Filing for Social Security disability benefits can be a daunting task, but understanding the SSA-1724 form and its application process can make a significant difference in the outcome of your claim. In this comprehensive guide, we will walk you through the SSA-1724 form instructions and provide a step-by-step application guide to help you navigate the process.

Why is the SSA-1724 form important?

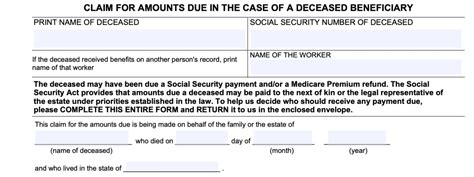

The SSA-1724 form, also known as the "Claim for Amounts Due in the Case of a Deceased Beneficiary," is a crucial document for individuals who are eligible to receive Social Security benefits after a beneficiary has passed away. The form is used to claim any remaining benefits that the deceased beneficiary was entitled to receive but did not receive before their death.

Who is eligible to file the SSA-1724 form?

To be eligible to file the SSA-1724 form, you must be one of the following:

- The spouse of the deceased beneficiary

- The child of the deceased beneficiary

- The parent of the deceased beneficiary (if the parent was dependent on the beneficiary)

- The executor or administrator of the deceased beneficiary's estate

- A representative payee appointed by the Social Security Administration (SSA)

What information do I need to file the SSA-1724 form?

To complete the SSA-1724 form, you will need to provide the following information:

- The deceased beneficiary's Social Security number

- The deceased beneficiary's date of birth and date of death

- Your relationship to the deceased beneficiary

- The deceased beneficiary's earnings record and benefit information

- Information about any other benefits the deceased beneficiary may have been receiving

- Your contact information, including your name, address, and phone number

How to complete the SSA-1724 form

Completing the SSA-1724 form requires careful attention to detail. Here is a step-by-step guide to help you complete the form:

Section 1: Claimant's Information

- Provide your name, address, and phone number

- Indicate your relationship to the deceased beneficiary

Section 2: Deceased Beneficiary's Information

- Provide the deceased beneficiary's name, Social Security number, date of birth, and date of death

- Indicate the type of benefit the deceased beneficiary was receiving (e.g., retirement, disability, or survivor benefits)

Section 3: Claim for Amounts Due

- Indicate the type of benefit you are claiming (e.g., lump-sum death payment, accrued benefits, or underpayment)

- Provide the date of the deceased beneficiary's last payment or the date of their death, whichever is later

Section 4: Certification

- Sign and date the form

- Provide your title (e.g., spouse, child, executor) if applicable

Section 5: Additional Information

- Provide any additional information that may be relevant to your claim

How to submit the SSA-1724 form

Once you have completed the SSA-1724 form, you can submit it to the SSA in one of the following ways:

- Mail the form to your local SSA office

- Fax the form to your local SSA office

- Take the form to your local SSA office in person

Tips and considerations

- Make sure to complete the form accurately and thoroughly to avoid delays in processing your claim

- Keep a copy of the completed form for your records

- If you have any questions or concerns about the SSA-1724 form or the application process, contact your local SSA office for assistance

Frequently Asked Questions

What is the SSA-1724 form used for?

+The SSA-1724 form is used to claim any remaining Social Security benefits that a deceased beneficiary was entitled to receive but did not receive before their death.

Who is eligible to file the SSA-1724 form?

+The SSA-1724 form can be filed by the spouse, child, parent, executor, or representative payee of the deceased beneficiary.

How long does it take to process the SSA-1724 form?

+The processing time for the SSA-1724 form varies depending on the complexity of the claim and the workload of the SSA office. It can take several weeks to several months to receive a decision.

Conclusion

Filing the SSA-1724 form can be a complex and time-consuming process, but understanding the form instructions and application guide can help you navigate the process more easily. If you have any questions or concerns about the SSA-1724 form or the application process, don't hesitate to contact your local SSA office for assistance.