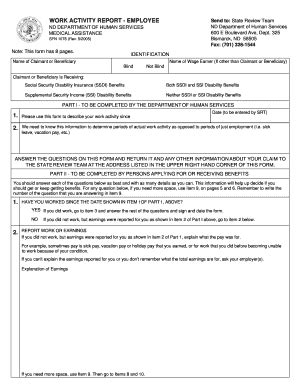

Applying for Social Security Disability (SSD) benefits can be a daunting task, especially when faced with the multitude of forms and documentation required. One of the most critical forms in the SSD application process is the SSA-821-BK, also known as the Work Activity Report. This form is used to gather information about your work activities and how they may impact your disability claim. In this article, we will delve into three essential SSA-821 form examples, explaining how to complete them accurately and what to expect during the process.

Understanding the SSA-821 Form

The SSA-821 form is a crucial part of the SSD application process, as it helps the Social Security Administration (SSA) determine whether your work activities are substantial gainful activity (SGA). SGA is a critical factor in determining whether you are eligible for SSD benefits. The form asks for detailed information about your work activities, including your job title, work hours, and earnings.

Why is the SSA-821 Form Important?

The SSA-821 form is essential because it helps the SSA understand your work situation and how it may impact your disability claim. By providing accurate and detailed information, you can help ensure that your claim is processed correctly and efficiently. Failure to provide complete or accurate information can result in delays or even denial of your claim.

SSA-821 Form Example 1: Reporting Wages from a Part-Time Job

Let's say you are currently working part-time as a retail sales associate, earning $1,000 per month. You would report this information on the SSA-821 form as follows:

- Question 1: What was your job title? Answer: Retail Sales Associate

- Question 2: What were your work hours per week? Answer: 20 hours per week

- Question 3: What were your gross earnings per month? Answer: $1,000 per month

Tips for Reporting Wages from a Part-Time Job

When reporting wages from a part-time job, make sure to include the following information:

- Your job title and work hours per week

- Your gross earnings per month

- Any tips or commissions you received

SSA-821 Form Example 2: Reporting Self-Employment Income

Let's say you are self-employed as a freelance writer, earning $2,000 per month. You would report this information on the SSA-821 form as follows:

- Question 1: What was your business or profession? Answer: Freelance Writer

- Question 2: What were your net earnings from self-employment per month? Answer: $2,000 per month

- Question 3: What were your business expenses per month? Answer: $500 per month

Tips for Reporting Self-Employment Income

When reporting self-employment income, make sure to include the following information:

- Your business or profession

- Your net earnings from self-employment per month

- Your business expenses per month

SSA-821 Form Example 3: Reporting Unpaid Work

Let's say you are volunteering at a local non-profit organization, working 10 hours per week without pay. You would report this information on the SSA-821 form as follows:

- Question 1: What was your job title? Answer: Volunteer

- Question 2: What were your work hours per week? Answer: 10 hours per week

- Question 3: Did you receive any pay or compensation for your work? Answer: No

Tips for Reporting Unpaid Work

When reporting unpaid work, make sure to include the following information:

- Your job title and work hours per week

- Whether you received any pay or compensation for your work

- Any expenses you incurred while performing your work

By following these SSA-821 form examples and tips, you can ensure that you provide accurate and complete information about your work activities. Remember to report all work activities, including part-time jobs, self-employment income, and unpaid work.

We hope this article has been informative and helpful in understanding the SSA-821 form and its importance in the SSD application process. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of the SSA-821 form?

+The SSA-821 form is used to gather information about your work activities and how they may impact your disability claim.

Do I need to report all work activities on the SSA-821 form?

+Yes, you should report all work activities, including part-time jobs, self-employment income, and unpaid work.

What happens if I don't provide complete or accurate information on the SSA-821 form?

+Failure to provide complete or accurate information can result in delays or even denial of your SSD claim.