The SF 425 form is a crucial document used by federal agencies in the United States to report on the financial status of grants, cooperative agreements, and other types of assistance awards. If you're a grant recipient or a federal agency, understanding the SF 425 form is essential to ensure compliance with federal regulations and to maintain a smooth relationship with funding agencies.

What is the SF 425 form?

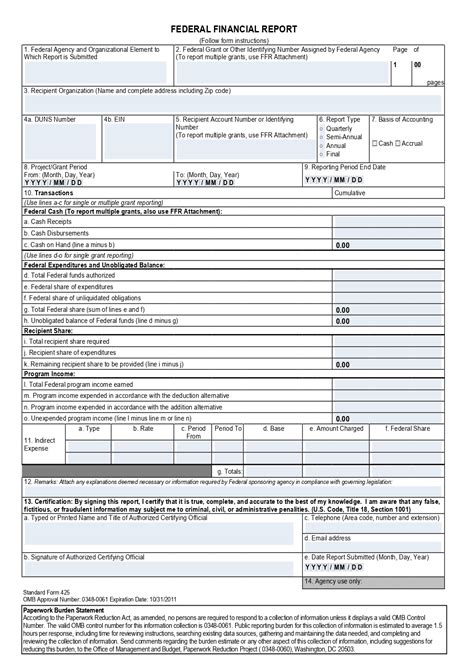

The SF 425 form, also known as the "Federal Financial Report," is a standardized form used by federal agencies to collect financial information from grant recipients. The form is used to report on the financial status of grants, cooperative agreements, and other types of assistance awards. The SF 425 form is typically used for non-construction projects, while the SF 424C form is used for construction projects.

Why is the SF 425 form important?

The SF 425 form is essential for several reasons:

- Financial reporting: The form provides a standardized way for grant recipients to report their financial expenditures, ensuring that funding agencies have accurate and up-to-date information on the use of federal funds.

- Compliance: The SF 425 form helps grant recipients comply with federal regulations, such as the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (2 CFR 200).

- Grant management: The form helps funding agencies manage grants effectively by providing a clear picture of the financial status of each grant.

- Auditing: The SF 425 form is used during audits to ensure that grant recipients have used federal funds in accordance with the terms of the grant agreement.

How to use the SF 425 form

To use the SF 425 form, follow these steps:

- Obtain the form: You can download the SF 425 form from the General Services Administration (GSA) website or request a copy from the funding agency.

- Review the instructions: Read the instructions carefully to ensure you understand the requirements and format of the form.

- Gather required information: Collect all necessary financial information, including expenditures, income, and other relevant data.

- Complete the form: Fill out the form accurately and completely, using the required format and codes.

- Submit the form: Submit the completed form to the funding agency by the required deadline, usually within 90 days of the end of the reporting period.

Components of the SF 425 form

The SF 425 form consists of several sections, including:

- Grant information: This section includes information about the grant, such as the grant number, title, and funding agency.

- Financial information: This section includes financial data, such as expenditures, income, and other relevant financial information.

- Reporting period: This section specifies the reporting period, which is usually quarterly or annually.

- Certification: This section requires the grant recipient to certify that the information reported is accurate and complete.

Tips for completing the SF 425 form

To ensure accurate and complete reporting, follow these tips:

- Use the correct format: Use the required format and codes to ensure that your report is easy to read and understand.

- Provide clear explanations: Provide clear explanations for any discrepancies or anomalies in your financial reports.

- Keep accurate records: Maintain accurate and complete records of your financial transactions to ensure that your reports are accurate.

- Seek assistance: If you're unsure about any aspect of the form, seek assistance from the funding agency or a qualified grant administrator.

Common mistakes to avoid

To avoid common mistakes, keep the following in mind:

- Inaccurate reporting: Ensure that your financial reports are accurate and complete to avoid delays or penalties.

- Late submissions: Submit your reports on time to avoid late fees or penalties.

- Inadequate documentation: Maintain accurate and complete records of your financial transactions to support your reports.

- Failure to certify: Ensure that you certify your reports accurately to avoid delays or penalties.

Conclusion

The SF 425 form is a critical document for grant recipients and funding agencies. By understanding the purpose and components of the form, you can ensure accurate and complete reporting, maintain compliance with federal regulations, and avoid common mistakes. Remember to seek assistance if you're unsure about any aspect of the form, and keep accurate records to support your reports.

What is the purpose of the SF 425 form?

+The SF 425 form is used to report on the financial status of grants, cooperative agreements, and other types of assistance awards.

Who uses the SF 425 form?

+Grant recipients and funding agencies use the SF 425 form to report on the financial status of grants and other types of assistance awards.

What are the common mistakes to avoid when completing the SF 425 form?

+Common mistakes to avoid include inaccurate reporting, late submissions, inadequate documentation, and failure to certify.