Filing taxes can be a daunting task, especially for those who are new to the process or have complex tax situations. However, with the right guidance and tools, it can be made easier. In this article, we will delve into the world of South Carolina tax return forms, providing you with a comprehensive guide on how to file your taxes with ease.

Understanding South Carolina Tax Return Forms

The South Carolina Department of Revenue requires individuals and businesses to file tax returns annually. The type of tax return form you need to file depends on your income, filing status, and other factors. The most common tax return forms in South Carolina are:

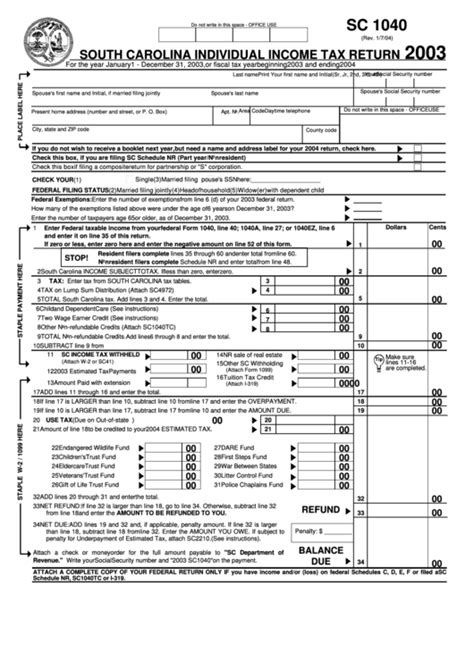

- SC1040: Individual Income Tax Return

- SC1120: Corporate Income Tax Return

- SC1065: Partnership Return of Income

Who Needs to File a South Carolina Tax Return Form?

Not everyone needs to file a South Carolina tax return form. Generally, you need to file a tax return if:

- You have a gross income of $10,000 or more

- You have a net loss from self-employment

- You have received unemployment benefits

- You have received distributions from a retirement account

Filing Your South Carolina Tax Return Form: A Step-by-Step Guide

Filing your South Carolina tax return form can be done electronically or by mail. Here's a step-by-step guide to help you through the process:

- Gather necessary documents: Before starting the filing process, make sure you have all the necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax-related documents.

- Choose a filing method: You can file your tax return electronically through the South Carolina Department of Revenue's website or by mail. Electronic filing is faster and more accurate.

- Select the correct tax return form: Choose the correct tax return form based on your income, filing status, and other factors.

- Fill out the tax return form: Fill out the tax return form accurately and completely. Make sure to sign and date the form.

- Pay any taxes owed: If you owe taxes, you can pay online, by phone, or by mail.

Tips for Filing Your South Carolina Tax Return Form

Here are some tips to keep in mind when filing your South Carolina tax return form:

- File electronically: Electronic filing is faster and more accurate.

- Use tax software: Tax software can help you navigate the filing process and ensure accuracy.

- Take advantage of tax credits: South Carolina offers various tax credits, such as the Earned Income Tax Credit (EITC).

- Seek professional help: If you're unsure about the filing process or have complex tax situations, consider seeking professional help.

Avoiding Common Mistakes When Filing Your South Carolina Tax Return Form

Common mistakes can delay the processing of your tax return or even result in penalties. Here are some common mistakes to avoid:

- Inaccurate or incomplete information: Make sure to fill out the tax return form accurately and completely.

- Math errors: Double-check your math calculations to avoid errors.

- Missing signatures: Make sure to sign and date the tax return form.

What to Do If You Owe Taxes

If you owe taxes, don't panic. Here are some steps you can take:

- Pay online, by phone, or by mail: You can pay your taxes online, by phone, or by mail.

- Set up a payment plan: If you're unable to pay your taxes in full, you can set up a payment plan.

- Seek professional help: If you're unsure about how to pay your taxes, consider seeking professional help.

Amending Your South Carolina Tax Return Form

If you need to make changes to your tax return form, you can file an amended return. Here's how:

- File Form SC1040X: If you need to amend your individual income tax return, file Form SC1040X.

- File Form SC1120X: If you need to amend your corporate income tax return, file Form SC1120X.

- Follow the instructions: Follow the instructions for filing an amended return.

South Carolina Tax Return Form Deadlines

Here are the deadlines for filing your South Carolina tax return form:

- April 15th: The deadline for filing your individual income tax return is April 15th.

- March 15th: The deadline for filing your corporate income tax return is March 15th.

Conclusion: Filing Your South Carolina Tax Return Form Made Easy

Filing your South Carolina tax return form can be a daunting task, but with the right guidance and tools, it can be made easier. By following the steps outlined in this article, you can ensure a smooth and accurate filing process.

Final Thoughts

Remember, filing your taxes is an important responsibility. By taking the time to understand the process and seeking help when needed, you can ensure a successful filing experience.

We hope this article has provided you with the information and guidance you need to file your South Carolina tax return form with ease. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing my South Carolina tax return form?

+The deadline for filing your individual income tax return is April 15th, and the deadline for filing your corporate income tax return is March 15th.

Can I file my South Carolina tax return form electronically?

+Yes, you can file your South Carolina tax return form electronically through the South Carolina Department of Revenue's website.

What if I owe taxes? What are my payment options?

+If you owe taxes, you can pay online, by phone, or by mail. You can also set up a payment plan if you're unable to pay your taxes in full.