:

- The child must be under the age of 18

- The child's income must be only from interest and dividends

- The child's income must not exceed $10,500 (for tax year 2022)

By electing to report their child's income on their tax return, parents can take advantage of the following benefits:

- Reduced tax liability: By including the child's income on their tax return, parents may be able to reduce their overall tax liability

- Simplified tax filing: Parents can avoid the complexity of filing a separate tax return for their child

- Increased tax credits: Parents may be eligible for increased tax credits, such as the Child Tax Credit

How to Fill Out Form 8814

To fill out Form 8814, parents will need to provide the following information:

- Child's name and Social Security number

- Parent's name and Social Security number

- Child's interest and dividend income

- Calculation of the child's tax liability

Parents will also need to complete the following sections:

- Section 1: Child's Interest and Dividend Income

- Section 2: Parent's Election to Report Child's Income

- Section 3: Calculation of Child's Tax Liability

Understanding Form 4972: Tax on Lump-Sum Distributions

Form 4972 is used to calculate the tax on lump-sum distributions from qualified retirement plans, such as 401(k) or pension plans. A lump-sum distribution is a single payment of the entire account balance, rather than a series of payments over time.

The primary purpose of Form 4972 is to calculate the tax on lump-sum distributions that are eligible for special tax treatment. To qualify for this special tax treatment, the distribution must meet specific requirements:

- The distribution must be from a qualified retirement plan

- The distribution must be a lump-sum payment

- The recipient must be under the age of 59 1/2

By using Form 4972, taxpayers can calculate the tax on their lump-sum distribution and take advantage of the following benefits:

- Reduced tax liability: Taxpayers may be able to reduce their tax liability by using the special tax treatment for lump-sum distributions

- Simplified tax filing: Taxpayers can use Form 4972 to calculate the tax on their lump-sum distribution, rather than using the general tax tables

How to Fill Out Form 4972

To fill out Form 4972, taxpayers will need to provide the following information:

- Recipient's name and Social Security number

- Plan name and plan number

- Date of distribution

- Amount of distribution

Taxpayers will also need to complete the following sections:

- Section 1: Lump-Sum Distribution

- Section 2: Calculation of Tax on Lump-Sum Distribution

- Section 3: Special Tax Treatment

Tips and Reminders for Filing Forms 8814 and 4972

When filing Forms 8814 and 4972, taxpayers should keep the following tips and reminders in mind:

- Ensure accuracy: Double-check the information on the forms to ensure accuracy and avoid errors

- Meet deadlines: File the forms by the required deadlines to avoid penalties and interest

- Keep records: Keep a copy of the forms and supporting documentation for at least three years in case of an audit

By understanding the purposes and requirements of Forms 8814 and 4972, taxpayers can ensure compliance with the IRS regulations and take advantage of the available tax benefits. If you're unsure about how to fill out these forms or have questions about the tax implications, consult with a tax professional or financial advisor.

What is the purpose of Form 8814?

+Form 8814 is used by parents to report their child's interest and dividend income on their tax return.

What is the purpose of Form 4972?

+Form 4972 is used to calculate the tax on lump-sum distributions from qualified retirement plans.

What is the deadline for filing Form 8814?

+The deadline for filing Form 8814 is the same as the deadline for filing the parent's tax return, typically April 15th.

We hope this comprehensive guide has helped you understand the purposes and requirements of Forms 8814 and 4972. If you have any further questions or concerns, feel free to comment below or share this article with others who may find it helpful.