The joy of tax season! As a former or current Taco Bell employee, you're probably eager to get your hands on your W2 form to file your taxes. But where do you start? Don't worry, we've got you covered. In this article, we'll walk you through the process of obtaining your Taco Bell W2 form in 5 easy steps.

Taco Bell, like all employers, is required by law to provide employees with a W2 form by January 31st of each year. This form shows your income and taxes withheld for the previous tax year. You'll need this form to file your taxes, so it's essential to get it as soon as possible.

Why is My W2 Form Important?

Your W2 form is a critical document for tax purposes. It contains information about your income, taxes withheld, and other relevant details that you'll need to report on your tax return. Without this form, you won't be able to file your taxes accurately, which could lead to delays or even penalties.

What Information is on My W2 Form?

Your W2 form will include the following information:

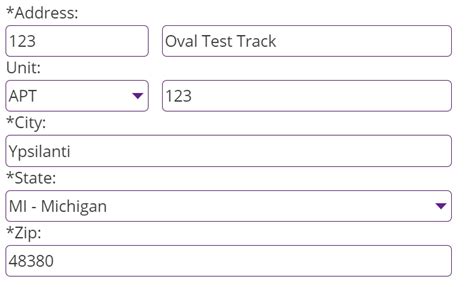

- Your name, address, and Social Security number

- Taco Bell's name, address, and Employer Identification Number (EIN)

- Your gross income and taxes withheld for the tax year

- Other relevant details, such as tips reported or dependent care benefits

Step 1: Check Your Email or Mailbox

Taco Bell typically sends W2 forms to employees via email or mail by January 31st. If you have a valid email address on file, you might receive an email with a link to access your W2 form online. Alternatively, you might receive a paper copy of your W2 form in the mail.

What if I Didn't Receive My W2 Form?

If you didn't receive your W2 form by January 31st, don't panic! You can try the following:

- Check your spam folder or junk mail for an email from Taco Bell or their payroll provider.

- Contact Taco Bell's HR department or payroll provider to request a duplicate W2 form.

- Visit the IRS website to see if you can access your W2 form online.

Step 2: Log in to the Taco Bell Employee Portal

If you have access to the Taco Bell employee portal, you can log in to view and print your W2 form. You'll need your employee ID and password to access the portal.

What if I Forgot My Password?

If you forgot your password, you can try the following:

- Click on the "Forgot Password" link on the login page to reset your password.

- Contact Taco Bell's HR department or IT support for assistance.

Step 3: Contact Taco Bell's HR Department

If you're unable to access your W2 form online or via email, you can contact Taco Bell's HR department for assistance. They can provide you with a duplicate W2 form or guide you through the process of obtaining one.

What Information Do I Need to Provide?

When contacting Taco Bell's HR department, be prepared to provide the following information:

- Your name and employee ID

- Your Social Security number

- Your email address and phone number

Step 4: Visit the IRS Website

If you're unable to obtain your W2 form from Taco Bell, you can try visiting the IRS website to see if you can access your form online. You'll need to create an account or log in to the IRS website to access your W2 form.

What if I Still Can't Find My W2 Form?

If you're still unable to find your W2 form, you can try the following:

- Contact the IRS directly for assistance.

- File Form 4852, Substitute for Form W-2, Wage and Tax Statement, with the IRS.

- Contact a tax professional for guidance.

Step 5: File Your Taxes

Once you have your W2 form, you can file your taxes accurately. Make sure to report all income and taxes withheld on your tax return. If you're unsure about how to file your taxes, consider consulting a tax professional or using tax preparation software.

What if I Need Help with My Taxes?

If you need help with your taxes, consider the following:

- Contact a tax professional for guidance.

- Use tax preparation software, such as TurboTax or H&R Block.

- Visit the IRS website for tax resources and guidance.

By following these 5 easy steps, you should be able to obtain your Taco Bell W2 form and file your taxes accurately. Remember to stay calm and patient, and don't hesitate to seek help if you need it.

What is a W2 form?

+A W2 form is a tax document that shows your income and taxes withheld for the previous tax year.

How do I access my W2 form online?

+You can access your W2 form online through the Taco Bell employee portal or by contacting Taco Bell's HR department.

What if I forgot my password to the employee portal?

+You can click on the "Forgot Password" link on the login page to reset your password or contact Taco Bell's HR department for assistance.

We hope this article has helped you obtain your Taco Bell W2 form and file your taxes accurately. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may need help. Happy filing!