As a business owner or manager, you're likely familiar with the concept of liability and the importance of protecting your company from potential losses. One often-overlooked aspect of risk management is the Statement of No Loss Accord Form, a crucial document that can help prevent unnecessary disputes and financial burdens. In this article, we'll delve into the world of insurance and explore the ins and outs of this vital form.

What is a Statement of No Loss Accord Form?

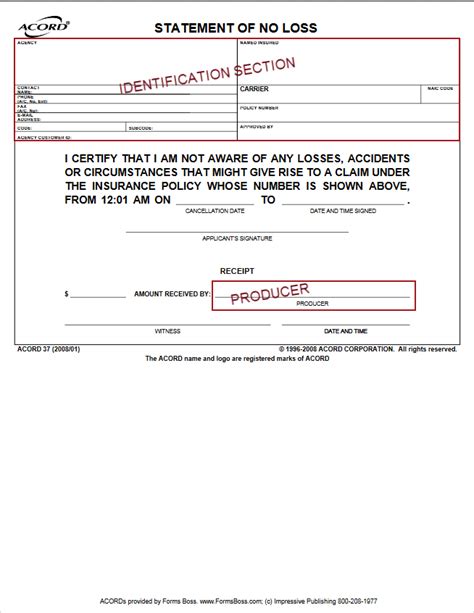

A Statement of No Loss Accord Form is a document that confirms an agreement between an insurance company and a policyholder regarding the absence of any loss or damage to insured property. This form is typically used in conjunction with an insurance policy, and its primary purpose is to acknowledge that no loss or damage has occurred within a specific period.

Why is a Statement of No Loss Accord Form necessary?

This form serves several purposes:

- Prevents disputes: By acknowledging the absence of loss or damage, both parties can avoid potential disputes and claims that may arise from miscommunication or misunderstanding.

- Streamlines insurance processes: A Statement of No Loss Accord Form helps insurance companies efficiently manage their policies and reduce administrative burdens.

- Provides clarity: This document provides a clear understanding of the policyholder's situation, ensuring that both parties are on the same page.

Benefits of a Statement of No Loss Accord Form

Implementing a Statement of No Loss Accord Form can bring numerous benefits to your business, including:

- Reduced risk: By confirming the absence of loss or damage, you can minimize the risk of unexpected claims and financial burdens.

- Improved relationships: This form fosters clear communication and understanding between you and your insurance provider, promoting a stronger and more trusting relationship.

- Enhanced efficiency: A Statement of No Loss Accord Form can help streamline your insurance processes, saving you time and resources.

How to use a Statement of No Loss Accord Form

To effectively utilize a Statement of No Loss Accord Form, follow these steps:

- Review your insurance policy: Familiarize yourself with your insurance policy's terms and conditions to understand the requirements for filing a Statement of No Loss Accord Form.

- Determine the necessary period: Identify the specific period for which you need to confirm the absence of loss or damage.

- Complete the form: Fill out the Statement of No Loss Accord Form accurately, ensuring that all necessary information is included.

- Submit the form: Send the completed form to your insurance provider, following their specified procedures.

Common scenarios where a Statement of No Loss Accord Form is used

A Statement of No Loss Accord Form is commonly used in the following situations:

- Annual policy reviews: Many insurance policies require a Statement of No Loss Accord Form to be completed during annual reviews.

- Policy renewals: This form may be necessary when renewing an insurance policy, especially if there have been changes to the insured property.

- Claims investigations: A Statement of No Loss Accord Form can be used to confirm the absence of loss or damage during claims investigations.

Best practices for completing a Statement of No Loss Accord Form

To ensure accuracy and efficiency when completing a Statement of No Loss Accord Form, follow these best practices:

- Carefully review the form: Double-check the form for completeness and accuracy before submission.

- Use clear and concise language: Avoid ambiguity by using straightforward language when completing the form.

- Keep records: Maintain a record of the completed form, as well as any supporting documentation.

Conclusion

In conclusion, a Statement of No Loss Accord Form is a vital document that plays a crucial role in preventing unnecessary disputes and financial burdens. By understanding the benefits, scenarios, and best practices surrounding this form, you can effectively utilize it to protect your business and maintain a strong relationship with your insurance provider.

Take action today: Review your insurance policy and determine if a Statement of No Loss Accord Form is necessary for your business. By taking proactive steps, you can ensure that your company is adequately protected and prepared for any situation that may arise.

We hope this article has provided valuable insights into the world of insurance and the importance of a Statement of No Loss Accord Form. If you have any questions or comments, please don't hesitate to share them below.

Share this article: Help others understand the importance of a Statement of No Loss Accord Form by sharing this article on social media or with your colleagues.

What is the primary purpose of a Statement of No Loss Accord Form?

+The primary purpose of a Statement of No Loss Accord Form is to confirm the absence of any loss or damage to insured property.

Who uses a Statement of No Loss Accord Form?

+A Statement of No Loss Accord Form is typically used by insurance companies and policyholders.

What are the benefits of using a Statement of No Loss Accord Form?

+The benefits of using a Statement of No Loss Accord Form include reduced risk, improved relationships, and enhanced efficiency.