Filing taxes can be a daunting task, especially when dealing with specific forms like the ST-8 form in New Jersey. The ST-8 form is a vital document for businesses in New Jersey, and completing it correctly is crucial to avoid any penalties or delays. In this article, we will guide you through the 8 steps to complete the ST-8 form NJ correctly.

Understanding the ST-8 Form

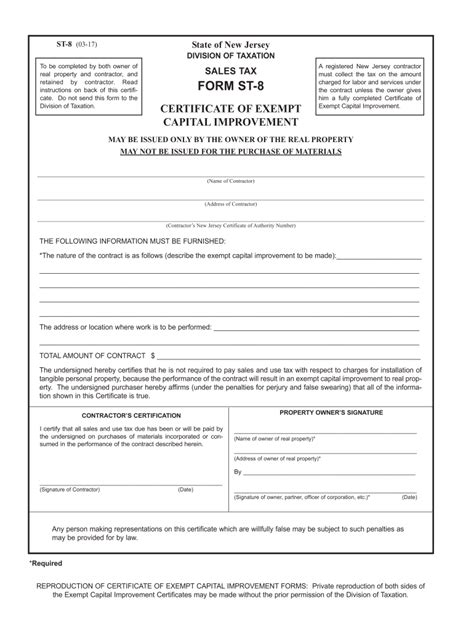

Before we dive into the steps, it's essential to understand what the ST-8 form is and its purpose. The ST-8 form, also known as the "Certificate of Exempt Sales", is a document required by the New Jersey Division of Taxation. It's used to certify exempt sales of tangible personal property or services. Businesses in New Jersey must complete this form to claim exemptions on their sales tax returns.

Benefits of Accurate Completion

Completing the ST-8 form correctly is crucial to avoid any penalties or delays in processing your sales tax returns. Accurate completion of the form ensures that you're taking advantage of the exemptions you're eligible for, which can help reduce your tax liability. Moreover, it helps maintain a good compliance record with the New Jersey Division of Taxation.

Step 1: Gather Required Information

To complete the ST-8 form correctly, you'll need to gather the required information. This includes:

- Your business's name and address

- Your business's New Jersey tax identification number

- The type of exemption you're claiming (e.g., resale, agricultural, etc.)

- The name and address of the purchaser

- A detailed description of the tangible personal property or services sold

Step 2: Determine the Type of Exemption

New Jersey offers various exemptions for businesses, including resale, agricultural, and manufacturing exemptions. You must determine which type of exemption you're eligible for and ensure you meet the requirements. Consult the New Jersey Division of Taxation's website or seek professional advice if you're unsure.

Types of Exemptions

- Resale exemption: For businesses that resell tangible personal property or services

- Agricultural exemption: For farmers and agricultural businesses

- Manufacturing exemption: For manufacturers of tangible personal property

Step 3: Complete the Form

Once you have the required information and have determined the type of exemption, you can start completing the ST-8 form. The form consists of two parts: Part 1 (Seller's Information) and Part 2 (Purchaser's Information).

- Part 1: Fill in your business's name, address, and New Jersey tax identification number. Also, provide a detailed description of the tangible personal property or services sold.

- Part 2: Fill in the purchaser's name, address, and tax identification number (if applicable).

Step 4: Sign and Date the Form

After completing the form, you must sign and date it. Ensure that the form is signed by an authorized representative of your business.

Step 5: Retain a Copy

You must retain a copy of the completed ST-8 form for your records. This will help you keep track of the exemptions you've claimed and provide proof of exemption in case of an audit.

Step 6: Provide the Form to the Purchaser

You must provide the completed ST-8 form to the purchaser. This form serves as proof of exemption for the purchaser, and they may need to present it to the New Jersey Division of Taxation.

Step 7: File the Form with the New Jersey Division of Taxation

You must file the ST-8 form with the New Jersey Division of Taxation. You can file the form electronically or by mail.

Step 8: Maintain Accurate Records

Finally, ensure that you maintain accurate records of the ST-8 forms you've completed. This will help you keep track of the exemptions you've claimed and provide proof of exemption in case of an audit.

By following these 8 steps, you can ensure that you complete the ST-8 form NJ correctly and avoid any penalties or delays. Remember to maintain accurate records and provide the form to the purchaser to ensure a smooth process.

If you have any questions or concerns about completing the ST-8 form NJ, feel free to comment below. Share this article with your colleagues and friends who may need guidance on completing the ST-8 form NJ.

FAQ Section:

What is the purpose of the ST-8 form NJ?

+The ST-8 form NJ is used to certify exempt sales of tangible personal property or services in New Jersey.

Who needs to complete the ST-8 form NJ?

+Businesses in New Jersey that sell tangible personal property or services must complete the ST-8 form NJ to claim exemptions on their sales tax returns.

How do I determine the type of exemption I'm eligible for?

+Consult the New Jersey Division of Taxation's website or seek professional advice to determine which type of exemption you're eligible for.