The state of South Carolina requires its residents to file tax returns annually, which can be a daunting task for many individuals. The process of navigating through the various tax forms, understanding the complexities of tax laws, and ensuring accuracy can be overwhelming. However, there are ways to simplify the South Carolina tax form filing process, making it more manageable and less stressful.

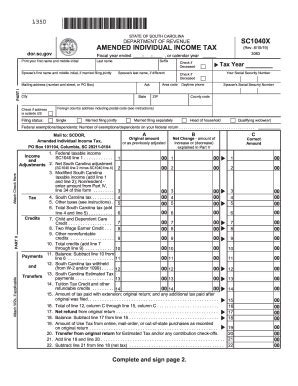

South Carolina tax forms can be complex, and the state offers various forms for different types of filers, including the SC1040, SC1040A, and SC1040EZ. Understanding which form to use and how to fill it out correctly can be a challenge. Moreover, the state's tax laws and regulations can change frequently, making it essential to stay up-to-date to avoid errors and penalties.

Fortunately, there are several ways to simplify the South Carolina tax form filing process. By taking advantage of these methods, individuals can reduce their stress levels and ensure accurate and timely filing of their tax returns.

1. E-Filing: A Convenient and Efficient Way to File Taxes

One of the most effective ways to simplify the South Carolina tax form filing process is to use e-filing. Electronic filing allows individuals to submit their tax returns online, eliminating the need for paper forms and reducing the risk of errors. The South Carolina Department of Revenue (SCDOR) offers a free e-filing option for eligible taxpayers, making it a convenient and efficient way to file taxes.

E-filing also provides several benefits, including:

- Faster processing times: E-filed returns are typically processed within 24-48 hours, compared to 6-8 weeks for paper returns.

- Reduced errors: The e-filing system checks for errors and inconsistencies, reducing the risk of mistakes and penalties.

- Convenient payment options: Taxpayers can pay their taxes online, by phone, or by mail.

Benefits of E-Filing for South Carolina Taxpayers

- Faster refunds: E-filed returns with direct deposit can result in faster refunds.

- Environmentally friendly: E-filing reduces paper waste and minimizes the carbon footprint.

- Secure: The SCDOR uses secure encryption to protect taxpayer data.

2. Tax Preparation Software: A User-Friendly Solution

Tax preparation software is another way to simplify the South Carolina tax form filing process. These programs guide taxpayers through the filing process, asking questions and providing explanations to ensure accuracy. Many tax preparation software programs are available, including TurboTax, H&R Block, and TaxAct.

Tax preparation software offers several benefits, including:

- User-friendly interface: The software provides a step-by-step guide, making it easy to navigate the tax filing process.

- Error checking: The software checks for errors and inconsistencies, reducing the risk of mistakes and penalties.

- Audit support: Many tax preparation software programs offer audit support, providing assistance in case of an audit.

Popular Tax Preparation Software for South Carolina Taxpayers

- TurboTax: Offers a user-friendly interface and comprehensive support.

- H&R Block: Provides accurate calculations and audit support.

- TaxAct: Offers a low-cost solution with free e-filing.

3. Hiring a Tax Professional: Expert Guidance and Support

Hiring a tax professional is another way to simplify the South Carolina tax form filing process. Tax professionals have extensive knowledge of tax laws and regulations, ensuring accurate and timely filing of tax returns. They can also provide guidance on tax planning and optimization, helping individuals minimize their tax liability.

Tax professionals offer several benefits, including:

- Expert knowledge: Tax professionals have in-depth knowledge of tax laws and regulations.

- Personalized support: Tax professionals provide personalized support and guidance.

- Audit representation: Tax professionals can represent taxpayers in case of an audit.

Benefits of Hiring a Tax Professional for South Carolina Taxpayers

- Accuracy: Tax professionals ensure accurate and timely filing of tax returns.

- Time-saving: Tax professionals handle the tax filing process, saving individuals time and effort.

- Peace of mind: Tax professionals provide peace of mind, knowing that tax returns are accurate and filed correctly.

4. South Carolina Taxpayer Assistance: Free Support and Guidance

The South Carolina Department of Revenue (SCDOR) offers free taxpayer assistance to individuals who need help with their tax returns. The SCDOR provides guidance and support through various channels, including phone, email, and in-person assistance.

Taxpayer assistance offers several benefits, including:

- Free support: The SCDOR provides free support and guidance to taxpayers.

- Expert knowledge: SCDOR representatives have extensive knowledge of tax laws and regulations.

- Personalized support: SCDOR representatives provide personalized support and guidance.

Benefits of South Carolina Taxpayer Assistance

- Convenient: Taxpayer assistance is available through various channels, including phone and email.

- Time-saving: Taxpayer assistance saves individuals time and effort.

- Peace of mind: Taxpayer assistance provides peace of mind, knowing that tax returns are accurate and filed correctly.

5. Understanding South Carolina Tax Laws and Regulations: Staying Informed

Understanding South Carolina tax laws and regulations is essential for accurate and timely filing of tax returns. The SCDOR provides information on tax laws and regulations through its website, publications, and taxpayer assistance.

Staying informed offers several benefits, including:

- Accuracy: Understanding tax laws and regulations ensures accurate filing of tax returns.

- Time-saving: Staying informed saves individuals time and effort.

- Peace of mind: Staying informed provides peace of mind, knowing that tax returns are accurate and filed correctly.

Benefits of Understanding South Carolina Tax Laws and Regulations

- Reduced errors: Understanding tax laws and regulations reduces the risk of errors and penalties.

- Optimized tax planning: Understanding tax laws and regulations enables individuals to optimize their tax planning.

- Improved compliance: Understanding tax laws and regulations improves compliance with tax laws and regulations.

By taking advantage of these methods, individuals can simplify the South Carolina tax form filing process, reducing their stress levels and ensuring accurate and timely filing of their tax returns. Whether it's e-filing, using tax preparation software, hiring a tax professional, seeking taxpayer assistance, or staying informed about tax laws and regulations, there are many ways to make the tax filing process easier and more manageable.

Now that you've learned about the ways to simplify the South Carolina tax form filing process, share your thoughts and experiences in the comments below. Have you tried any of these methods? Which one do you think is the most effective? Share your feedback and help others who may be struggling with their tax returns.

FAQ Section

What is the deadline for filing South Carolina tax returns?

+The deadline for filing South Carolina tax returns is typically April 15th, but it may vary depending on the type of return and any extensions that may be granted.

Can I file my South Carolina tax return electronically?

+Yes, the South Carolina Department of Revenue (SCDOR) offers free e-filing options for eligible taxpayers.

How do I know which South Carolina tax form to use?

+The SCDOR provides guidance on which tax form to use based on individual circumstances, such as income level, filing status, and type of return.