The world of mergers and acquisitions can be complex and intriguing, with various regulatory filings required to ensure transparency and compliance. One such filing is the SEC Form S-4, a crucial document in the merger and acquisition process. In this article, we will delve into the world of SEC Form S-4, exploring its purpose, requirements, and significance in the context of mergers and acquisitions.

What is SEC Form S-4?

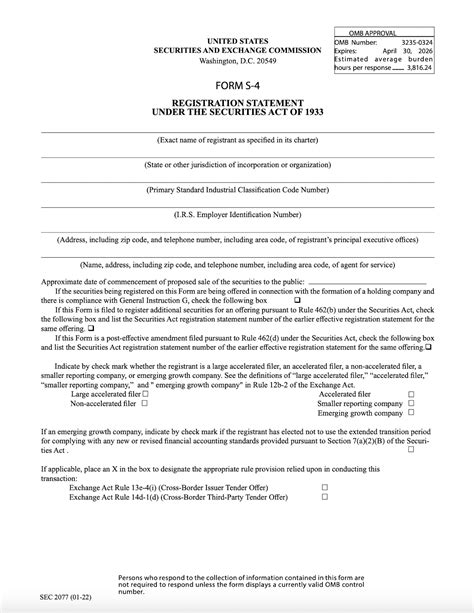

The SEC Form S-4 is a registration statement filed with the U.S. Securities and Exchange Commission (SEC) in connection with a merger or acquisition. The form is used to register the securities of the surviving company in a merger or the acquirer in an acquisition. The purpose of the form is to provide investors with a comprehensive disclosure of the proposed transaction, including the terms and conditions, financial information, and potential risks and benefits.

**Purpose of SEC Form S-4**

The primary purpose of SEC Form S-4 is to register the securities of the surviving company in a merger or the acquirer in an acquisition. This registration is required under the Securities Act of 1933, which mandates that companies register their securities with the SEC before they can be sold or exchanged.

The form serves several purposes:

- To provide investors with a comprehensive disclosure of the proposed transaction, including the terms and conditions, financial information, and potential risks and benefits.

- To facilitate the registration of securities with the SEC.

- To enable the SEC to review the proposed transaction and ensure compliance with federal securities laws.

SEC Form S-4 Filing Requirements

The SEC Form S-4 must be filed with the SEC in connection with a merger or acquisition. The form requires disclosure of various information, including:

- Transaction terms: A detailed description of the proposed transaction, including the structure, terms, and conditions.

- Financial information: Financial statements of the companies involved in the transaction, including balance sheets, income statements, and cash flow statements.

- Management's discussion and analysis: A discussion of the transaction's financial implications and potential risks and benefits.

- Risk factors: A description of the potential risks associated with the transaction.

- Management and organization: Information about the management team and organizational structure of the surviving company or acquirer.

**SEC Review Process**

Once the SEC Form S-4 is filed, the SEC reviews the document to ensure compliance with federal securities laws. The review process typically involves:

- Initial review: The SEC staff reviews the form to ensure that it is complete and compliant with the relevant regulations.

- Comment letters: The SEC staff may issue comment letters requesting additional information or clarification on certain aspects of the transaction.

- Response to comment letters: The company must respond to the comment letters and provide the requested information.

Significance of SEC Form S-4 in Mergers and Acquisitions

The SEC Form S-4 plays a critical role in the merger and acquisition process. The form provides investors with a comprehensive disclosure of the proposed transaction, enabling them to make informed decisions. The form also facilitates the registration of securities with the SEC, ensuring compliance with federal securities laws.

In addition, the SEC Form S-4 helps to:

- Facilitate due diligence: The form provides a detailed disclosure of the transaction, enabling parties to conduct thorough due diligence.

- Mitigate risks: The form highlights potential risks and benefits, enabling parties to mitigate risks and make informed decisions.

- Ensure transparency: The form provides transparency into the transaction, enabling investors and other stakeholders to understand the terms and conditions.

**Best Practices for Filing SEC Form S-4**

To ensure a smooth filing process, companies should follow best practices when filing the SEC Form S-4:

- Seek professional advice: Engage experienced counsel and advisors to ensure compliance with relevant regulations.

- Conduct thorough due diligence: Conduct thorough due diligence to identify potential risks and benefits.

- Provide clear and concise disclosure: Ensure that the form provides clear and concise disclosure of the transaction.

- Respond promptly to comment letters: Respond promptly to comment letters and provide the requested information.

Conclusion

The SEC Form S-4 is a critical document in the merger and acquisition process, providing investors with a comprehensive disclosure of the proposed transaction. Companies should follow best practices when filing the form to ensure compliance with federal securities laws and facilitate a smooth review process. By understanding the purpose, requirements, and significance of the SEC Form S-4, companies can navigate the complex world of mergers and acquisitions with confidence.

We encourage you to share your thoughts and experiences with SEC Form S-4 in the comments section below. Your feedback will help us create more informative and engaging content.

Frequently Asked Questions

What is the purpose of SEC Form S-4?

+The primary purpose of SEC Form S-4 is to register the securities of the surviving company in a merger or the acquirer in an acquisition.

What information is required to be disclosed in SEC Form S-4?

+The form requires disclosure of various information, including transaction terms, financial information, management's discussion and analysis, risk factors, and management and organization.

What is the significance of SEC Form S-4 in mergers and acquisitions?

+The SEC Form S-4 plays a critical role in the merger and acquisition process, providing investors with a comprehensive disclosure of the proposed transaction, facilitating due diligence, mitigating risks, and ensuring transparency.