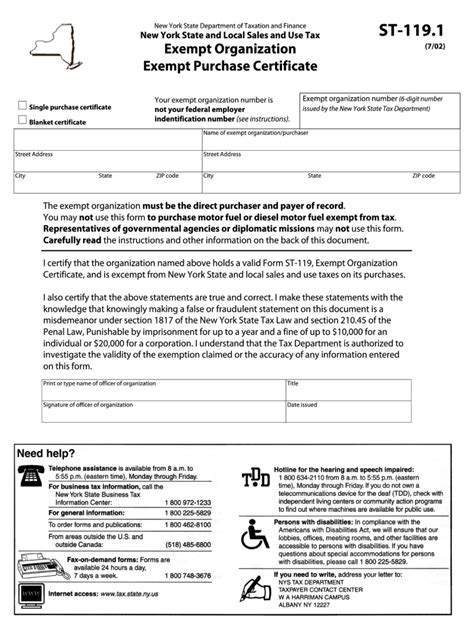

As a business owner or individual in New York State, you may be required to file a Form ST-119.1, also known as the Exemption Certificate for Purchases of Tangible Personal Property and Services by a Qualifying Purchaser. This form is used to certify that a purchase is exempt from New York State sales tax. However, filling out this form can be a daunting task, especially for those who are new to the process. In this article, we will guide you through the process of filling out the ST-119.1 form correctly, highlighting five key ways to ensure accuracy and compliance.

Understanding the Purpose of the ST-119.1 Form

Before we dive into the details of filling out the form, it's essential to understand its purpose. The ST-119.1 form is used to certify that a purchase is exempt from New York State sales tax. This form is typically required for businesses or individuals who are making exempt purchases, such as those related to manufacturing, agriculture, or non-profit organizations.

5 Ways to Fill Out the ST-119.1 Form Correctly

Filling out the ST-119.1 form requires attention to detail and a clear understanding of the exemption requirements. Here are five ways to ensure you fill out the form correctly:

1. Provide Accurate Business Information

The first section of the ST-119.1 form requires you to provide accurate business information, including your business name, address, and New York State sales tax vendor registration number. It's essential to ensure that this information is up-to-date and accurate, as incorrect information may lead to delays or even rejection of your exemption claim.

- Business Name: Enter your business name as it appears on your sales tax vendor registration.

- Address: Enter your business address, including the street, city, state, and zip code.

- Sales Tax Vendor Registration Number: Enter your valid New York State sales tax vendor registration number.

2. Identify the Exemption Type

The ST-119.1 form requires you to identify the type of exemption you are claiming. This can include exemptions for manufacturing, agriculture, non-profit organizations, or other qualifying purchases. It's essential to choose the correct exemption type, as incorrect selection may lead to rejection of your claim.

- Manufacturing Exemption: Check this box if you are a manufacturer making exempt purchases related to your manufacturing business.

- Agricultural Exemption: Check this box if you are a farmer or agricultural business making exempt purchases related to your agricultural operations.

- Non-Profit Exemption: Check this box if you are a non-profit organization making exempt purchases related to your non-profit activities.

3. List Exempt Purchases

The next section of the form requires you to list the exempt purchases you are making. This includes the type of property or services being purchased, the purchase price, and the vendor's name and address.

- Property or Services: Describe the type of property or services being purchased, including the quantity and unit price.

- Purchase Price: Enter the total purchase price of the exempt items.

- Vendor's Name and Address: Enter the vendor's name and address, including the street, city, state, and zip code.

4. Certify the Exemption

The final section of the form requires you to certify that the purchases listed are exempt from New York State sales tax. This includes certifying that the purchases are for a qualifying purpose and that you have the necessary documentation to support the exemption claim.

- Certification: Check the box to certify that the purchases listed are exempt from New York State sales tax.

- Signature: Sign the form to confirm that the information provided is accurate and true.

5. Attach Supporting Documentation

Finally, it's essential to attach supporting documentation to the ST-119.1 form, including invoices, receipts, and other documentation that supports the exemption claim. This documentation should include the vendor's name and address, the purchase price, and a description of the exempt items.

- Invoices: Attach invoices for the exempt purchases, including the vendor's name and address, the purchase price, and a description of the exempt items.

- Receipts: Attach receipts for the exempt purchases, including the vendor's name and address, the purchase price, and a description of the exempt items.

Common Mistakes to Avoid

When filling out the ST-119.1 form, there are several common mistakes to avoid, including:

- Incorrect business information

- Incorrect exemption type

- Incomplete or inaccurate exempt purchase information

- Failure to certify the exemption

- Failure to attach supporting documentation

By avoiding these common mistakes, you can ensure that your ST-119.1 form is filled out correctly and that your exemption claim is processed smoothly.

Conclusion

Filling out the ST-119.1 form requires attention to detail and a clear understanding of the exemption requirements. By following the five ways outlined in this article, you can ensure that your form is filled out correctly and that your exemption claim is processed smoothly. Remember to provide accurate business information, identify the correct exemption type, list exempt purchases, certify the exemption, and attach supporting documentation. By avoiding common mistakes and following these steps, you can ensure that your ST-119.1 form is filled out correctly and that you receive the sales tax exemption you are eligible for.

We hope this article has been informative and helpful in guiding you through the process of filling out the ST-119.1 form. If you have any questions or concerns, please don't hesitate to comment below. We would be happy to hear from you and provide any additional guidance or support you may need.

What is the purpose of the ST-119.1 form?

+The ST-119.1 form is used to certify that a purchase is exempt from New York State sales tax.

What type of businesses are eligible for a sales tax exemption?

+Businesses that are eligible for a sales tax exemption include manufacturers, agricultural businesses, non-profit organizations, and other qualifying purchases.

What documentation is required to support an exemption claim?

+Documentation required to support an exemption claim includes invoices, receipts, and other documentation that supports the exemption claim.