The world of tax forms can be a daunting place, especially when it comes to passive losses. One of the most important forms for handling these types of losses is the IRS Tax Form 8582. In this guide, we'll take a deep dive into the world of Form 8582, exploring its purpose, who needs to use it, and how to fill it out correctly.

Understanding Passive Losses

Before we dive into the specifics of Form 8582, it's essential to understand what passive losses are. Passive losses occur when the losses from a passive activity exceed the income from that activity. Passive activities include:

- Rental properties

- Limited partnerships

- S corporations

- Limited liability companies (LLCs)

Passive losses can be a valuable tax deduction, but the IRS has strict rules about how they can be claimed.

Who Needs to Use Form 8582?

Form 8582 is used to report passive losses and calculate the allowable passive loss deduction. You'll need to use this form if you have passive losses from any of the following sources:

- Rental properties

- Limited partnerships

- S corporations

- Limited liability companies (LLCs)

Additionally, you may need to use Form 8582 if you have a net loss from a passive activity that exceeds the income from that activity.

What is Form 8582 Used For?

Form 8582 is used to:

- Calculate the allowable passive loss deduction

- Report passive losses from rental properties, limited partnerships, S corporations, and LLCs

- Determine the amount of passive losses that can be carried forward to future years

How to Fill Out Form 8582

Filling out Form 8582 can be a complex process, but we'll break it down step by step.

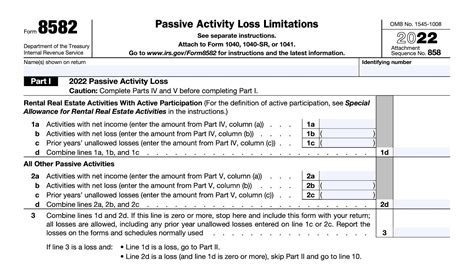

Part 1: Passive Activity Loss Limitation

This section calculates the total passive losses from all passive activities.

- Line 1: Enter the total passive losses from all passive activities

- Line 2: Enter the total passive income from all passive activities

- Line 3: Calculate the net passive loss by subtracting the passive income from the passive losses

Part 2: Modified Adjusted Gross Income (MAGI)

This section calculates the modified adjusted gross income (MAGI) that's used to limit the passive loss deduction.

- Line 4: Enter the adjusted gross income (AGI) from Form 1040

- Line 5: Add back certain deductions and exclusions to calculate the MAGI

Part 3: Passive Loss Deduction

This section calculates the allowable passive loss deduction.

- Line 6: Enter the net passive loss from Part 1

- Line 7: Enter the MAGI from Part 2

- Line 8: Calculate the allowable passive loss deduction

Part 4: Carryover of Passive Losses

This section determines the amount of passive losses that can be carried forward to future years.

- Line 9: Enter the net passive loss from Part 1

- Line 10: Enter the allowable passive loss deduction from Part 3

- Line 11: Calculate the carryover of passive losses

Tips and Tricks for Filling Out Form 8582

- Make sure to keep accurate records of all passive activities, including income and losses

- Use Schedule E (Supplemental Income and Loss) to report rental income and losses

- Use Form 1065 (Partnership Return of Income) to report partnership income and losses

- Use Form 1120S (S Corporation Income Tax Return) to report S corporation income and losses

Common Mistakes to Avoid

- Failing to report all passive activities

- Miscalculating the net passive loss

- Failing to carry over passive losses to future years

Conclusion

Form 8582 is a crucial form for anyone with passive losses. By understanding the purpose of the form, who needs to use it, and how to fill it out correctly, you can ensure that you're taking advantage of the passive loss deduction. Remember to keep accurate records, use the correct schedules and forms, and avoid common mistakes.

If you have any questions or need further guidance, don't hesitate to ask. Share your experiences with Form 8582 in the comments below!

FAQ Section:

What is the purpose of Form 8582?

+Form 8582 is used to report passive losses and calculate the allowable passive loss deduction.

Who needs to use Form 8582?

+You'll need to use Form 8582 if you have passive losses from rental properties, limited partnerships, S corporations, or limited liability companies (LLCs).

What is the difference between passive losses and active losses?

+Passive losses occur when the losses from a passive activity exceed the income from that activity. Active losses occur when the losses from an active activity exceed the income from that activity.