The SSA-7050 form, also known as the "Request for Estimate of Earnings Information," is a crucial document that enables individuals to request an estimate of their Social Security benefits from the Social Security Administration (SSA). This form is essential for people who are approaching retirement age or are planning to apply for Social Security benefits in the near future. In this article, we will provide a comprehensive, step-by-step guide on how to fill out the SSA-7050 form correctly.

The Importance of Accurate Information

Before we dive into the instructions, it's essential to emphasize the importance of providing accurate information on the SSA-7050 form. The SSA uses the information provided on this form to estimate your Social Security benefits, so it's crucial to ensure that all the details are correct. Inaccurate information can lead to incorrect estimates, which may affect your decision-making process when it comes to claiming your Social Security benefits.

Who Should Fill Out the SSA-7050 Form?

The SSA-7050 form is designed for individuals who are interested in estimating their Social Security benefits. This includes:

- People who are approaching retirement age (62-70 years old)

- Individuals who are planning to apply for Social Security benefits in the near future

- Workers who want to estimate their Social Security benefits based on their current earnings record

Step 1: Gather Required Information

Before filling out the SSA-7050 form, you'll need to gather some essential information. This includes:

- Your full name (as it appears on your Social Security card)

- Your Social Security number

- Your date of birth

- Your current address

- Your employment history (including job titles, employers, and dates of employment)

Step 2: Fill Out Section 1 - Claimant Information

Section 1 of the SSA-7050 form requires you to provide your personal information. This includes:

- Your name (first, middle, and last)

- Your Social Security number

- Your date of birth

- Your current address

Step 3: Fill Out Section 2 - Earnings Information

Section 2 of the SSA-7050 form requires you to provide your earnings information. This includes:

- Your employment history (including job titles, employers, and dates of employment)

- Your earnings for each year (starting from 1951)

Estimating Your Earnings

To estimate your earnings, you can use the SSA's online calculator or consult your Social Security statement. You can also use your W-2 forms or pay stubs to estimate your earnings.

Step 4: Fill Out Section 3 - Benefit Estimate Options

Section 3 of the SSA-7050 form requires you to choose your benefit estimate options. This includes:

- Selecting the age at which you want to start receiving benefits (62-70 years old)

- Choosing the type of benefit estimate you want to receive (e.g., retirement benefits, disability benefits)

Understanding Your Benefit Options

It's essential to understand your benefit options before making a decision. You can use the SSA's online calculator to estimate your benefits based on different ages and scenarios.

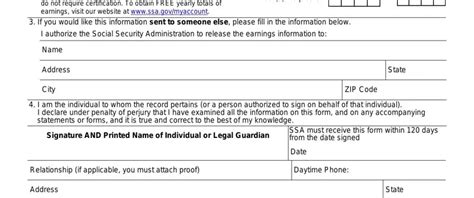

Step 5: Review and Sign the Form

Once you've completed the SSA-7050 form, review it carefully to ensure that all the information is accurate. Sign the form in the designated area, and date it.

What Happens Next?

After submitting the SSA-7050 form, the SSA will review your information and provide an estimate of your Social Security benefits. You can expect to receive a response within 2-3 weeks.

Conclusion

Filling out the SSA-7050 form is a straightforward process that requires accurate information and attention to detail. By following these steps, you can ensure that you receive an accurate estimate of your Social Security benefits. Remember to review your form carefully before submitting it, and don't hesitate to contact the SSA if you have any questions or concerns.

We hope this article has provided you with a comprehensive guide on how to fill out the SSA-7050 form. If you have any further questions or need additional assistance, please don't hesitate to comment below.

What is the SSA-7050 form used for?

+The SSA-7050 form is used to request an estimate of Social Security benefits from the Social Security Administration.

Who should fill out the SSA-7050 form?

+The SSA-7050 form is designed for individuals who are approaching retirement age (62-70 years old) or are planning to apply for Social Security benefits in the near future.

How long does it take to receive a benefit estimate?

+You can expect to receive a benefit estimate within 2-3 weeks after submitting the SSA-7050 form.