The Shiftkey 1099 form - a crucial document for independent contractors and freelancers who use the Shiftkey platform to find work. As a 1099 earner, understanding how to handle this form is essential for a smooth tax season. In this article, we'll explore five ways to handle your Shiftkey 1099 form easily, ensuring you're well-prepared for tax time.

Dealing with tax forms can be daunting, especially for those who are new to freelancing or independent contracting. However, with the right guidance, you can navigate the process with ease. The Shiftkey 1099 form is a critical document that reports your income earned through the platform, and it's essential to handle it correctly to avoid any potential issues with the IRS.

Whether you're a seasoned freelancer or just starting out, this article will provide you with the necessary information to tackle your Shiftkey 1099 form with confidence. From understanding the form's purpose to tips on how to file it correctly, we've got you covered.

Understanding the Shiftkey 1099 Form

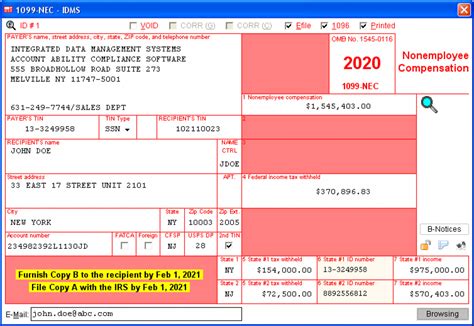

Before we dive into the ways to handle your Shiftkey 1099 form, let's take a closer look at what this form is all about. The Shiftkey 1099 form, also known as the 1099-MISC form, is used to report miscellaneous income earned by independent contractors and freelancers. This form is typically issued by the payer (in this case, Shiftkey) and is used to report income earned by the recipient (you) in a calendar year.

The Shiftkey 1099 form will include information such as:

- Your name and address

- Your taxpayer identification number (TIN)

- The amount of money you earned through the Shiftkey platform

- Any taxes withheld (if applicable)

It's essential to carefully review the information on your Shiftkey 1099 form to ensure it's accurate. If you notice any discrepancies, contact Shiftkey immediately to resolve the issue.

Why Is the Shiftkey 1099 Form Important?

The Shiftkey 1099 form is a critical document for both you and the IRS. Here are a few reasons why:

- Reports income: The Shiftkey 1099 form reports your income earned through the platform, which is essential for tax purposes.

- Verifies income: The form verifies the income you've earned, ensuring you're reporting accurate information on your tax return.

- Determines tax obligations: The form helps determine your tax obligations, including any taxes you may owe or be eligible for a refund.

5 Ways to Handle Your Shiftkey 1099 Form Easily

Now that we've covered the basics of the Shiftkey 1099 form, let's explore five ways to handle it easily.

1. Review and Verify Information

When you receive your Shiftkey 1099 form, take the time to carefully review and verify the information. Ensure your name, address, and TIN are accurate, and the income reported matches your records. If you notice any discrepancies, contact Shiftkey immediately to resolve the issue.

2. Keep Accurate Records

Accurate record-keeping is essential for handling your Shiftkey 1099 form easily. Keep a record of your income earned through the platform, including invoices, receipts, and bank statements. This will help you verify the information on your 1099 form and ensure you're reporting accurate income on your tax return.

3. File Your Taxes Correctly

When filing your taxes, ensure you report the income from your Shiftkey 1099 form accurately. You'll need to report this income on your tax return, typically on Schedule C (Form 1040). If you're unsure about how to report this income, consider consulting a tax professional or using tax preparation software.

4. Take Advantage of Deductions and Credits

As a freelancer or independent contractor, you may be eligible for deductions and credits that can reduce your tax liability. Take advantage of these by keeping accurate records of business expenses and claiming them on your tax return. Some common deductions include home office expenses, travel expenses, and equipment costs.

5. Seek Professional Help When Needed

If you're unsure about how to handle your Shiftkey 1099 form or have complex tax situations, consider seeking professional help. A tax professional or accountant can guide you through the process and ensure you're taking advantage of all the deductions and credits available to you.

Conclusion - Take Control of Your Shiftkey 1099 Form

Handling your Shiftkey 1099 form doesn't have to be daunting. By following these five tips, you can ensure a smooth tax season and avoid any potential issues with the IRS. Remember to review and verify the information on your form, keep accurate records, file your taxes correctly, take advantage of deductions and credits, and seek professional help when needed.

By taking control of your Shiftkey 1099 form, you'll be well-prepared for tax time and can focus on what matters most - growing your business and achieving your financial goals.

What's Next?

Have questions about handling your Shiftkey 1099 form? Share your thoughts and concerns in the comments below. We'd love to hear from you!

FAQ Section

What is the Shiftkey 1099 form?

+The Shiftkey 1099 form is a document used to report miscellaneous income earned by independent contractors and freelancers through the Shiftkey platform.

Why is the Shiftkey 1099 form important?

+The Shiftkey 1099 form is important because it reports income earned through the platform, verifies income, and determines tax obligations.

How do I handle my Shiftkey 1099 form?

+To handle your Shiftkey 1099 form, review and verify the information, keep accurate records, file your taxes correctly, take advantage of deductions and credits, and seek professional help when needed.