The world of tax reporting can be complex and overwhelming, especially for corporations and businesses. One crucial aspect of tax compliance is accurately completing and submitting the necessary forms to the Internal Revenue Service (IRS). In this article, we will delve into the intricacies of Schedule M-3, a critical component of the Form 1120, and provide a comprehensive guide to help you navigate the process.

The importance of accurate tax reporting cannot be overstated. Failure to comply with tax laws and regulations can result in penalties, fines, and even loss of business licenses. Moreover, accurate tax reporting is essential for maintaining transparency and accountability in financial transactions. As a business owner or tax professional, it is vital to understand the requirements and nuances of tax reporting to ensure compliance and avoid any potential issues.

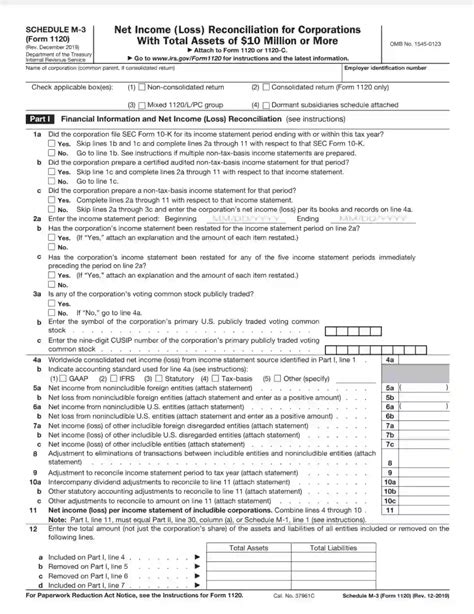

What is Schedule M-3?

Schedule M-3 is a supplemental form to the Form 1120, which is the standard corporate income tax return. The purpose of Schedule M-3 is to provide a detailed reconciliation of the corporation's financial statements to the tax return. This reconciliation is essential to ensure that the corporation's financial statements accurately reflect its tax liability.

Who Needs to File Schedule M-3?

Not all corporations are required to file Schedule M-3. The IRS requires corporations with total assets of $10 million or more to file Schedule M-3. This threshold applies to the corporation's total assets at the end of the tax year. Additionally, corporations with total assets below $10 million may voluntarily file Schedule M-3, but it is not mandatory.

Components of Schedule M-3

Schedule M-3 is a comprehensive form that requires detailed information about the corporation's financial statements and tax return. The form is divided into several sections, each focusing on a specific aspect of the corporation's financial activity.

Section 1: Financial Statement and Tax Return Information

This section requires the corporation to provide detailed information about its financial statements, including the balance sheet and income statement. The corporation must also provide information about its tax return, including the total tax liability and any estimated tax payments.

Section 2: Reconciliation of Net Income (Loss) per Financial Statements with Net Income (Loss) per Return

In this section, the corporation must reconcile its net income or loss per financial statements with its net income or loss per tax return. This reconciliation involves identifying and explaining any differences between the financial statements and the tax return.

Section 3: Reconciliation of Taxable Income (Loss) per Return with Pretax Income (Loss) per Financial Statements

This section requires the corporation to reconcile its taxable income or loss per tax return with its pretax income or loss per financial statements. This reconciliation involves identifying and explaining any differences between the tax return and the financial statements.

Benefits of Accurate Schedule M-3 Reporting

Accurate Schedule M-3 reporting offers several benefits to corporations, including:

- Improved transparency and accountability in financial transactions

- Enhanced accuracy in tax reporting and compliance

- Reduced risk of penalties and fines for non-compliance

- Better financial planning and decision-making

- Improved relationships with investors, stakeholders, and regulatory agencies

Best Practices for Schedule M-3 Reporting

To ensure accurate and compliant Schedule M-3 reporting, corporations should follow these best practices:

- Maintain accurate and detailed financial records

- Ensure timely and accurate completion of the Schedule M-3 form

- Reconcile financial statements and tax returns regularly

- Review and update financial statements and tax returns as necessary

- Seek professional advice from tax professionals or accountants

Common Mistakes to Avoid in Schedule M-3 Reporting

Corporations should be aware of common mistakes to avoid in Schedule M-3 reporting, including:

- Inaccurate or incomplete financial statements

- Failure to reconcile financial statements and tax returns

- Inadequate documentation and support for financial transactions

- Failure to comply with IRS regulations and guidelines

- Inadequate review and updating of financial statements and tax returns

Conclusion

Schedule M-3 is a critical component of the Form 1120, requiring corporations to provide a detailed reconciliation of their financial statements to the tax return. Accurate and compliant Schedule M-3 reporting is essential for maintaining transparency and accountability in financial transactions, reducing the risk of penalties and fines, and improving financial planning and decision-making. By following best practices and avoiding common mistakes, corporations can ensure accurate and compliant Schedule M-3 reporting.

We hope this article has provided valuable insights and guidance on Schedule M-3 reporting. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.

What is the purpose of Schedule M-3?

+The purpose of Schedule M-3 is to provide a detailed reconciliation of the corporation's financial statements to the tax return.

Who needs to file Schedule M-3?

+Corporations with total assets of $10 million or more are required to file Schedule M-3.

What are the benefits of accurate Schedule M-3 reporting?

+Accurate Schedule M-3 reporting offers several benefits, including improved transparency and accountability, enhanced accuracy in tax reporting, reduced risk of penalties and fines, better financial planning, and improved relationships with investors and regulatory agencies.