Are you a foreign national or an organization looking to claim tax exemptions in the United States? The Tamu Tax Exempt Form is a crucial document that can help you achieve this goal. However, navigating the complex world of tax exemptions can be overwhelming, especially for those who are new to the process. In this article, we will provide you with 5 easy filing tips to help you successfully complete the Tamu Tax Exempt Form.

As a foreign national or organization, it's essential to understand that the Tamu Tax Exempt Form is a required document for claiming tax exemptions in the United States. The form is used to certify that you are eligible for tax exemptions under the Internal Revenue Code. By following these 5 easy filing tips, you can ensure that your application is processed smoothly and efficiently.

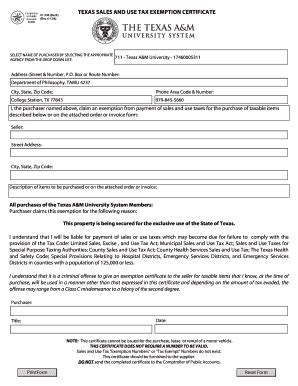

Understanding the Tamu Tax Exempt Form

Before we dive into the filing tips, it's essential to understand the purpose and scope of the Tamu Tax Exempt Form. The form is designed to gather information about your organization or individual status, including your tax identification number, name, and address. The form also requires you to provide documentation supporting your claim for tax exemptions.

Tip 1: Gather Required Documents

To successfully complete the Tamu Tax Exempt Form, you'll need to gather all the required documents. These documents may include:

- A copy of your passport or identification document

- A copy of your tax identification number or employer identification number

- Documentation supporting your claim for tax exemptions, such as a certificate of exemption or a letter from the relevant tax authority

- A completed Form W-8BEN or W-8BEN-E, if applicable

Make sure to carefully review the instructions and requirements for the Tamu Tax Exempt Form to ensure you have all the necessary documents.

Filing the Tamu Tax Exempt Form

Once you have gathered all the required documents, you can begin filling out the Tamu Tax Exempt Form. Here are a few tips to keep in mind:

Tip 2: Complete the Form Accurately

It's essential to complete the Tamu Tax Exempt Form accurately and thoroughly. Make sure to review the instructions carefully and fill out all the required fields. If you're unsure about any part of the form, don't hesitate to seek advice from a tax professional.

Tip 3: Sign and Date the Form

Once you've completed the form, make sure to sign and date it. This is an essential step, as the form will not be processed without a valid signature and date.

Tip 4: Submit the Form on Time

The Tamu Tax Exempt Form should be submitted on time to avoid any delays or penalties. Make sure to review the submission deadline carefully and plan accordingly.

Tip 5: Follow Up

After submitting the Tamu Tax Exempt Form, it's essential to follow up with the relevant authorities to ensure that your application is being processed. You can do this by contacting the tax authority or checking the status of your application online.

By following these 5 easy filing tips, you can ensure that your Tamu Tax Exempt Form is completed accurately and efficiently. Remember to gather all the required documents, complete the form accurately, sign and date the form, submit the form on time, and follow up with the relevant authorities.

Conclusion: Simplify Your Tax Exemption Process

The Tamu Tax Exempt Form can be a complex and overwhelming document, especially for those who are new to the process. However, by following these 5 easy filing tips, you can simplify your tax exemption process and ensure that your application is processed smoothly and efficiently. Remember to stay organized, seek advice when needed, and follow up with the relevant authorities to ensure that your application is being processed.

We hope this article has been helpful in guiding you through the Tamu Tax Exempt Form filing process. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your friends and colleagues who may be going through a similar process.

What is the Tamu Tax Exempt Form?

+The Tamu Tax Exempt Form is a document used to certify that a foreign national or organization is eligible for tax exemptions in the United States.

Who needs to file the Tamu Tax Exempt Form?

+Foreign nationals and organizations who are eligible for tax exemptions in the United States need to file the Tamu Tax Exempt Form.

What documents do I need to gather for the Tamu Tax Exempt Form?

+You'll need to gather documents such as a copy of your passport or identification document, a copy of your tax identification number or employer identification number, and documentation supporting your claim for tax exemptions.