The SSA 1588 Form is a crucial document for individuals who receive Supplemental Security Income (SSI) benefits. It is used to report income, resources, and other information that may affect the recipient's benefits. Filling out and submitting the SSA 1588 Form correctly is essential to ensure that benefits are not interrupted or terminated. In this article, we will guide you through the process of filling and submitting the SSA 1588 Form.

Why is the SSA 1588 Form Important?

The SSA 1588 Form is a critical document that helps the Social Security Administration (SSA) determine whether an individual's SSI benefits should be continued, terminated, or adjusted. The form requires recipients to report their income, resources, and other information that may affect their benefits. Failure to submit the form or providing inaccurate information can result in interrupted or terminated benefits.

Who Needs to Fill Out the SSA 1588 Form?

Individuals who receive SSI benefits are required to fill out the SSA 1588 Form. This includes:

- Recipients of SSI benefits

- Representatives payees who manage benefits on behalf of a recipient

- Guardians or conservators who manage benefits on behalf of a minor or incapacitated individual

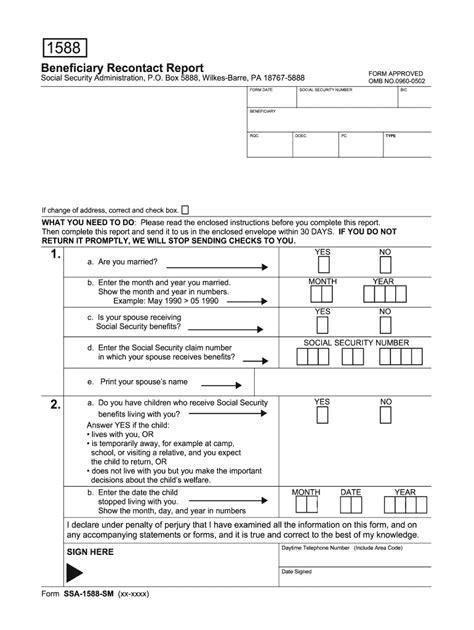

How to Fill Out the SSA 1588 Form

Filling out the SSA 1588 Form requires careful attention to detail. Here are some tips to help you complete the form accurately:

- Read the instructions carefully: Before starting to fill out the form, read the instructions carefully to understand what information is required.

- Use black ink: Use black ink to fill out the form to ensure that it can be read clearly.

- Be accurate: Provide accurate information, including dates, amounts, and descriptions.

- Report all income: Report all income, including wages, self-employment income, and unearned income such as interest and dividends.

- Report all resources: Report all resources, including cash, bank accounts, stocks, and bonds.

Section 1: Recipient Information

In this section, you will need to provide your name, Social Security number, and address.

Section 1: Recipient Information

- Name: _____________________________________________

- Social Security number: _____________________________________

- Address: _______________________________________________________

Section 2: Income

In this section, you will need to report all income, including wages, self-employment income, and unearned income.

Section 2: Income

- Wages: $_______________

- Self-employment income: $_______________

- Unearned income: $_______________

Section 3: Resources

In this section, you will need to report all resources, including cash, bank accounts, stocks, and bonds.

Section 3: Resources

- Cash: $_______________

- Bank accounts: $_______________

- Stocks and bonds: $_______________

Section 4: Additional Information

In this section, you will need to provide any additional information that may affect your benefits.

Section 4: Additional Information

- Is there anything else that may affect your benefits? _______________________________________________________

Section 5: Signature

In this section, you will need to sign and date the form.

Section 5: Signature

- Signature: _____________________________________________

- Date: __________________________________________________

How to Submit the SSA 1588 Form

Once you have completed the SSA 1588 Form, you can submit it to the SSA in several ways:

- Mail: Mail the form to the SSA address listed on the form.

- Fax: Fax the form to the SSA fax number listed on the form.

- In-person: Take the form to your local SSA office.

Tips for Submitting the SSA 1588 Form

- Make a copy of the form before submitting it.

- Keep a record of the date and time you submitted the form.

- If you have any questions or concerns, contact the SSA for assistance.

Conclusion

Filling out and submitting the SSA 1588 Form is a critical step in ensuring that your SSI benefits are not interrupted or terminated. By following the tips and guidelines outlined in this article, you can ensure that your form is completed accurately and submitted correctly. If you have any questions or concerns, don't hesitate to contact the SSA for assistance.

Frequently Asked Questions

What is the SSA 1588 Form?

+The SSA 1588 Form is a document used by the Social Security Administration to report income, resources, and other information that may affect SSI benefits.

Who needs to fill out the SSA 1588 Form?

+Recipients of SSI benefits, representatives payees, and guardians or conservators who manage benefits on behalf of a minor or incapacitated individual need to fill out the SSA 1588 Form.

How do I submit the SSA 1588 Form?

+You can submit the SSA 1588 Form by mail, fax, or in-person to your local SSA office.