As a self-employed individual in Wisconsin, it's essential to understand the importance of accurately reporting your self-employment income to the state. The Wisconsin Self Employment Income Report Form is a crucial document that helps you report your income and claim any deductions you're eligible for. In this comprehensive guide, we'll walk you through the process of filling out the form, highlighting key sections, and providing valuable tips to ensure you're taking advantage of all the benefits available to you.

Why is the Wisconsin Self Employment Income Report Form Important?

The Wisconsin Self Employment Income Report Form is a vital document for self-employed individuals, as it allows them to report their income and claim deductions for business expenses. This form is used to calculate your self-employment tax liability, which is a critical component of your overall tax obligation.

By accurately completing the form, you'll be able to:

- Report your self-employment income

- Claim deductions for business expenses

- Calculate your self-employment tax liability

- Avoid potential penalties and fines

Who Needs to File the Wisconsin Self Employment Income Report Form?

If you're a self-employed individual in Wisconsin, you're required to file the Self Employment Income Report Form if you have net earnings from self-employment of $400 or more. This includes:

- Sole proprietors

- Single-member limited liability companies (LLCs)

- Partnerships

- S corporations

How to Fill Out the Wisconsin Self Employment Income Report Form

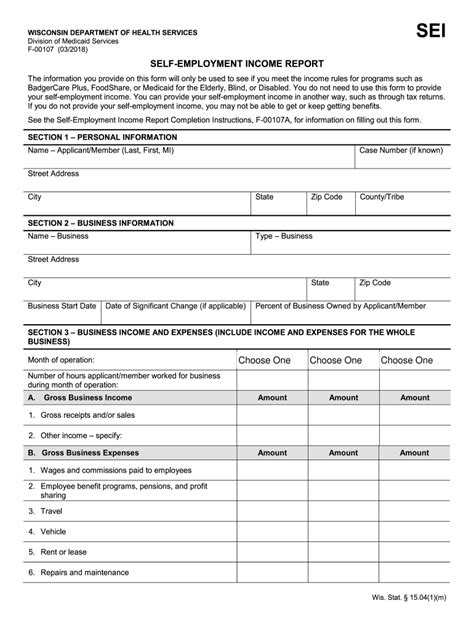

The Wisconsin Self Employment Income Report Form is a relatively straightforward document, but it's essential to understand the different sections and how to complete them accurately. Here's a step-by-step guide to help you fill out the form:

- Section 1: Business Information

- Provide your business name and address

- List your business type (e.g., sole proprietorship, partnership, etc.)

- Enter your business's Employer Identification Number (EIN)

- Section 2: Self-Employment Income

- Report your total self-employment income from all sources

- Include income from freelance work, consulting, and other self-employment activities

- Section 3: Business Expenses

- List your business expenses, including deductions for:

- Business use of your home

- Travel expenses

- Equipment and supplies

- Professional fees

- List your business expenses, including deductions for:

- Section 4: Net Earnings from Self-Employment

- Calculate your net earnings from self-employment by subtracting your business expenses from your self-employment income

- Section 5: Self-Employment Tax

- Calculate your self-employment tax liability based on your net earnings from self-employment

Common Mistakes to Avoid

When filling out the Wisconsin Self Employment Income Report Form, it's essential to avoid common mistakes that can lead to penalties and fines. Here are some mistakes to watch out for:

- Inaccurate or incomplete business information

- Failure to report all self-employment income

- Incorrect calculation of net earnings from self-employment

- Failure to claim eligible deductions

Tips for Filing the Wisconsin Self Employment Income Report Form

To ensure you're taking advantage of all the benefits available to you, here are some valuable tips for filing the Wisconsin Self Employment Income Report Form:

- Keep accurate records of your business income and expenses

- Claim all eligible deductions to minimize your self-employment tax liability

- Consult with a tax professional if you're unsure about any aspect of the form

- File the form on time to avoid penalties and fines

Conclusion

Filing the Wisconsin Self Employment Income Report Form is a critical step in reporting your self-employment income and claiming deductions for business expenses. By following the guidelines outlined in this article, you'll be able to accurately complete the form and avoid potential penalties and fines. Remember to keep accurate records, claim all eligible deductions, and consult with a tax professional if you're unsure about any aspect of the form.

What is the deadline for filing the Wisconsin Self Employment Income Report Form?

+The deadline for filing the Wisconsin Self Employment Income Report Form is typically April 15th of each year.

What happens if I don't file the Wisconsin Self Employment Income Report Form?

+If you don't file the Wisconsin Self Employment Income Report Form, you may be subject to penalties and fines. You may also be required to pay interest on any unpaid taxes.