The Schedule K Form 1120s is a crucial document for S corporations, providing a detailed breakdown of the company's income, deductions, and credits. Accurately completing this form is essential to ensure compliance with the Internal Revenue Service (IRS) and to avoid any potential penalties. In this article, we will explore the five ways to fill out Schedule K Form 1120s, including the importance of understanding the form's structure, gathering necessary information, and accurately reporting income and deductions.

Understanding the Structure of Schedule K Form 1120s

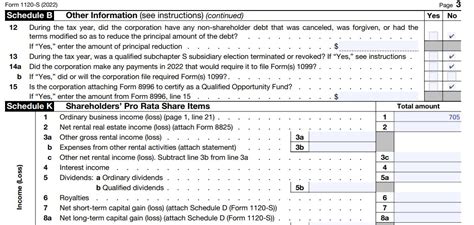

Before diving into the process of filling out Schedule K Form 1120s, it's essential to understand the form's structure. The form is divided into several sections, including:

- Section 1: Income

- Section 2: Deductions

- Section 3: Credits

- Section 4: Other Income and Deductions

- Section 5: Reconciliation of Income (Loss) per Books With Income (Loss) per Return

Each section requires specific information, and accurately completing each section is crucial to ensure the form is completed correctly.

Gathering Necessary Information

To accurately complete Schedule K Form 1120s, you'll need to gather specific information, including:

- Financial statements, such as the company's balance sheet and income statement

- Records of income, including receipts and invoices

- Records of deductions, including business expenses and depreciation

- Records of credits, including tax credits and deductions

- Information about the company's shareholders, including their names, addresses, and percentage of ownership

Having this information readily available will make the process of filling out the form much easier and help ensure accuracy.

Accurately Reporting Income

Accurately reporting income is a critical component of filling out Schedule K Form 1120s. This includes reporting all sources of income, including:

- Gross receipts from sales and services

- Interest income

- Dividend income

- Rent income

- Capital gains

It's essential to accurately report all income to ensure compliance with the IRS and to avoid any potential penalties.

Accurately Reporting Deductions

Accurately reporting deductions is another critical component of filling out Schedule K Form 1120s. This includes reporting all allowable deductions, including:

- Business expenses, such as salaries and wages, rent, and utilities

- Depreciation and amortization

- Interest expenses

- Taxes, including federal, state, and local taxes

It's essential to accurately report all deductions to ensure compliance with the IRS and to avoid any potential penalties.

Reconciling Income and Loss

The final step in filling out Schedule K Form 1120s is to reconcile the company's income and loss. This involves comparing the company's income and loss per books with the income and loss per return. This reconciliation is essential to ensure accuracy and compliance with the IRS.

Common Mistakes to Avoid

When filling out Schedule K Form 1120s, there are several common mistakes to avoid, including:

- Inaccurate reporting of income and deductions

- Failure to report all sources of income

- Failure to report all allowable deductions

- Failure to reconcile income and loss

Avoiding these mistakes is essential to ensure compliance with the IRS and to avoid any potential penalties.

Conclusion

Filling out Schedule K Form 1120s requires attention to detail and a thorough understanding of the form's structure and requirements. By gathering necessary information, accurately reporting income and deductions, and reconciling income and loss, you can ensure that your company's Schedule K Form 1120s is completed accurately and efficiently. Remember to avoid common mistakes and take the time to review and double-check your work to ensure compliance with the IRS.

We encourage you to share your experiences and tips for filling out Schedule K Form 1120s in the comments below. If you have any questions or need further guidance, don't hesitate to ask.

FAQ Section

What is Schedule K Form 1120s?

+Schedule K Form 1120s is a tax form used by S corporations to report their income, deductions, and credits.

Who is required to file Schedule K Form 1120s?

+S corporations that have shareholders are required to file Schedule K Form 1120s.

What is the deadline for filing Schedule K Form 1120s?

+The deadline for filing Schedule K Form 1120s is typically March 15th for calendar-year corporations.