The Tamu Hotel Tax Exempt Form is a crucial document for guests who are exempt from paying taxes on their hotel stay. As a guest, understanding the importance of this form and how to use it can save you a significant amount of money. In this article, we will delve into the world of tax-exempt forms, exploring what they are, who is eligible, and how to obtain and use them.

What is a Tamu Hotel Tax Exempt Form?

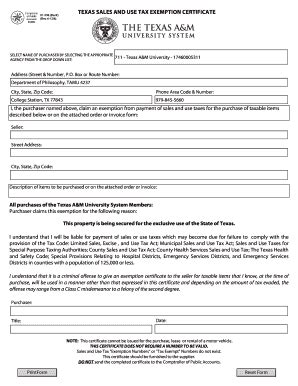

A Tamu Hotel Tax Exempt Form is a document that certifies a guest's exemption from paying taxes on their hotel stay. This form is typically used by individuals or organizations that are exempt from paying taxes, such as government employees, non-profit organizations, or diplomatic missions. The form is usually provided by the hotel and must be completed and signed by the guest before their stay.

Why is the Tamu Hotel Tax Exempt Form Important?

The Tamu Hotel Tax Exempt Form is essential for guests who are exempt from paying taxes on their hotel stay. Without this form, guests may be required to pay taxes on their stay, which can add up quickly. By providing the form, guests can avoid paying unnecessary taxes and save money on their hotel stay.

Who is Eligible for a Tamu Hotel Tax Exempt Form?

To be eligible for a Tamu Hotel Tax Exempt Form, guests must meet certain criteria. These criteria may vary depending on the hotel and the guest's location, but common eligibility requirements include:

- Government employees on official business

- Non-profit organizations

- Diplomatic missions

- Students on educational field trips

- Guests with disabilities

Guests who meet these eligibility requirements can obtain a Tamu Hotel Tax Exempt Form from the hotel or through their organization.

How to Obtain a Tamu Hotel Tax Exempt Form

Obtaining a Tamu Hotel Tax Exempt Form is a straightforward process. Guests can follow these steps:

- Contact the hotel: Guests can contact the hotel directly to request a Tamu Hotel Tax Exempt Form. The hotel will provide the form and explain the eligibility requirements.

- Check with your organization: If you are a member of an organization that is exempt from paying taxes, you can check with your organization to see if they have a Tamu Hotel Tax Exempt Form.

- Download the form: Some hotels may have the Tamu Hotel Tax Exempt Form available for download on their website.

How to Use a Tamu Hotel Tax Exempt Form

Using a Tamu Hotel Tax Exempt Form is easy. Guests can follow these steps:

- Complete the form: Guests must complete the Tamu Hotel Tax Exempt Form, providing all required information, including their name, address, and tax-exempt status.

- Sign the form: Guests must sign the form, certifying that they are exempt from paying taxes on their hotel stay.

- Provide the form to the hotel: Guests must provide the completed and signed form to the hotel before their stay.

Tips for Using a Tamu Hotel Tax Exempt Form

Here are some tips for using a Tamu Hotel Tax Exempt Form:

- Make sure to complete the form accurately and completely.

- Sign the form in the presence of a hotel representative.

- Provide the form to the hotel before your stay to avoid any delays or issues.

- Keep a copy of the form for your records.

Common Mistakes to Avoid When Using a Tamu Hotel Tax Exempt Form

When using a Tamu Hotel Tax Exempt Form, there are several common mistakes to avoid:

- Failing to complete the form accurately and completely.

- Not signing the form in the presence of a hotel representative.

- Not providing the form to the hotel before your stay.

- Not keeping a copy of the form for your records.

By avoiding these common mistakes, guests can ensure a smooth and hassle-free stay.

Benefits of Using a Tamu Hotel Tax Exempt Form

Using a Tamu Hotel Tax Exempt Form can provide several benefits, including:

- Saving money on hotel stays

- Avoiding unnecessary taxes

- Simplifying the hotel booking process

- Providing proof of tax-exempt status

By using a Tamu Hotel Tax Exempt Form, guests can enjoy a more convenient and cost-effective hotel stay.

Conclusion

In conclusion, the Tamu Hotel Tax Exempt Form is an essential document for guests who are exempt from paying taxes on their hotel stay. By understanding the importance of this form and how to use it, guests can save money and avoid unnecessary taxes. We hope this article has provided you with valuable information and insights on the Tamu Hotel Tax Exempt Form.

What is a Tamu Hotel Tax Exempt Form?

+A Tamu Hotel Tax Exempt Form is a document that certifies a guest's exemption from paying taxes on their hotel stay.

Who is eligible for a Tamu Hotel Tax Exempt Form?

+Guests who meet certain eligibility requirements, such as government employees, non-profit organizations, and diplomatic missions, are eligible for a Tamu Hotel Tax Exempt Form.

How do I obtain a Tamu Hotel Tax Exempt Form?

+Guests can obtain a Tamu Hotel Tax Exempt Form by contacting the hotel, checking with their organization, or downloading the form from the hotel's website.