As a Spark driver, it's essential to understand the tax implications of your work. One of the most critical aspects of tax compliance is accurately completing and filing the necessary tax forms. In this article, we will discuss the 5 essential Spark driver tax forms to know, as well as provide a comprehensive guide on how to navigate the tax filing process.

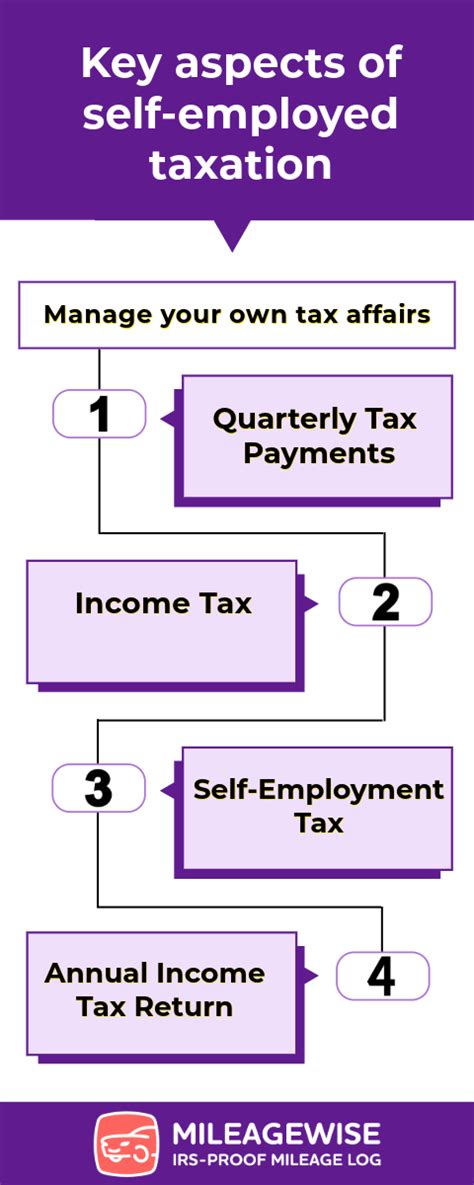

Spark drivers are considered independent contractors, which means they are responsible for reporting their own income and expenses on their tax returns. This can be a bit more complicated than being an employee, as drivers need to keep track of their own business expenses and deductions. However, with the right knowledge and preparation, Spark drivers can minimize their tax liability and ensure they are in compliance with the IRS.

Form 1099-MISC: Miscellaneous Income

The first essential tax form for Spark drivers is the Form 1099-MISC. This form is used to report miscellaneous income, such as freelance work, independent contracting, and other types of non-employee compensation. Spark will provide drivers with a Form 1099-MISC at the end of each tax year, showing the total amount of money earned through the platform.

What to Expect on Form 1099-MISC

When reviewing your Form 1099-MISC, you can expect to see the following information:

- Your name and address

- Spark's name and address

- The total amount of money earned through the platform

- Any federal income tax withheld

It's essential to carefully review your Form 1099-MISC for accuracy, as this information will be used to report your income on your tax return.

Form 1040: U.S. Individual Income Tax Return

The next essential tax form for Spark drivers is the Form 1040. This form is used to report personal income, including income earned through freelance work or independent contracting. Spark drivers will need to report their income from the Form 1099-MISC on their Form 1040.

What to Expect on Form 1040

When completing your Form 1040, you can expect to report the following information:

- Your personal income, including income from Spark

- Business expenses related to your Spark driving business

- Any deductions or credits you are eligible for

It's essential to accurately report your income and expenses on your Form 1040 to ensure you are in compliance with the IRS and minimize your tax liability.

Schedule C (Form 1040): Business Income and Expenses

The Schedule C is a critical tax form for Spark drivers, as it is used to report business income and expenses. This form is attached to the Form 1040 and provides a detailed breakdown of business income and expenses.

What to Expect on Schedule C

When completing your Schedule C, you can expect to report the following information:

- Business income from Spark

- Business expenses, such as gas, maintenance, and insurance

- Any deductions or credits related to your business

It's essential to accurately report your business income and expenses on your Schedule C to ensure you are in compliance with the IRS and minimize your tax liability.

Form 8829: Expenses for Business Use of Your Home

If you use a dedicated space in your home for your Spark driving business, you may be eligible for a home office deduction. The Form 8829 is used to calculate this deduction and report it on your tax return.

What to Expect on Form 8829

When completing your Form 8829, you can expect to report the following information:

- The square footage of your dedicated home office space

- The total square footage of your home

- The business use percentage of your home

- Any expenses related to your home office, such as utilities and maintenance

It's essential to accurately report your home office expenses on your Form 8829 to ensure you are eligible for the home office deduction.

Form 4562: Depreciation and Amortization

Finally, the Form 4562 is used to report depreciation and amortization on business assets, such as your vehicle. This form is critical for Spark drivers, as it allows them to deduct the cost of their vehicle over time.

What to Expect on Form 4562

When completing your Form 4562, you can expect to report the following information:

- The type and cost of your business asset (vehicle)

- The date you placed the asset in service

- The depreciation method used (e.g. MACRS)

It's essential to accurately report your depreciation and amortization on your Form 4562 to ensure you are eligible for this deduction.

Now that we've discussed the 5 essential Spark driver tax forms to know, it's essential to take the next step and ensure you are in compliance with the IRS. Take the time to carefully review and complete each form, and don't hesitate to reach out to a tax professional if you have any questions or concerns.

By following these tips and staying informed, you can minimize your tax liability and ensure a smooth tax filing process.

Don't forget to share this article with your fellow Spark drivers, and take the first step towards tax compliance today!

What is the deadline for filing my Spark driver tax forms?

+The deadline for filing your Spark driver tax forms is typically April 15th of each year. However, it's essential to check with the IRS for any changes to the filing deadline.

Do I need to file a separate tax return for my Spark driving business?

+No, you do not need to file a separate tax return for your Spark driving business. You will report your business income and expenses on your personal tax return (Form 1040).